Gold Price Weekly Forecast: XAU/USD eyes correction before extending rally

- Gold price registered gains for the fourth straight week.

- Falling US Treasury bond yields and broad-based US Dollar weakness fueled XAU/USD's weekly rally.

- Technical outlook suggests that the pair could make a downward correction in the short term.

Following the decisive upsurge witnessed on Friday, Gold price started the new week on a bullish note and closed in positive territory on Monday and Tuesday. After staying relatively quiet on Wednesday, XAU/USD regained its traction and climbed above $1,900 for the first time in seven months ahead of the weekend, closing the fourth straight week in positive territory. Risk perception and the performance of the US Treasury bond yields could drive the pair's action next week amid a lack of high-tier macroeconomic data releases from the US.

What happened last week?

Dovish Fed bets dominated the financial markets at the beginning of the week after the data from the US showed that wage inflation and input price inflation in the US softened in December. With the 10-year US Treasury bond yield falling toward 3.5% on Monday, inversely-correlated XAU/USD managed to build on Friday's gains.

Although Fed policymakers tried to push back against expectations for a Fed policy pivot, risk flows dominated the financial markets on Tuesday. In turn, the US Dollar struggled to find demand and allowed XAU/USD to continue to stretch higher. In the absence of high-impact data releases on Wednesday, investors refrained from making large bets ahead of the highly-anticipated inflation data from the US on Thursday.

The US Bureau of Labor Statistics reported that the Consumer Price Index (CPI) declined to 6.5% on a yearly basis in December from 7.1% in November, matching the market expectation. On a monthly basis, the CPI fell by 0.1%. Additionally, the Core CPI, which excludes volatile food and energy prices, rose by 0.3% in November, but the annual rate retreated to 5.7%. With the initial reaction, the US Dollar came under heavy selling pressure, and Gold price advanced beyond $1,900 for the first time since May on Thursday. Meanwhile, Federal Reserve Bank of Philadelphia President Patrick Harker and Atlanta Fed President Raphael Bostic both voiced their support for a 25 basis points (bps) Fed rate hike in early February, increasing expectations of a deceleration in the pace of tightening.

Following the CPI figures and dovish Fed comments, the probability of a 25 bps Fed rate hike rose above 90%, and the 10-year US T-bond yield dropped below 3.5% for the first time in three weeks, fueling XAU/USD's rally in the second half of the week.

Ahead of the weekend, the University of Michigan (UoM) reported that the Consumer Confidence Index rose to 64.6 in early January from 59.7 in December. More importantly, "year-ahead inflation expectations receded for the fourth straight month, falling to 4.0% in January from 4.4% in December," the UoM noted in its publication. With this report shutting the door for a recovery in US T-bond yields, XAU/USD held its ground and ended up gaining nearly 2% on a weekly basis.

Next week

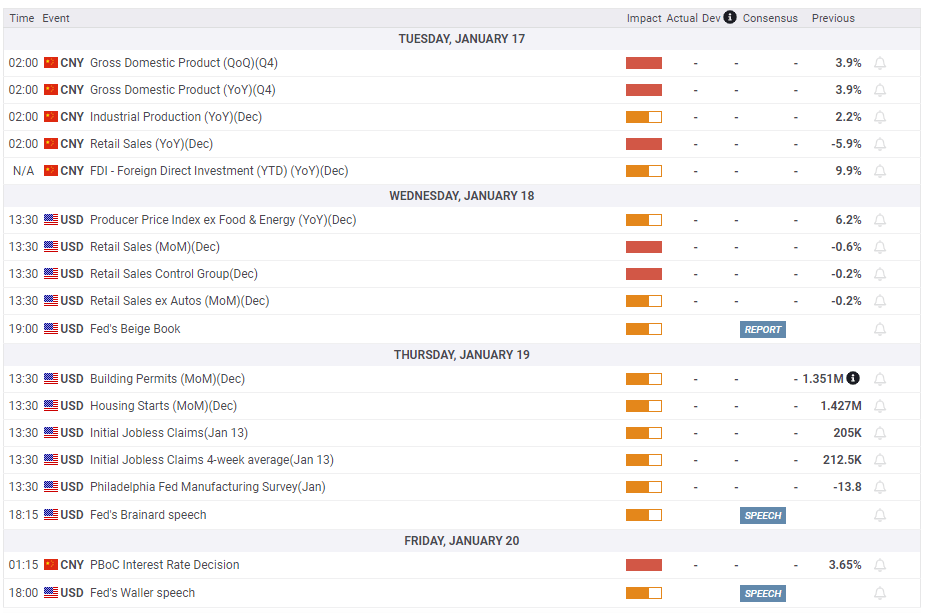

On Tuesday, Gross Domestic Product (GDP) data from China for the fourth quarter, alongside December Retail Sales and Industrial Production figures, will be watched closely by market participants. Better-than-expected economic performance in China, the world's largest gold consumer, could help XAU/USD push higher. On the other hand, the potential negative impact of a disappointing GDP print, which is likely given the surging number of coronavirus infections in December, should remain short-lived.

The US economic docket will feature December Retail Sales on Wednesday. Since that data is not adjusted for price changes, it is unlikely to have a noticeable impact on risk sentiment or the US Dollar's valuation.

Next week, investors will also pay attention to fourth-quarter earnings figures. Morgan Stanley, Goldman Sachs and Netflix Inc. are among the notable corporations that will report earnings next week. During the American trading hours, the performance of Wall Street's main indexes could provide a directional clue to XAU/USD. An improving market mood is likely to help the pair keep its footing and vice versa.

It's also worth noting that 3.4% aligns as key support for the 10-year US Treasury bond yield. In early December, the 10-year yield staged a strong rebound after having tested that level. A similar action could trigger a downward correction in Gold price. On the flip side, a drop below 3.4% is likely to open the door for an extended slide in yields and provide a boost to XAU/USD.

Gold price technical outlook

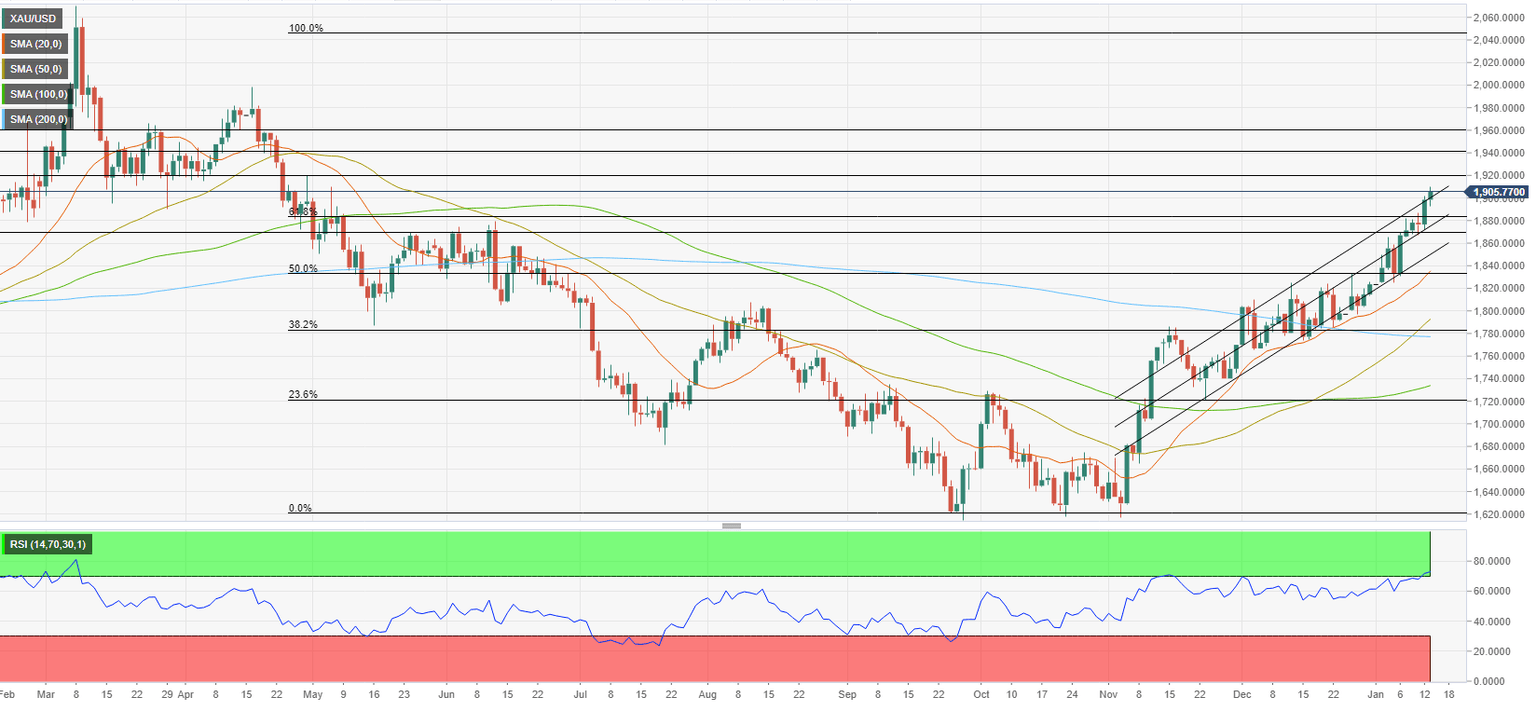

XAU/USD's near-term technical outlook points to overbought conditions with the pair trading slightly above the ascending regression channel coming from early November and the daily Relative Strength Index (RSI) holding above 70. Hence, Gold price could stage a technical correction before extending its uptrend.

On the downside, $1,880 (Fibonacci 61.8% retracement of the latest downtrend, mid-point of the ascending channel) aligns as initial support ahead of $1,860 (lower limit of the ascending channel). In case the latter support fails, XAU/USD could continue to fall toward $1,830, where the 20-day Simple Moving Average is located.

In case Gold price stabilizes above $1,900 and confirms that level as support, it could target $1,920, $1,940 and $1,960, all static levels from April 2022.

Gold price forecast poll

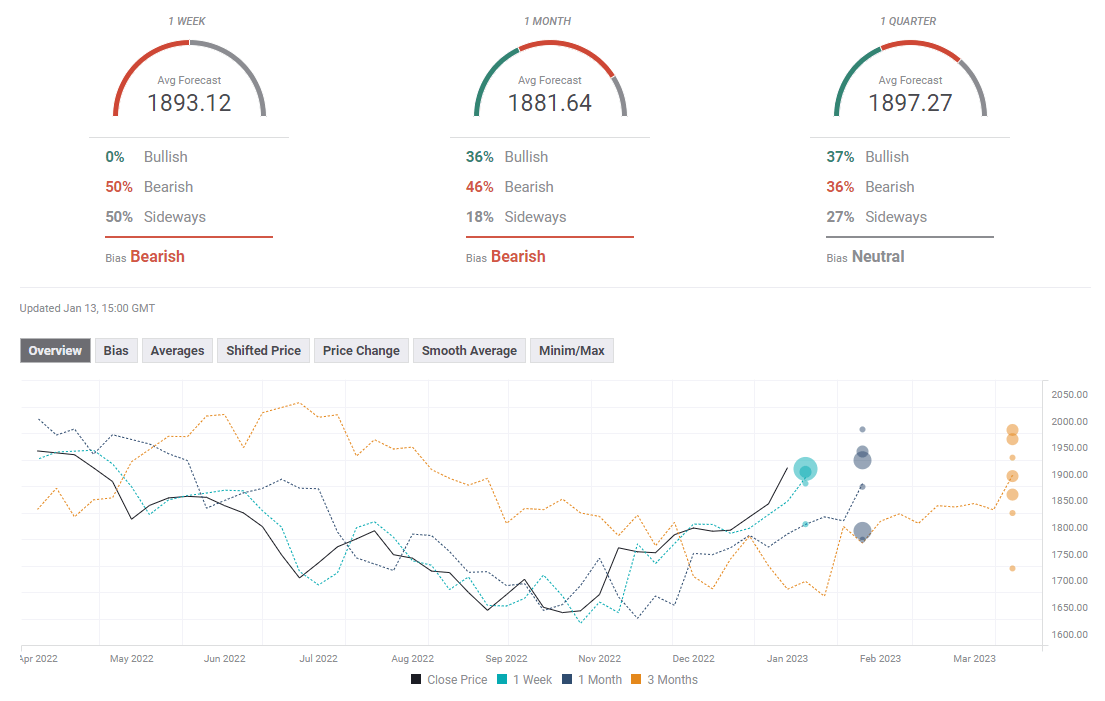

The FXStreet Forecast poll shows that experts don't expect Gold price to register significant gains next week with the average target on the one-week outlook sitting at $1,893. The one-month outlook paints a mixed picture.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.