Gold Price Forecast: XAU/USD bides time before retesting record highs, as US jobs data loom

- Gold price gathers strength for the next leg up, battling $2,500 early Thursday.

- The US Dollar suffers from the increased odds of a big Fed rate cut in September.

- Gold price looks to US jobs data and record highs once $2,500 is cleared sustainably.

Gold price is gathering pace to yield a sustained move above the $2,500 threshold in the Asian session on Thursday, as traders turn their focus to the key US ADP Employment Change data and the ISM Services PMI due later in the day.

Gold price cheers increased bets of outsized Fed rate cut

Gold price bounced off the key short-term daily support level, then at $2,485, following a brief dip under it, as the US Dollar (USD) gave into the bearish pressures emanating from rising expectations that the US Federal Reserve (Fed) will opt for a 50 basis points (bps) interest-rate cut at its September 17-18 policy meeting.

Weak US ISM Manufacturing PMI was joined by further signs of cooling in the labor market, as reflected by the decline in the US Job Openings survey published by the JOLTS on Wednesday.

US Job Openings dropped to a 3-1/2-year low in July, arriving at 7.67 million, following the 7.9 million openings (revised from 8.1 million) in June while below the market expectation of 8.1 million. Markets are now pricing in a 45% chance of an outsized 50 bps rate cut by the Fed later this month, up from 31% at the start of this week, according to the CME Group’s FedWatch tool.

The USD meets fresh supply and languishes in multi-day troughs yet again, in the aftermath of the dovish remarks from San Francisco Fed President Mary Daly. Daly said that the “Fed needs to cut policy rate because inflation is falling and the economy is slowing.” On the side of the rate cut, she said that “we don't know yet,” adding that they “need more data, including Friday's job market report and CPI.”

Therefore, the US Nonfarm Payrolls and wage inflation data due on Friday hold the utmost significance in helping markets gauge the size of the Fed rate cut this month. In the meantime. Gold traders will seek cues from the ADP private sector jobs report, Jobless Claims and ISM Services PMI data slated for release later this Thursday.

These data are likely to have a notable impact on the US Dollar’s performance across the board, in turn, influencing the Gold price action in the near term. Disappointing US employment data could double down on the dovish Fed sentiment, bolstering the bets for an outsized September Fed rate cut and Gold price.

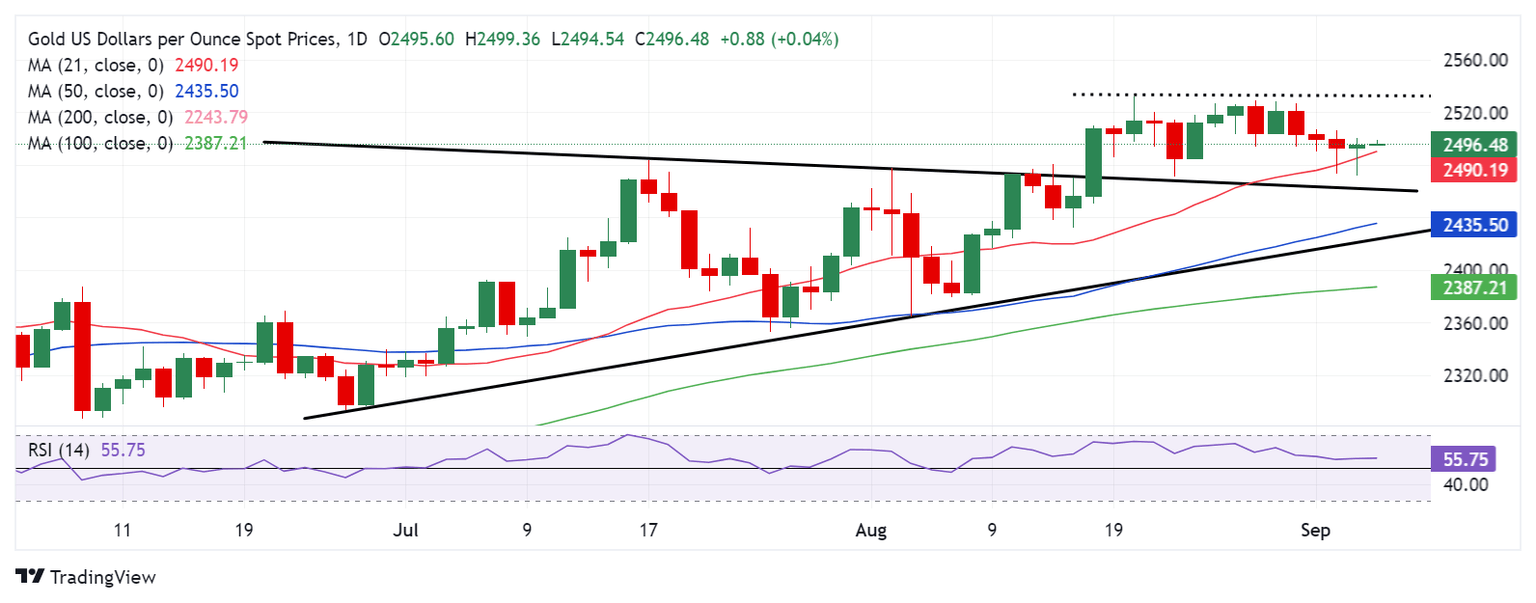

Gold price technical analysis: Daily chart

The short-term technical outlook for Gold price also remains in favor of buyers, as the 21-day Simple Moving Average (SMA), now at $2,490, continues to hold the fort.

The 14-day Relative Strength Index (RSI) edges higher above the 50 level, adding credence to the bullish potential in Gold price.

On the upside, recapturing the $2,500 level on a daily closing basis is critical for Gold price to resume its upward trajectory. The next relevant topside barrier is seen at the record high of $2,532, above which the $2,550 psychological level will be tested.

If the corrective downside regains momentum, Goild price needs a daily closing below the 21-day SMA at $2,490, below which this week’s low of $2,472 will be challenged.

Further down, sellers will need to crack the symmetrical triangle resistance-turned-support at $2,460. A fresh downtrend would initiate below that support level, as they target the $2,430 area, where the triangle support line and the 50-day SMA close in.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.