Gold Price Forecast: XAU/USD needs to crack one key resistance to take on $2,000

- Gold price sits at three-month highs near $1,980 early Friday, targeting $2,000.

- US Dollar finds demand amid Middle East tensions-led risk-off mood. US Treasury bond yields retreat.

- Gold price has more room to the upside, peeping into the overbought conditions.

Gold price is sitting at the highest level since July near $1,980, sustaining its ongoing bullish momentum early Friday. Gold price continues to capitalize on escalating geopolitical tensions between Gaza and Israel, shrugging off the relentless upsurge in the US Treasury bond yields.

US Treasury yields and Middle East strife hold the key

The US Treasury bond yields extended its upside amid a continued bond market rout, further fuelled by comments from the US Federal Reserve (Fed) Jerome Powell, which suggested that rising US Treasury bond yields are not indicative of further Fed rate hikes or higher inflation. "It's really happening in term premiums," Powell said, meaning the compensation investors demand for holding bonds for a longer time. He added, "financial conditions have tightened significantly" with the rise of long-term bond yields.

His comments exacerbated the pain in the US Dollar, as it was already sold off into an improvement in the market sentiment. Strong US Jobless Claims report also failed to impress the US Dollar bulls. Meanwhile, the US Treasury bond yields extended their rally on Powell’s comments, with the benchmark 10-year US Treasury bond yields briefly touching the 5.0% level for the first time since 2007.

The US Dollar, however, swung back into the bid, as Gaza-Israel tensions escalated and hit risk appetite once again. The Israel Defense Forces (IDF) had been given the ‘green light’ to enter Gaza whenever it deems necessary, potentially paving the way to a ground invasion of Gaza, a member of the Israeli security cabinet told ABC News on Thursday.

The traditional safe-haven, Gold price, caught a massive bid on these headlines and stormed through key barriers, gaining more than $30 on Thursday to settle near $1,975.

At the time of writing, Gold price is trading firmer, testing multi-month highs amid heightened risk of a probable Israel invasion of Gaza, with fears of geopolitical tensions spreading into other Middle East regions. There are reports that Drones and rockets have reportedly attacked Iraq's Ain Al-Asad airbase which houses US forces.

Therefore, Gold traders will keep a close eye on the geopolitical developments surrounding the Middle East conflict while the end-of-the-week flow could also play its part in driving the Gold price action. The US economic calendar is data-dry on Friday, although speeches from Fed officials Patrick Harker and Loretta Mester will be watched for fresh cues on the Fed policy outlook, as the central bank enters its ‘blackout period’ from Saturday.

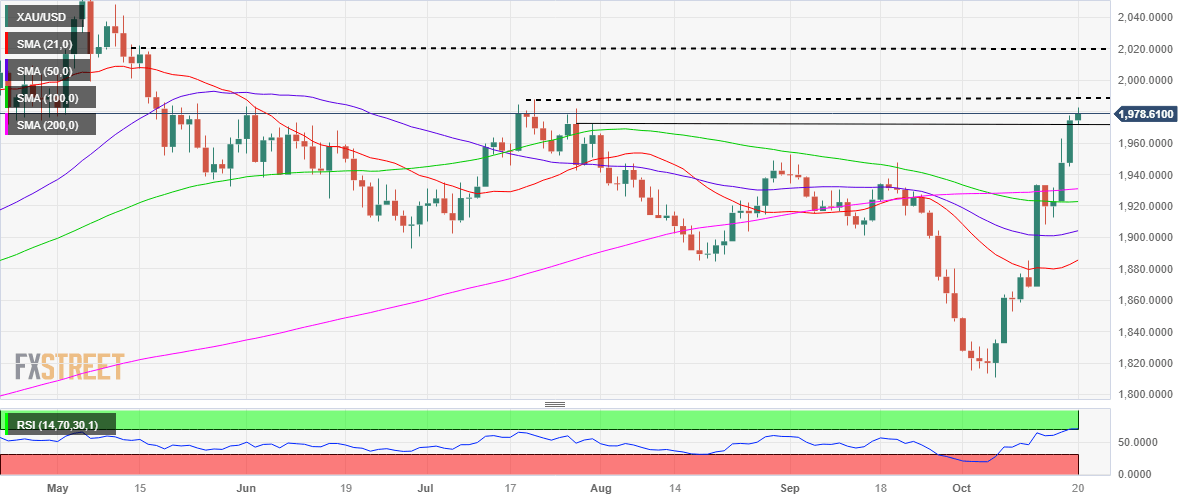

Gold price technical analysis: Daily chart

Having surpassed all key Daily Moving Averages (DMA) and end-July highs, Gold price is marching higher to challenge the one last hurdle at $1,988 (July 20 high) before the $2,000 threshold could be challenged.

The 14-day Relative Strength Index (RSI) indicator is peeping into the overbought region, just above 71.00, suggesting that there is some more room to the upside before a correction could set in.

On the flip side, any retracement from multi-month highs could test the previous resistance now support at $1,972, the July 31 high. The next cushion is envisioned at Wednesday’s high of $1,963.

Further south, the $1,950 psychological level will challenge bullish commitments, putting the focus back on the key 200 DMA resistance-turned-support at $1,930.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.