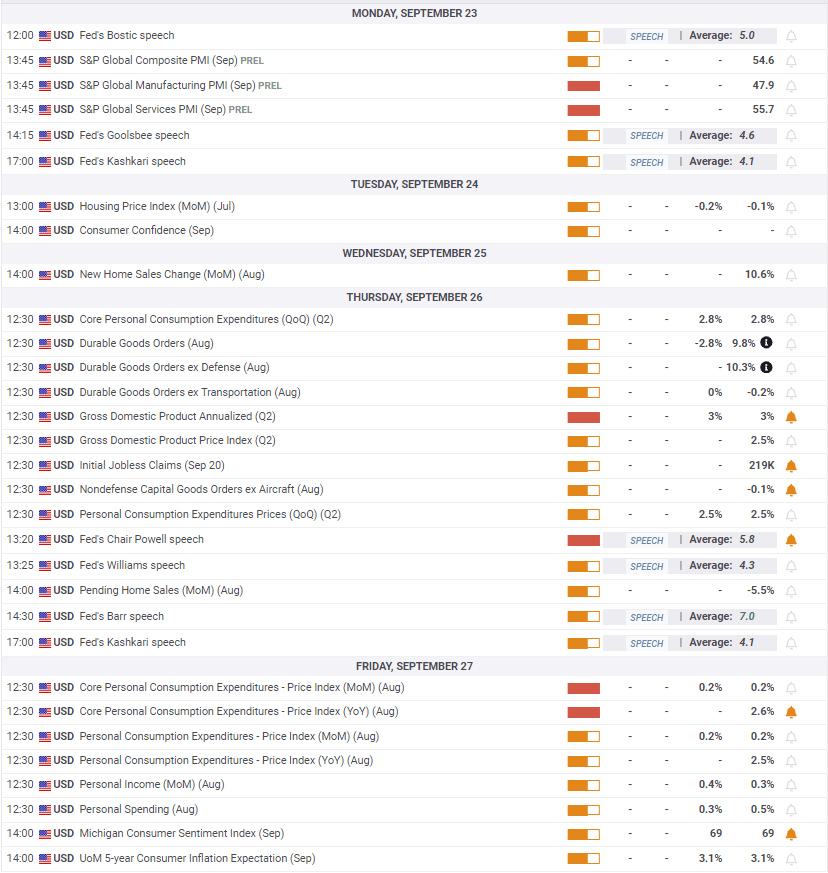

Gold Weekly Forecast: Room for correction following bullish week

- Gold climbed to a new record high above $2,600 this week.

- The near-term technical outlook suggests that XAU/USD is close to turning overbought.

- Fedspeak and PCE inflation data could influence Gold’s valuation next week.

Gold (XAU/USD) rallied to a new all-time high above $2,600 as the US Dollar (USD) faced heavy selling pressure following the Federal Reserve’s (Fed) decision to lower the policy rate by 50 basis points. The precious metal is close to turning technically overbought ahead of Friday’s Personal Consumption Expenditures (PCE) Price Index data release, likely the next big catalyst for Gold.

Gold bulls take action on dovish Fed decision

After ending the previous week on a bullish note, Gold entered a consolidation phase on Monday. With markets adopting a cautious stance ahead of the Fed’s policy announcements, XAU/USD closed in negative territory on Tuesday.

On Wednesday, the Fed announced that it lowered the policy rate by 50 bps to the range of 4.75%-5%. Ahead of the event, the CME FedWatch Tool was showing that there was about 40% probability of the Fed opting for a 25 bps cut. Hence, the immediate market reaction triggered a USD sell-off. In turn, Gold gathered bullish momentum and reached a new record high of $2,600. Meanwhile, the revised Summary of Economic Projections (SEP) showed that policymakers were forecasting a total of another 50 bps rate reduction in the remaining two policy meetings of the year.

Following the knee-jerk sell-off, the negative shift seen in risk mood helped the USD stage a rebound later in the American session, causing XAU/USD to make a sharp U-turn and close the day in the red. Investors might have seen the large rate cut as a sign that the Fed was late to react to the worsening economic outlook and softening labor market conditions. Nevertheless, Fed Chairman Jerome Powell’s reassuring comments about the job market and the growth prospects seem to have allowed markets to breathe a sigh of relief.

"We don't think we need to see further loosening of the labor market to get inflation down to 2%,” Powell said, adding that they see no signs of an elevated likelihood of an economic downturn.

Once the Fed dust settled on Thursday, risk flows started to dominate the action in financial markets. The USD came under renewed selling pressure, opening the door for another leg higher in Gold. After the data published by the US Department of Labor showed that the number of first-time applications for unemployment benefits dropped to 219,000 in the week ending September 14 from 231,000 in the previous week, XAU/USD corrected lower in the early American session. With Wall Street’s main indexes posting impressive gains, however, the USD failed to preserve its recovery momentum, allowing Gold to end the day in the green.

In the absence of high-tier data releases, Gold extended its rally and set another all-time record above $2,600 on Friday.

Gold investors shift focus to US data, Fedspeak

The US economic calendar will feature the preliminary S&P Global Manufacturing and Services Purchasing Managers Index (PMI) data for September on Monday. In case the Manufacturing PMI recovers above 50 and the Services PMI holds comfortably above 50, investors are likely to be encouraged about the robust economic outlook. In this case, the USD could stay resilient against its major rivals and cause XAU/USD to correct lower. On the other hand, weaker-than-forecast PMI readings are likely to have the opposite effect on the USD’s valuation.

On Thursday, the US Bureau of Economic Analysis (BEA) will publish the final revision to the second-quarter Gross Domestic Product (GDP) data, which is unlikely to trigger a market reaction. On Friday, the BEA will release the PCE Price Index figures for August, the Fed’s preferred gauge of inflation. Investors are less concerned about inflation than they were earlier in the year. Nonetheless, a strong increase of 0.3%, or bigger, in the monthly core PCE Price Index could boost the USD. On the flip side, a soft reading could weigh on the USD with the immediate reaction.

With the Fed’s blackout period coming to an end, investors will also pay close attention to comments from policymakers. According to the CME FedWatch Tool, markets are pricing in a nearly 70% probability that the Fed will lower the policy rate by at least another 75 bps in 2024. If Fed officials push back against the possibility of one more large rate cut this year, the market positioning suggests that the USD could rebound, dragging XAU/USD lower. In case policymakers entertain the idea of another 50 bps cut in one of the upcoming meetings, the USD is likely to have a hard time finding demand.

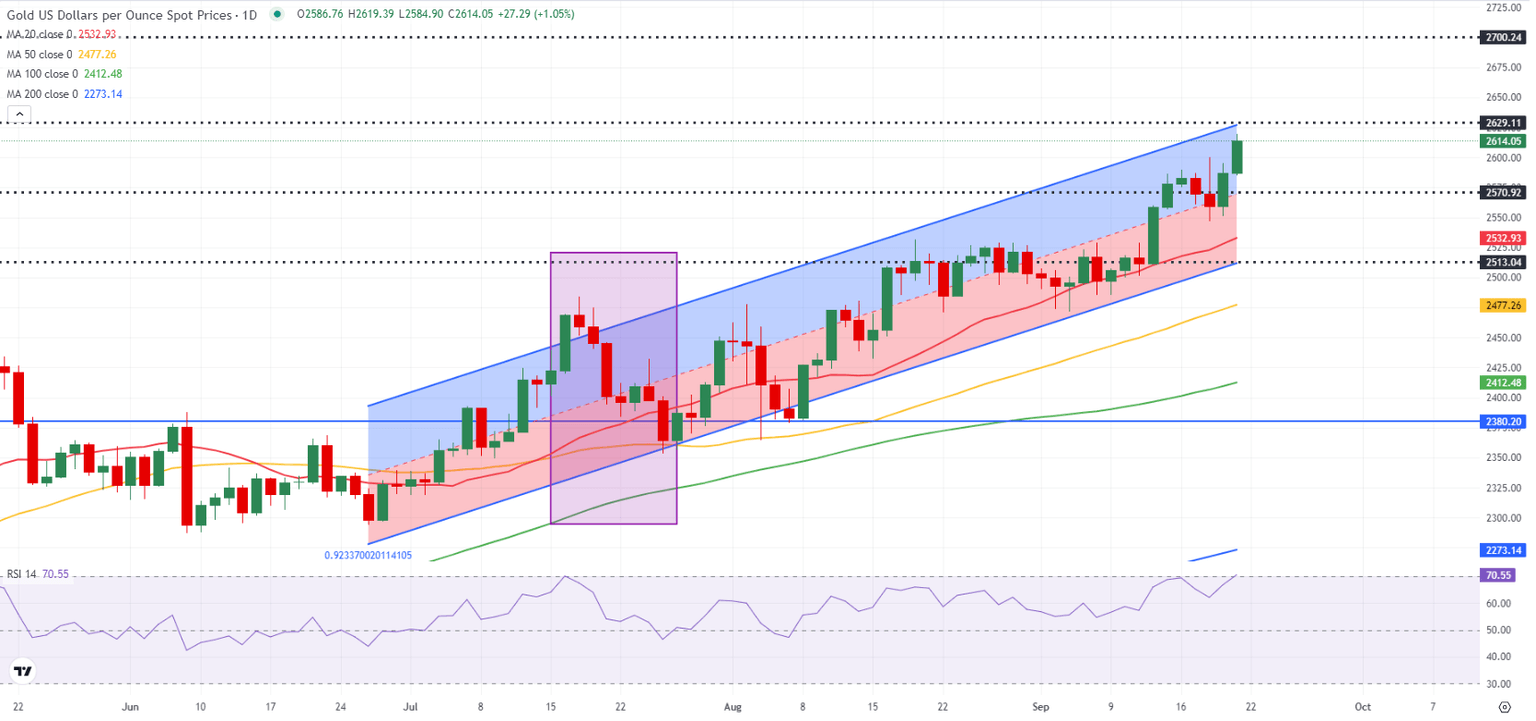

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart rose to 70 this week. Gold remains within the upper half of the ascending regression channel coming from late June. The upper limit of the channel aligns as key resistance level at $2,630. The last time the daily RSI hit 70 and Gold climbed above the upper limit of the ascending channel back in mid-July, there was a sharp correction. Hence, buyers could refrain from committing to another leg higher in the near term and allow Gold to correct lower if it turns overbought by rising above $2,630.

On the downside, $2,600 (round level) aligns as interim support before $2,570 (mid-point of the ascending channel and $2,530, where the 20-day Simple Moving Average (SMA) is located.

It’s difficult to set a near-term target on the upside because Gold is already trading in unchartered territory. The $2,700 round level could be seen as next resistance if investors ignore overbought conditions.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.