Gold Price Forecast: XAU/USD: Downside appears more compelling below 200-DMA, US GDP eyed

- The Fed’s wait and watch stance knocks-off gold.

- Daily technical chart points to the additional downside.

- US Q4 GDP eyed amid mounting covid concerns.

Gold (XAU/USD) fell as low as $1831 on Wednesday but recovered some ground, finishing the day down nearly $15. Gold traders were unimpressed by the Fed’s status-quo, as the central bank appeared less dovish than expected. Further, uncertainty over the US stimulus plan and the relentless covid surge added to the Fed-led pessimism and lifted the haven demand for the US dollar. Gold tumbled alongside Wall Street stocks amid broad US dollar strength.

Markets look forward to the US Q4 advance GDP and weekly jobless claims for a clear direction in the metal. Joseph Trevisani, FXStreet’s Senior, noted: “Annualized GDP in the fourth quarter expected to be 3.9% in the Reuters Survey. Dow Jones poll predicts 4.5%, Atlanta Fed GDPNow forecast at 7.5%.” The dollar’s strength amid continued risk-aversion could likely limit any upside attempts while the declines could still be guarded amid stimulus hopes. Although the risks remain tilted to the downside, as the technical setup continues to favor the bears.

Gold Price Chart - Technical outlook

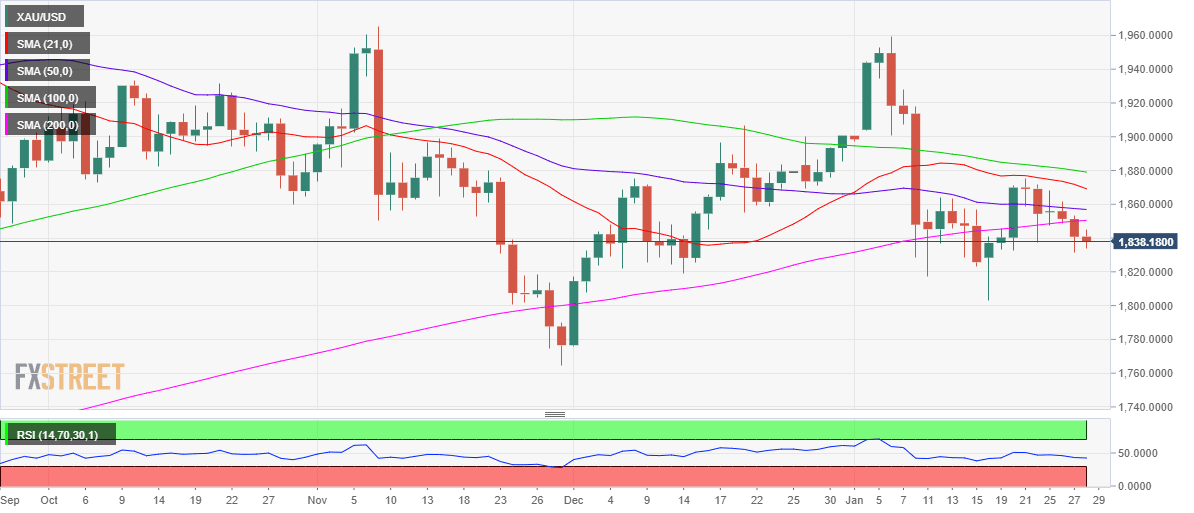

Gold: Daily chart

Wednesday’s fall prompted gold to breach the critical 200-daily moving average (DMA) at $1850, with the path of least resistance seemingly downside after closing the day below the 200-DMA support.

The 14-day Relative Strength Index (RSI) points south below the midline, further backs the case for the bearish momentum.

Unless the XAU bulls recapture the 200-DMA on a sustained basis, the sellers remain hopeful and could target the January 18 low at $1803.

Wednesday’s low of $1831 could offer some initial support to the bulls.

On the flip side, the 100-DMA barrier at $1857 could return to play if the buyers find a foothold above the 200-DMA.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.