Gold Price Weekly Forecast: Bulls encouraged as losses remain limited in face of hawkish Fed

- XAU/USD managed to find support despite broad-based US Dollar strength this week.

- The Fed left the door open to a tighter monetary policy for longer.

- The technical outlook highlights a lack of directional momentum in the near term.

Gold price started the week on a bullish note and climbed to its highest level since early September near $1,950 before reversing its direction in the second half of the week. Pressured by rising US Treasury bond yields, XAU/USD dropped below $1,920 on Thursday. Nevertheless, the pair regained traction ahead of the weekend and ended the week virtually unchanged.

What happened last week?

Gold price registered small gains on Monday as the improving risk mood made it difficult for the US Dollar (USD) to find demand during the American trading hours. With investors moving to the sidelines ahead of the Federal Reserve’s (Fed) policy announcements, however, XAU/USD struggled to preserve its bullish momentum.

The Fed left its policy rate unchanged at 5.25%-5.5% following the September meeting as anticipated. The revised Summary of Economic Projections – also known as the dot plot – showed that the US central bank intended to raise the policy rate one more time before the end of the year. Additionally, the publication showed that policymakers were expecting the policy rate to be lowered by 50 basis points (bps) in 2024, compared to the 100 bps rate cut projection seen in June’s dot plot.

“Majority of policymakers believe it is more likely than not another rate hike will be appropriate,” FOMC Chairman Jerome Powell said in the post-meeting press conference. He also reiterated that the Fed is prepared to raise rates further if needed. Although the initial ‘buy the rumor, sell the fact’ market reaction triggered a USD sell-off and allowed XAU/USD to rise to its strongest level in nearly three weeks at $1,947, the USD regathered its strength once the dust settled.

As investors assessed the hawkish revisions to the dot plot on Thursday, the benchmark 10-year US Treasury bond yield climbed higher alongside the USD Index, dragging XAU/USD below $1,920. In the meantime, the Bank of England and the Swiss National Bank’s decisions to unexpectedly leave interest rates unchanged highlighted the policy divergence between the Fed and other major central banks. Capital outflows out of the Swiss Franc and Pound Sterling provided an additional boost to the USD in the second half of the week.

After touching its highest level since 2007 above 4.5% on Thursday, the 10-year US yield corrected lower on Friday and helped Gold price edge higher. The final data release of the week from the US showed that the business activity in the private sector nearly stagnated in early September, with the S&P Global Composite PMI edging lower to 50.1. Commenting on PMI surveys' findings, “PMI data for September added to concerns regarding the trajectory of demand conditions in the US economy following interest rate hikes and elevated inflation," said Siân Jones, Principal Economist at S&P Global Market Intelligence.

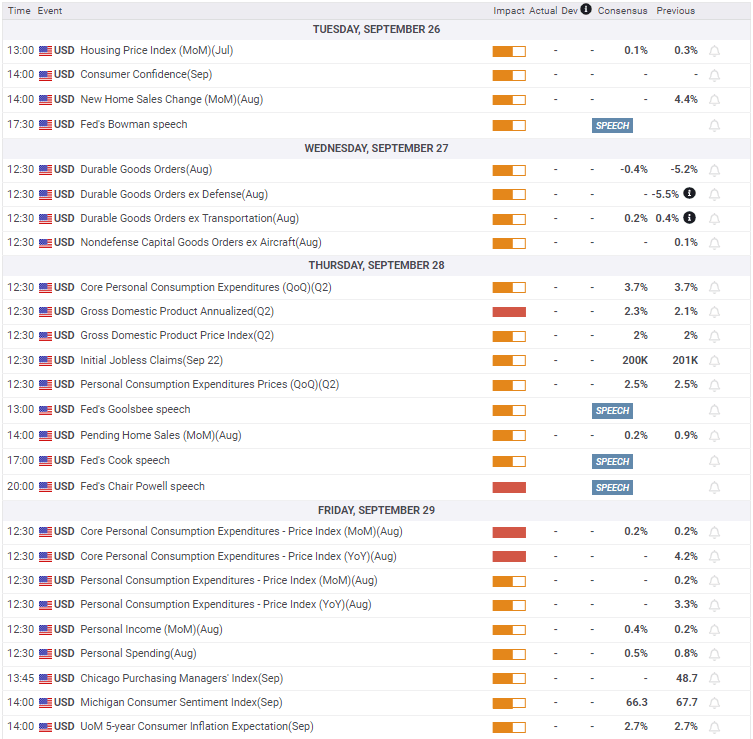

Next week

August Durable Goods Orders will be featured in the US economic docket on Wednesday. Even though this data doesn’t usually trigger a noticeable market reaction, a significant negative print at or below -2% following July’s 5.2% contraction could revive concerns over the US economic outlook. When asked whether he would call a soft landing his baseline scenario, “no, I would not do that," Chairman Powell responded. "I've always thought that the soft landing was a plausible outcome. Ultimately, this may be decided by factors that are outside our control at the end of the day, but I do think it's possible,” he explained.

According to the CME Group FedWatch Tool, markets are still pricing in a 55% probability that the Fed will keep the interest rate steady this year. Hence, markets could remain sceptical about the Fed’s willingness to tighten policy further if there are signs of a loss of momentum in economic activity. "Risk of overtightening and undertightening is becoming more equal, we need to find our way to the right level of restriction,” Powell acknowledged at the presser.

In the second half of the week, the US Bureau of Economic Analysis (BEA) will release the final reading of the annualized Gross Domestic Product (GDP) growth for the second quarter, which is forecast to be revised slightly higher to 2.2% from 2.1% in the previous estimate. On Friday, the BEA will publish the Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred gauge of inflation, data for August. On a monthly basis, the Core PCE Price Index, which excludes volatile food and energy prices, is expected to rise 0.2% to match July’s increase. Unless there is a noteworthy divergence from the market estimate, the market reaction to this data could remain short-lived.

Several Fed policymakers, including Boston Fed President Susan Collins and Atlanta Fed President Raphael Bostic, called earlier this month for a patient monetary policy moving forward. Market participants will pay close attention to comments from Fed officials now that the blackout period is over. If more officials voice their preference for a no change in policy this year, US Treasury bond yields could retreat and help XAU/USD hold its ground.

Even if the USD stays resilient against its peers and the 10-year US T-bond yield holds steady near multi-year highs, Gold price could still manage to inch higher. In September, XAU/USD is down 0.7%, while XAU/EUR and XAU/GBP pairs are up 1.2% and 2.7%, respectively. The weakening positive correlation between these pairs suggest that Gold could continue to find demand while investors look for a safer alternative to these currencies.

In summary, it might be risky to bet on a steady increase in Gold price in the near term but losses are likely to remain limited in the current market environment.

Gold technical outlook

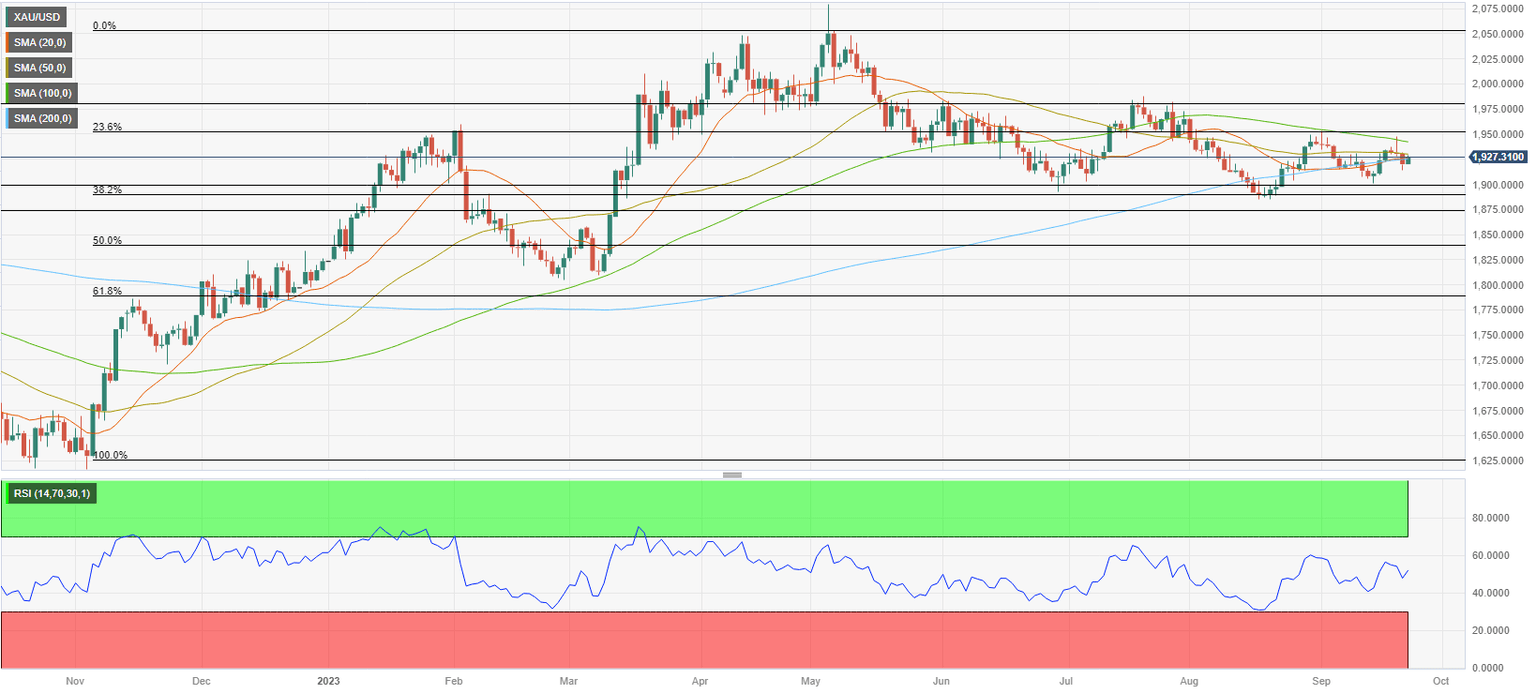

The near-term technical outlook highlights XAU/USD’s indecisiveness. The pair fluctuated at around the $1,920-$1,925 area in the second half of the week, where the 20-day, 50-day and the 200-day Simple Moving Averages (SMA) converge. Additionally, the Relative Strength Index (RSI) indicator returned to 50 on Friday after fluctuating between 40 and 60 earlier in the week, confirming the lack of directional momentum.

On the upside, $1,940 (100-day SMA) aligns as immediate resistance before $1,950 (Fibonacci 23.6% retracement of the latest uptrend). A daily close above the latter could attract technical buyers and open the door for another leg higher to $1,980 (static level).

If the pair makes a sharp decline below $1,920 and confirms that level as resistance, the $1,900-$1,890 area (Fibonacci 38.2% retracement, static level, psychological level) could be set as the next bearish target before $1,875 (static level, former resistance).

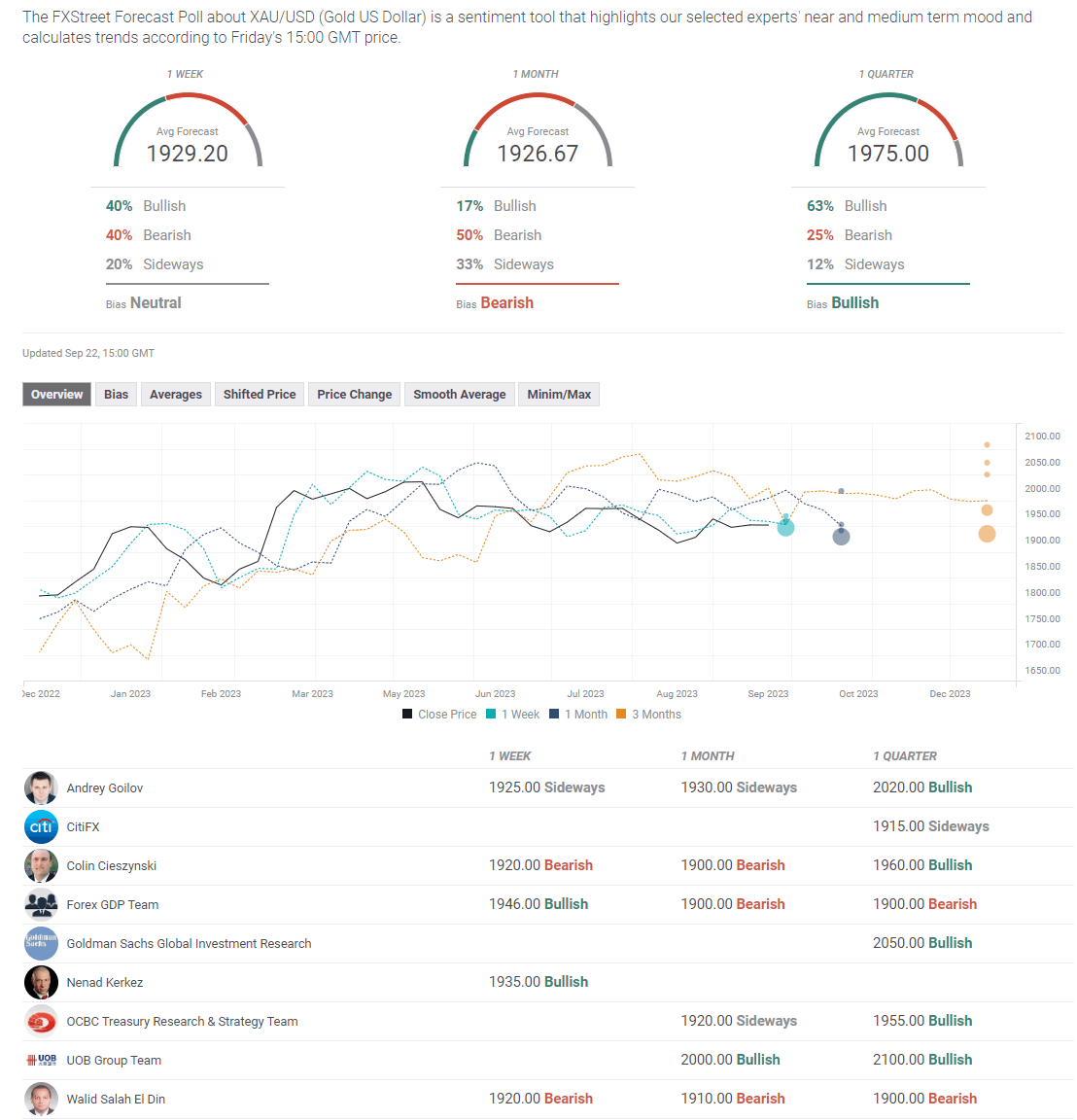

Gold forecast poll

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.