Gold Price Forecast: XAU/USD weighed down by rallying US bond yields, upbeat market mood

- A combination of factors prompted some fresh selling around gold on Thursday.

- The risk-on mood, stronger US bond yields exerted some pressure on the metal.

- A softer tone around the USD might extend some support and help limit losses.

Gold struggled to capitalize on the previous day's goodish intraday bounce and witnessed some fresh selling during the Asian session on Thursday. The underlying bullish tone in the financial markets was seen as one of the key factors that weighed on the safe-haven XAU/USD. Apart from this, the recent runaway rally in the US Treasury bond yields exerted some additional pressure on the non-yielding yellow metal. That said, a softer tone surrounding the US dollar might extend some support to the dollar-denominated commodity and help limit deeper losses, at least for the time being.

Reflation trade remains the primary theme amid the progress in coronavirus vaccinations and US President Joe Biden's proposed $1.9 trillion stimulus package, which has been fueling hopes for a strong global economic recovery. In the latest development, the US Food and Drug Administration said that Johnson & Johnson's one-dose COVID-19 vaccine appeared safe and effective in clinical trials and could grant emergency use approval by the end of the week. Meanwhile, the pandemic-relief legislation will be put on the House floor for a potential vote on Friday or over the weekend.

Adding to this, Fed Chair Jerome Powell's reassurance that interest rates would stay low for a long time further boosted investors' confidence. During his second day of testimony before the House Financial Services Committee on Wednesday, Powell showed commitment to the current ultra-easy monetary policy and reiterated that the Fed has no plans to cut back on money-printing or raise interest rates in the short term. Powell also calmed fears about inflation and said that he will only start worrying if prices begin to rise in a persistent and troubling way.

Meanwhile, rising inflation expectations, along with the reflation trade continued pushing the US bond yields higher, though did little to provide any meaningful boost to the greenback. This, in turn, might hold bearish traders from placing any aggressive bets. Market participants now look forward to the US economic docket, highlighting the release of the Prelim (second estimate) Q4 GDP print. Apart from this, the US Durable Goods Orders data and speeches by influential FOMC members, will influence the USD and produce some meaningful trading opportunities around the commodity.

Short-term technical outlook

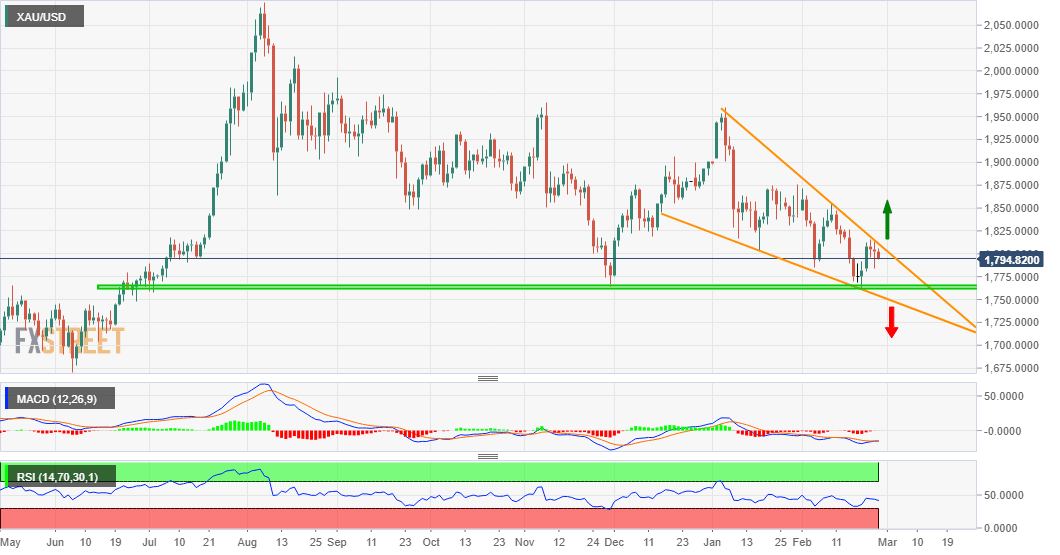

From a technical perspective, the commodity has been oscillating between two converging trend-lines over the past two months or so. This seemed to constitute the formation of a bullish falling wedge pattern on the daily charts. However, technical indicators on the mentioned chart have been drifting lower in the negative territory and are yet to support the constructive set-up. This makes it prudent to wait for a sustained breakthrough the wedge resistance, currently around the $1812-13 region, before positioning for any further appreciating move.

Some follow-through buying beyond the weekly tops, near the $1816 level, will reaffirm the bullish breakout and push the commodity back towards the next relevant resistance near the $1842 horizontal zone. The momentum could further get extended towards the $1852-55 supply zone en-route monthly swing highs, around the $1870 region.

On the flip side, the $1783-80 area now seems to have emerged as immediate strong support. This is followed by multi-month lows, around the $1760 region and wedge support near the $1751 level. Sustained weakness below might now accelerate the downfall towards the $1725-24 congestion zone before the metal eventually drops to the next relevant support just ahead of the $1700 mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.