Gold prices tumble as higher interest rate concerns remain

American equities jumped sharply on Thursday after the strong economic data from the United States. The Dow Jones rose by more than 400 points while the S&P 500 and Nasdaq 100 indices rose by 45 and 70 points, respectively. The performance happened after the US published strong GDP numbers. The data revealed that the country’s GDP jumped from 2.3% in the third quarter to 6.9% in the fourth quarter. That increase was better than the median estimate of 5.5%. As a result, the economy recorded its fastest growth in a few decades. These numbers came a day after the Federal Reserve made a hawkish interest rate decision.

The euro continued to decline against the US dollar as investors priced in more divergence between the Federal Reserve and the ECB. In its interest rate decision, the Fed hinted that it will implement about three interest rate hikes this year. Jerome Powell did not rule out implementing more rate hikes in a bid to lower the stubbornly high inflation. On the other hand, the ECB appears committed about leaving interest rates low this year. Analysts expect that it will hike interest rates possibly in the third or fourth quarter. Later today, the euro will react to the latest business climate and consumer confidence data from the Eurozone.

The US dollar continued its bullish momentum while gold and silver declined after the Fed decision. The strong US GDP data also provided a catalyst for the US dollar. Later today, the US dollar and gold will react to the latest personal consumer expenditure (PCE) data from the US. Economists expect the data to show that the PCE increased to over 6% in December. This is important economic data since it is one of the Fed’s favourite inflation metrics. The US will also publish the latest consumer sentiment data.

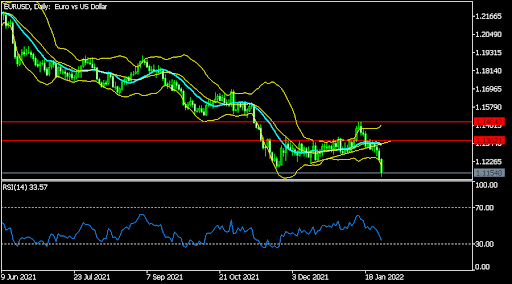

EUR/USD

The EURUSD pair continued its bearish momentum in the overnight session as investors reacted to the divergence between the Fed and ECB. the pair declined to a low of 1.1135, which was the lowest level since May 2020. The pair moved below the 25-day and 50-day moving averages on the daily chart. It also moved below the 61.8% Fibonacci retracement level while the MACD is moving towards the oversold level. Therefore, the pair will likely continue dropping as bears target the next key support at 1.1050.

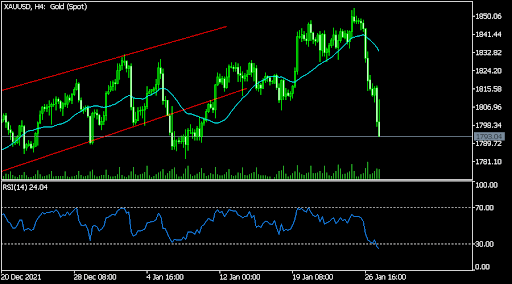

XAU/USD

The XAUUSD pair declined sharply during the American and Asian sessions. The pair is trading at 1,795, which was the lowest level since January 10. It even moved below the lower side of the ascending channel that is shown in red. It also dropped below the 38.2% Fibonacci retracement level and the 25-day and 50-day moving averages. Therefore, the pair will likely keep falling as bears target the next key support at 1,750.

USD/CAD

The USDCAD pair tilted upwards as the US dollar strength continued. It is trading at 1.2720, which was the highest level since January 7th. It moved above the 25-day and 50-day moving average and the 38.2% Fibonacci retracement level. Therefore, the pair will likely keep rising in the near term.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.