- Vaccine progress-driven optimism to cap gold’s recovery.

- 200-DMA is the level to beat for the XAU/USD bulls.

- Sell the bounce likely a key theme ahead of US data.

Gold (XAU/USD) slumped to five-month lows of $1765 on Monday but managed to recover $20 to finish the day around $1776. Gold’s decline was mainly driven by increased expectations of a swifter global economic recovery, as coronavirus vaccine rollout looks imminent and could propel a return of normality to markets early next year. The vaccine-induced optimism dented gold’s safe-haven appeal. US Treasury Secretary Steve Mnuchin’s call to utilize $455 billion from the CARES Act fuelled stimulus hopes and helped the upside attempts in the precious metal. However, the US dollar rebounded on month-end demand, which kept a check on gold’s recovery.

Gold clings onto the recovery gains so far this Tuesday amid a broad-based US dollar retreat, as the optimism over the vaccine and US stimulus combined with strong Chinese Manufacturing PMI boosts the demand for the riskier assets. However, it remains to be seen if the metal sustains the bounce, as the vaccine progress could once again overwhelm the gold traders. Also, of note remains the critical US economic releases, including the ISM Manufacturing PMI, and Fed Chair Jerome Powell’s testimony due later in the NA session. Powell’s prepared text of the testimony voiced his concerns regarding the economic recovery amid the virus resurgence.

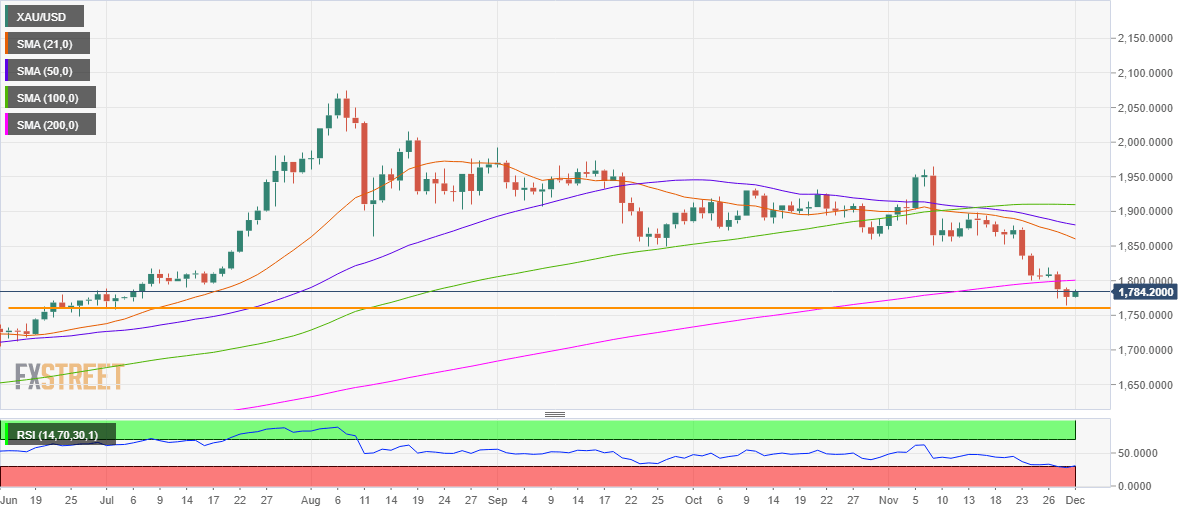

Gold Price Chart - Technical outlook

Daily chart

The daily chart shows that the recovery in gold from multi-month troughs is likely to face strong resistance at $1800, which is the confluence of the 200-daily moving average (DMA) and psychological level. Acceptance above the latter on a daily closing basis is critical to unleashing further recovery gains.

The 14-day Relative Strength Index (RSI) has bounced off the oversold region but trades flat below the 50 level, suggesting that the metal is not out of the woods yet. Therefore, the downside remains exposed towards the five-month lows of $1765, below which the July 2 low could be put to test. Further south, the $1750 support is the last hope for the XAU bulls.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.