Gold Price Forecast: XAU/USD risks a profit-taking decline heading into Trump’s inauguration

- Gold price treads water below the monthly high of $2,725 early Friday.

- The US Dollar and Treasury bond yields sustain correction amid renewed dovish bets.

- Gold traders could cash in, repositioning for Trump’s inauguration on Monday.

- Technically, Gold price remains a ‘buy-the-dip’ trade, per the daily chart.

Gold's price has paused its three-day uptrend to monthly highs of $2,725 as buyers catch a breather ahead of the weekend and US President-elect Donald Trump’s inaugural ceremony on Monday.

Gold price could pullback before the next leg up

Gold price has entered a bullish consolidation phase and could risk a near-term correction before resuming the uptrend toward all-time highs of $2,790. The bright metal fails to find any inspiration from stronger-than-expected China’s Gross Domestic Product (GDP) for the fourth quarter (Q4) of 2024, which came in at 5.4% over the year, compared to the 5.% estimates and the previous reading of 4.6%. Chinese Retail Sales and Industrial Production data also surpassed forecasts. China is the world’s top Gold consumer.

Chinese economy achieved its 5% growth target in the final quarter of last week but that optimism seems to be overshadowed by concerns over China’s property market and looming tariffs proposed by US President-elect Trump.

However, the downside in Gold price remains cushioned by reinforced expectations that the US Federal Reserve (Fed) will deliver two interest rate cuts this year, following the tame December inflation data released earlier this week. Dovish Fed bets continue to exert downward pressure on the US Treasury bond yields and the US Dollar (USD), underpinning the non-interest-bearing Gold price.

Mixed US Retail Sales and disappointing Initial Jobless Claims data, released on Thursday, added to the market expectations for Fed rate cuts. Initial Claims for state unemployment benefits rose to a seasonally adjusted 217,000 for the week ended Jan. 11, the Labor Department said on Thursday, missing the expected 210,000 figure.

However, Fed Governor Christopher Waller's commentary exacerbated the pain in US Treasury bond yields and the Greenback. “If price pressures continue on the current path of decelerating, it's reasonable to think rate cuts could possibly happen in the first half of the year," Waller said in Thursday’s interview with CNBC.

Next of note for Gold traders, in terms of economic data, are the mid-tier US housing data and Industrial Production. The data could provide fresh trading incentives for Gold price. Further, the end-of-the-week flows and profit-taking on the recent long positions could also act as headwinds for the bullion.

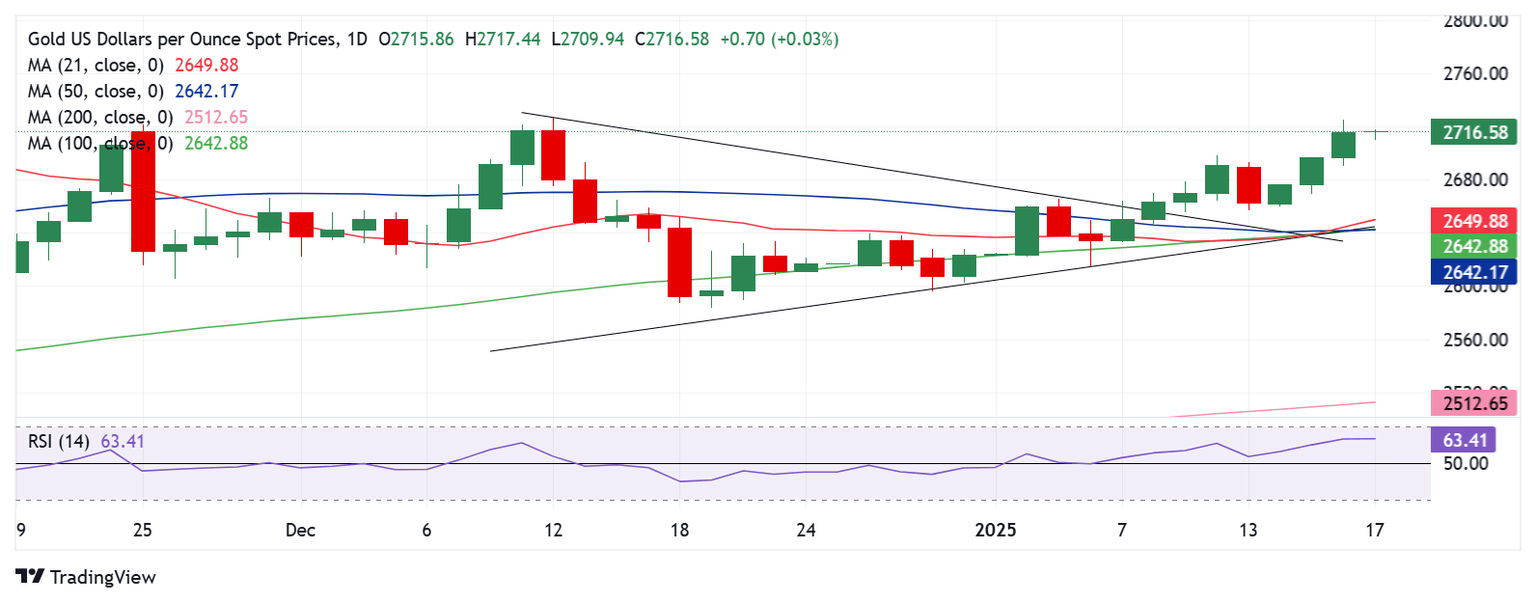

Gold price technical analysis: Daily chart

The short-term technical outlook for Gold price continues to favor of Gold buyers as the previous week’s symmetrical triangle breakout remains in play and the yellow metal holds well above all the major daily simple moving averages (SMA).

The 14-day Relative Strength Index (RSI) has flattened above the midline, currently near 63.50, suggesting that Gold price could see a brief pullback before moving higher.

Gold price eyes acceptance above the key static resistance at $2,726 to extend the uptrend toward the $2,750 psychological barrier. The next target is aligned at the record high of $2,790.

If the correction unfolds, Gold price will find initial demand at the previous day’s low of $2,690, below which the January 15 low of $2,670 will be tested.

Deeper declines will challenge the powerful support area near $2,745, where the 21-day SMA, 50-day SMA, 100-SMA and the triangle convergence meet.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.