How Much Recession Warning Did You Expect?

How often have you heard the stock market looks a year ahead of a recession?

Stock Market is Not Forward Looking

A widespread myth persists that the stock market is a leading indicator of recessions, providing a year or more warning on average before one starts.

Actually, the stock market is a coincident indicator of sentiment towards stocks, no more no less.

The stock market sees ahead myth stems from Wall Street pimps who want you in the market 100% of the time or they don't make money.

2007 Recession Trigger

The stock market peaked in November of 2007. Recession started in December of 2007.

What was the 2007 recession trigger?

There was none, at least one that people can easily point to. More accurately, sentiment changed and that was the trigger. The pool of greater fools willing to buy houses ran out.

Conditions rapidly changed from people standing in lines wrapped around the corner to enter a lottery to buy a condo, to no one in line at all.

The change happened in a week in Florida then rapidly spread through the country with agents touting "this market is different" until the entire country was engulfed.

2020 Trigger

People are already blaming the coronavirus.

Yes, it was a trigger. No, it is not to blame.

This recession was baked in the cake long ago, running solely on fumes of Fed stimulus then Trump tax cuts.

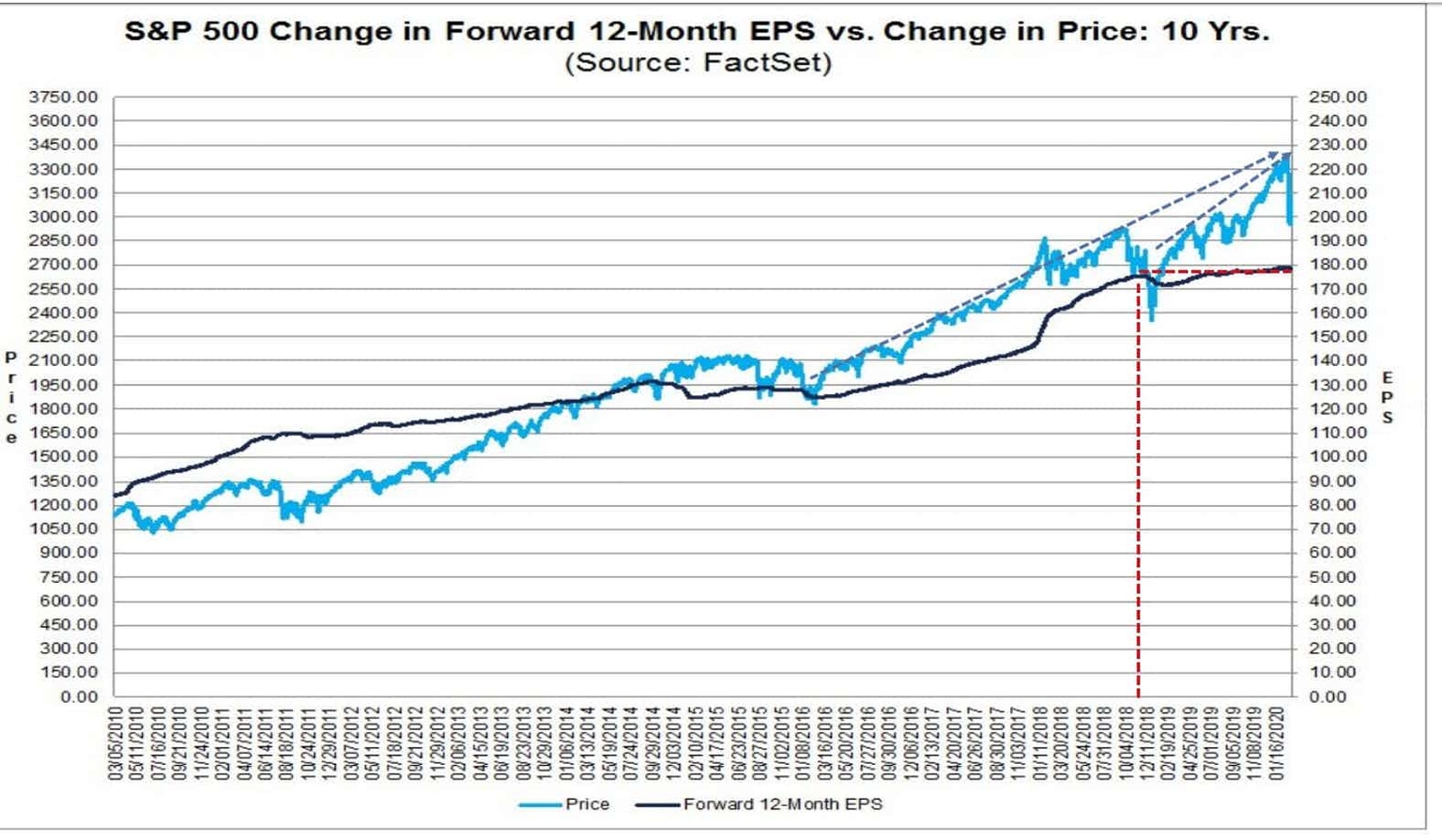

Price vs Earnings Estimates

Image from FactSet, anecdotes mine.

Anatomy of a Bubble

That's the anatomy of a bubble and the coronavirus had nothing to do with it.

Moreover, earnings estimates are horrendous at the top. So despite the decline, stock are still not cheap.

It will take another 20% decline from here before we can begin discussing cheap.

Guess what?

Bubbles burst. The coronavirus no doubt accelerated the decline and kicked off a recession, but Fed-sponsored bubbles sew the seeds of their own decline. That is the true cause.

Recession Has Begun

I am confident a recession has started or will start within a month. This shock was that severe.

Cruise ships cancelled, NBA and NHL cancelled. The local businesses and bars around those hotshots will suffer.

There are supply chain disruptions everywhere.

The stock market decline will put a dent into boomers buying cars, taking vacations etc.

The demographics are poor. Downsizing and retired boomers wanting to sell their homes will not find millennial buyers.

Trump was good for the market. It hasn't priced in Trump losing, and a recession coupled with his poor handling of the coronavirus will do it, no matter how quickly the coronavirus pandemic cools. Lost wages and profits are gone forever.

Denial

There was strong denial in 2007 regarding a recession.

Bernanke proclaimed in March of 2008 there would not be a recession. It had already started 3 months prior. He also told Congress there was no housing bubble to bust.

Is the same happening now? I think so. The Atlanta Fed GDPNow model estimate for first-quarter GDP is 3.1%. The New York Fed Nowcast is a more believable 1.59%.

Perhaps you have a month or two before recession starts. Perhaps it has already started.

The NBER will tell you when it started in about a year. Lovely.

Mike "Mish" Shedlock

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc