Gold Weekly Forecast: Geopolitics could continue to drive the action

- Gold gathered bullish momentum after reclaiming the $2,400 level this week.

- XAU/USD benefited from falling US Treasury bond yields after the Fed policy announcement, weak US data.

- Escalating geopolitical tensions, Fed rate cut expectations boost Gold.

After posting losses for two consecutive weeks, Gold (XAU/USD) rallied this one, gaining over 3% since Monday’s opening. Next week’s economic calendar will feature several high-tier data releases, but geopolitical developments could continue to impact the price action.

Gold benefits from escalating tensions in the Middle East

Gold started the week in a quiet manner as investors refrained from taking large positions ahead of key macroeconomic events. After closing the first trading day of the week virtually unchanged, however, XAU/USD gathered bullish momentum on Tuesday and climbed above $2,400.

Reports of Hamas’ political leader Ismail Haniyeh being killed in Iran during a visit to attend the inauguration ceremony of Iran’s newly elected President Masoud Pezeshkian caused geopolitical tensions to escalate. In response, Iran’s Supreme Leader Ayatollah Ali Khamenei has promised “harsh punishment” for Israel in retaliation for the death of Haniyeh. Gold benefited from growing fears over a deepening crisis in the Middle East and continued to push higher.

Meanwhile, the US Federal Reserve (Fed) announced on Wednesday that it left monetary policy settings unchanged, as widely expected. In the post-meeting press conference, Fed Chairman Jerome Powell noted that there was a “real discussion” about the case for reducing rates at the July meeting, adding that a rate cut could be on the table in September. Although a 25 basis points (bps) September rate cut was already fully priced in, according to the CME FedWatch Tool, the benchmark 10-year US Treasury bond yield turned south after the Fed event and lost over 2.5% on the day, providing an additional boost to Gold.

Disappointing macroeconomic data releases from the US caused US T-bond yields to decline further in the second half of the week. As the 10-year yield dropped below 4% for the first time since early February, Gold built on its weekly gains and climbed above $2,460. The number of applications for first-time unemployment benefits in the US rose to its highest level since August 2023 at 249,000 in the week ending July 27, and the ISM Manufacturing Purchasing Managers Index (PMI) dropped to 46.8 in July from 48.5 in June, reflecting an acceleration in the ongoing contraction in the manufacturing sector’s business activity.

On Friday, the US Bureau of Labor Statistics (BLS) reported that Nonfarm Payrolls rose 114,000 in July. Additionally, June’s increase of 206,000 got revised lower to 179,000. The Unemployment Rate edged higher to 4.3% from 4.2% in June and annual wage inflation, as measured by the change in Average Hourly Earnings, softened to 3.6% from 3.8%. The 10-year US yield slumped below 3.8% after dismal US jobs data and Gold surged above $2,470 in the American session.

Gold investors will keep a close eye on geopolitics

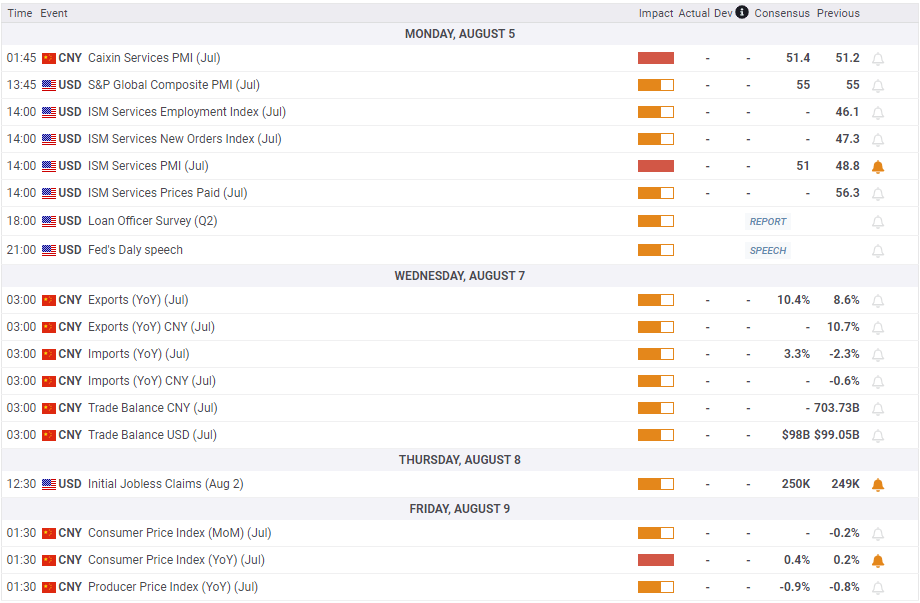

The ISM Services PMI for July will be featured in the US economic docket on Monday. Markets expect the headline PMI to rise to 51 from 48.8 in June. In case this data stays below 50, the US Dollar (USD) could have a hard time finding demand. On the other hand, a positive surprise could support the currency and cap XAU/USD’s upside with the initial reaction.

In the Asian session on Wednesday, Trade Balance data for July from China, the world’s biggest consumer of Gold, will be watched closely by market participants. A couple of weeks ago, the People’s Bank of China (PBoC) unexpectedly lowered the one-year Loan Prime Rate (LPR), the five-year LPR, and the one-year Medium-term Lending Facility (MLF) rate. These decisions revived fears over a worsening Chinese economic outlook and weighed on Gold. Hence, XAU/USD could lose its footing midweek if the Trade Balance data from China disappoints.

The economic calendar will not offer any other high-tier data releases that could impact Gold’s valuation next week. Nevertheless, investors will remain focused on headlines surrounding geopolitics and pay close attention to comments from Fed officials, now that the blackout period is over.

If Fed policymakers push back against the market expectation for multiple interest rate cuts this year, US Treasury bond yields could rebound and cause XAU/USD to stage a downward correction.

In case tensions in the Middle East continue to escalate with Iran taking retaliatory action, Gold is likely to continue to find demand as a safe haven.

Gold technical outlook

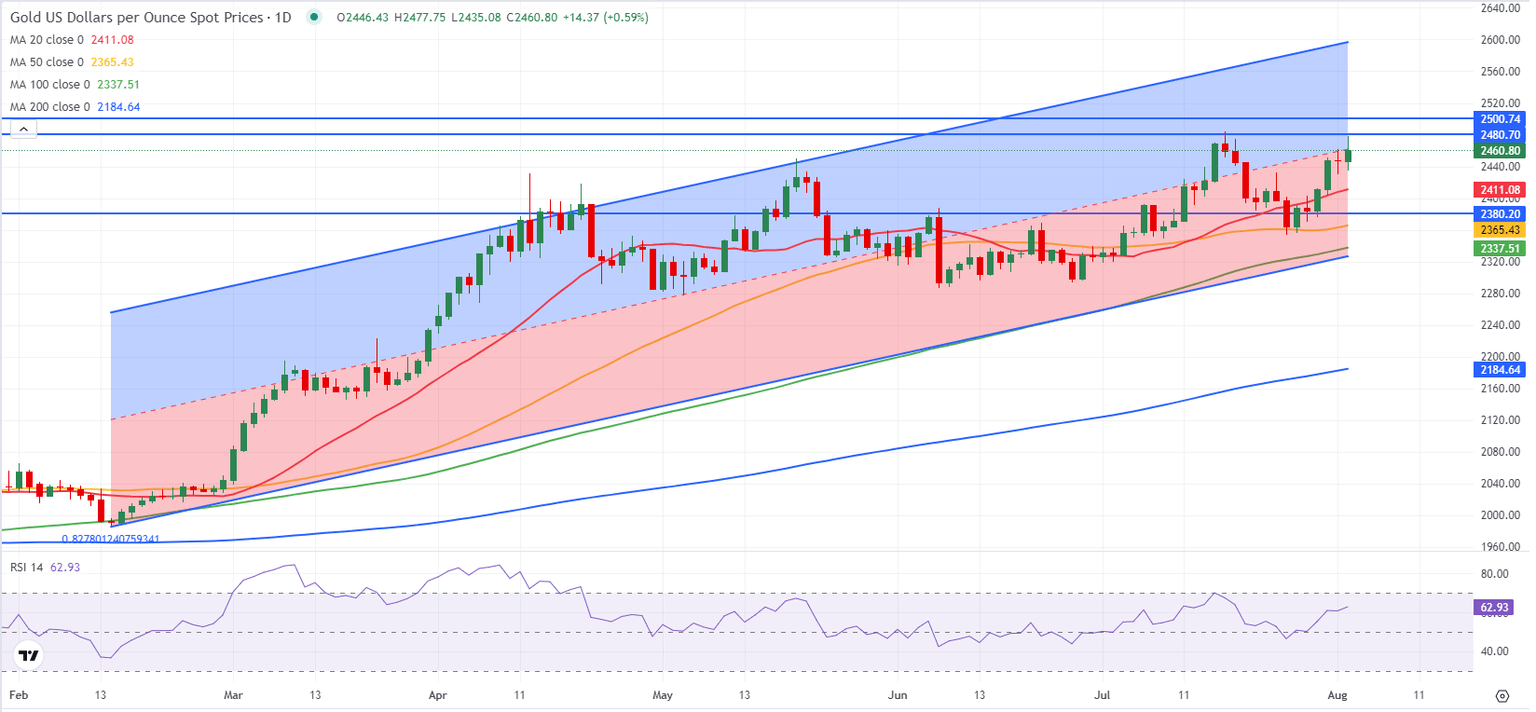

The Relative Strength Index (RSI) indicator on the daily chart rose above 60 following this week’s rally, suggesting that Gold has more room on the upside before turning technically overbought. $2,480 (static level) aligns as immediate resistance before $2,500 (psychological level). In case Gold stabilizes above $2,500 and confirms that level as support, the upper limit of the ascending regression channel coming from mid-February could be seen as the next bullish target at $2,600.

On the downside, the support area seems to have formed at $2,410-$2,400 (20-day Simple Moving Average (SMA), psychological level) before $2,365 (50-day SMA) and $2,340 (100-day SMA).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.