Gold Price Weekly Forecast: XAU/USD needs a blue wave for a golden era, all eyes on the elections

- Rising coronavirus cases and election uncertainty have hit gold.

- All eyes are on the elections, but central bank decisions are also of interest.

- Early November's daily chart is showing bears have gained some ground.

Meltdown – the formal end of fiscal stimulus talks was only the beginning of a down week for gold, which also struggled with the covid-related gloom. The fate of the precious metal hinges on the elections, yet surprise stimulus from central banks could also move XAU/USD.

This week in XAU/USD: Gloom hits gold

The yellow metal had been rocking on the scope for more greenbacks from Uncle Sam – fiscal stimulus talks seemed to be making progress, but after Congress adjourned, the final nail hit the coffin of talks. The breakdown in talks weighed on the precious metal.

Democrats and Republicans were hovering around a $2 trillion deal that could have helped gold prices. While that may still happen, it all depends on the elections.

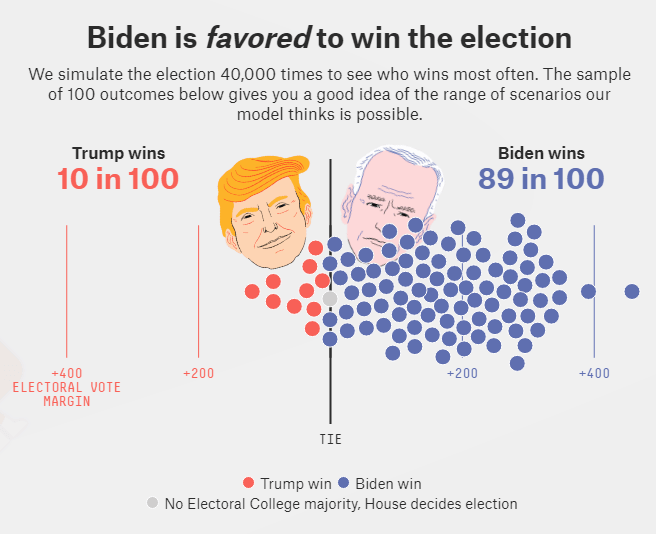

FiveThirtyEight's model has been showing Democrat Joe Biden as having an 89% chance of beating President Donald Trump, but at least for now, markets have the memory of 2016 in their minds and are cautious. Uncertainty weighed on markets, and gold was carried lower.

Source: FiveThirtyEight

Another reason for the suffer-fest stems from the surge in COVID-19 cases, especially in Europe. Germany and France, the eurozone's largest economies, announced nationwide lockdowns and contributed to concerns. The European Central Bank responded by signaling it will likely add more stimulus in December.

The prospects of more funds coming from Frankfurt helped stabilize XAU/USD amid the general storm. However, the ECB may also cut rates or make other changes that may not help the precious metal.

Coronavirus cases are also on the rise in the UK and the US, with the latter having a potential impact on the elections.

Next week in Gold: All eyes on Trump

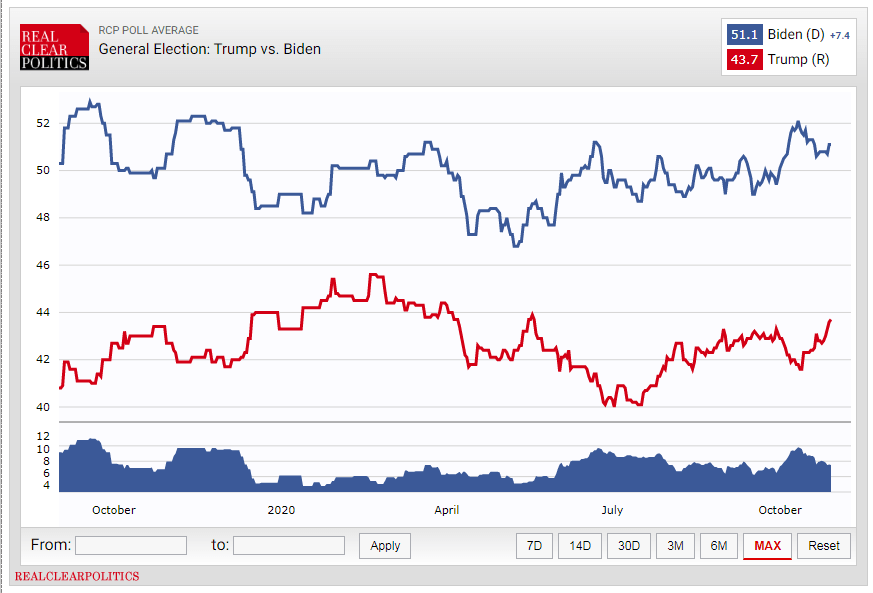

Gold heavily depends on the election results – for the White House and very much the Senate. As mentioned earlier, opinion polls are pointing to a handy victory for Biden over Trump. RealClearPolitics is showing that the narrowing gap still leaves the challenger above the pre-first presidential debate level:

Source: RealClearPolitics

Moreover, the same website compares the 2016 polling levels for the same period, and it is currently pointing to around five points separating Biden's lead and Hillary Clinton's gap four years ago.

Another bullish factor for the former Vice President is that millions of Americans have already voted – 82 million at the time of writing, nearly 60% of the 2016 turnout. That means there is little time for Trump to impact the few undecideds – and high turnout also implies a desire for change.

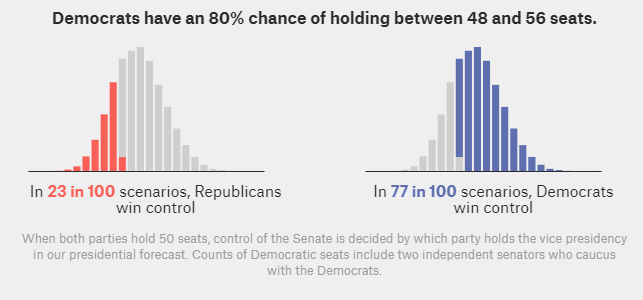

However, Trump may not necessarily accept the outcome – as he clearly said – and that could cause chaos that would drag markets down and gold with it. Yet even assuming Biden wins, the path higher for gold would be clearer with a blue wave – flipping the Senate.

A unified Democratic government would implement a generous, perhaps $3 trillion stimulus package and boost the precious metal. If Biden replaces Trump, but Republicans hold onto the Senate, they could limit the next support package to under $1 trillion. The middle way would be a victory for Trump – he would be able to force the GOP to compromise, citing a fresh mandate.

More Gold has three ways to go in response to the 2020 Presidential Elections.

Source: FiveThirtyEight

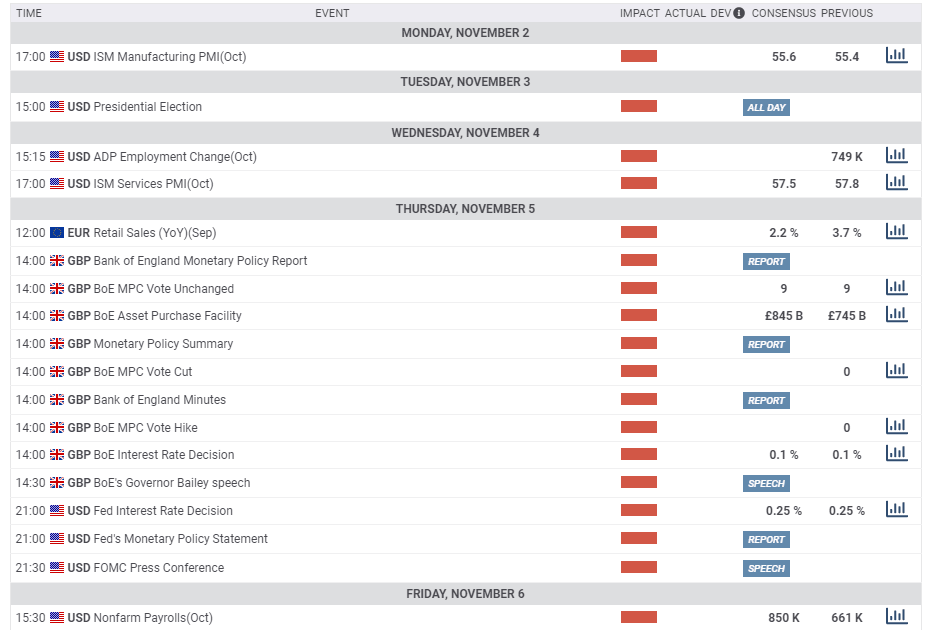

While the elections are left, right, and center, the Federal Reserve decision could also impact markets this time on Thursday. The Fed is set to leave its policy unchanged and not rock the boat two days after the elections. However, any hint of new bond-buying – to stem the uncertainty resulting from covid – would boost gold. Rejecting any new changes could weigh on it.

The Bank of England's rate decision is also worth mentioning. While the BOE has less impact on commodities, it could boost XAU/USD if it surprises by announcing negative interest rates already now. However, the London-based institution has been contemplating the idea for many months. Without signaling, it is imminent.

The US Nonfarm Payrolls report – and its full buildup – may help the precious metal if they disappoint, yet expectations are upbeat. Economists foresee an increase of 850,000 jobs in October, higher than 661,000 in September. In any case, labor statistics play third-fiddle in a week in which the Fed needs to compete for attention against the Fed.

Here are the key events for gold on the economic calendar:

XAU/USD technical analysis

Gold has dropped below the 100-day Simple Moving Average after failing to break above the 50-day SMA. While it is well above the 200-day SMA, momentum has turned to the downside. Moreover, XAU/USD fell under the uptrend support line that accompanied it since mid-September.

Some support awaits at $1,860, the late-October low. It is followed by $1,848, September's trough and the lowest since July. Further down, $1,820 and $1,793 await the precious metal.

Some resistance awaits at $1,895, which provided support in mid-October, and followed strong resistance at $1,935, a double-top. The next lines are $1,975 and $2,020.

Gold sentiment

Investors are too scarred, and some are scared of 2016. However, pollsters have fixed some of the mistakes, and alongside high turnout, it could turn into a "blue wave." A clean sweep for Biden and Dems is not priced and could trigger a rally in gold.

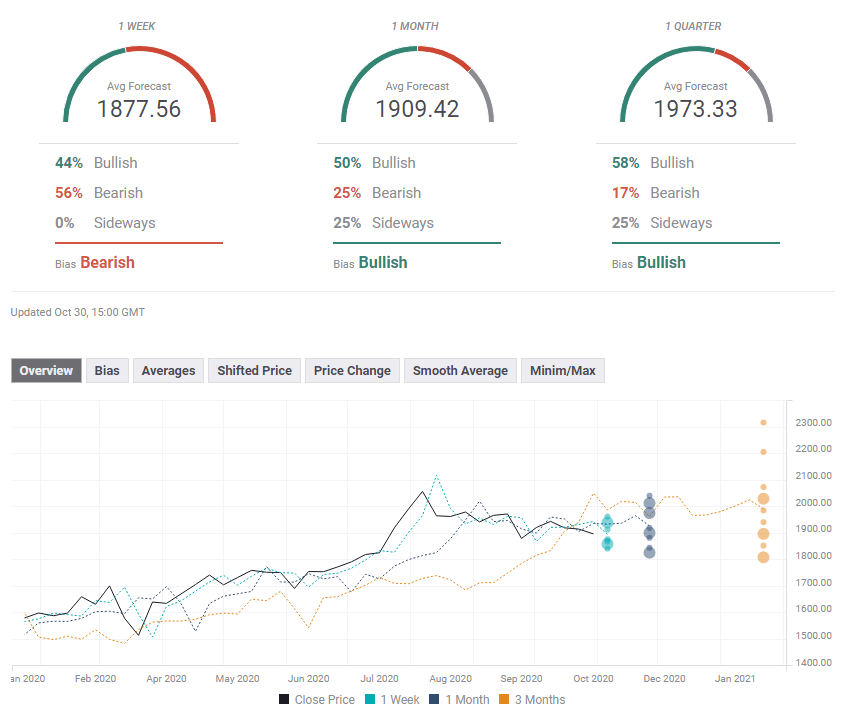

The FX Poll is showing a short-term fall and rises afterward. Perhaps experts foresee a contested election that would weigh on gold, while a clear result afterward would send the precious metal surging – especially in the long term.

Related Reads

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637396654870398836.png&w=1536&q=95)