Goldman Sachs (GS Stock) see more commodity gains in 2022

This was an interesting research note from Goldman Sachs (GS) on the case for further commodity gains this year. Below are some points GS make for further upside in the commodity space.

1. Many forward balances are showing draws in many commodities

Wheat, copper, European gas, aluminium and Nickel are all seeing continued draws in balances. In other words, the supply is not in place to meet the demand. If the world gets moving again and the pandemic moves firmly into an endemic stage this could quickly become worse as demand picks up again.

2. Capital investment into commodities has been hit hard

GS say that the latest risks from Omicron and China have slowed capital flows into commodity investments. They project scarcity pricing to continue and see 16.2% returns for commodities this year. Added to this is the fact that supply uncertainty remains extremely high. On top of this is the fact that a green pivot has made investors reluctant to invest in fossil fuels and investment in the oil industry is low.

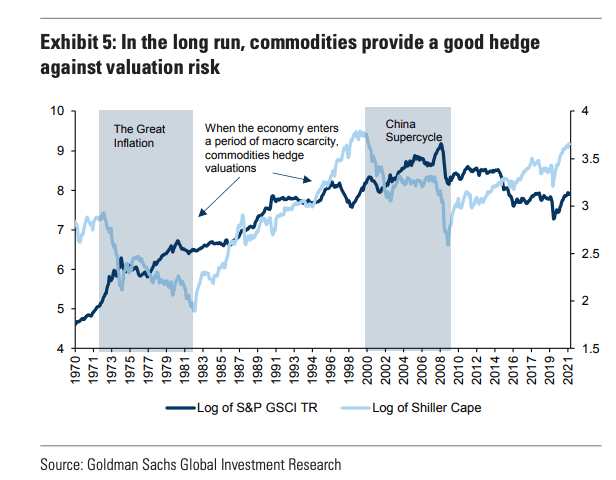

3. Commodities can make a good hedge against valuation risk

Equities are highly valued and look very vulnerable to rising rates. With 4 priced in this year (from 0 last) commodities can offer a hedge against falling valuations.

They also note that commodities tend to perform besting the hiking phase of the rates cycle as outlined in this useful chart below.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.