Gold Price Forecast: XAU/USD bears turn cautious near ascending trend-line, NFP awaited

- A combination of factors prompted some aggressive selling around gold on Thursday.

- The Fed taper talks prompted some USD short-covering and weighed on the commodity.

- Upbeat US macro data, uptick in the US bond yields further underpinned the greenback.

- The market focus will remain on Friday’s release of the closely-watched US jobs report.

Gold witnessed a dramatic turnaround from the highest level since January and tumbled around 2% on Thursday amid resurgent US dollar demand. The incoming positive economic data indicated that the US recovery is gathering pace and fueled speculations about a potential pullback of stimulus measures. This, in turn, forced investors to unwind their USD bearish bets, which, in turn, weighed heavily on dollar-denominated commodities, including gold. The USD buying interest picked up pace following the release of upbeat US macro releases.

The ADP report showed that the US private-sector employers added 978K new jobs in May. This was well above consensus estimates pointing to a reading of 650K and marked the biggest increase since June 2020. Adding to this, the US Initial Weekly Jobless Claims fell more than anticipated, to 385K during the week ended May 28 from the 405K previous. Separately, the US ISM Services PMI also surpassed market expectations and touched another record high level of 64.0 in May, highlighting the ramp-up in business activity across the economy.

Signs of a strengthening US economy boosted bets for higher inflation and further fueled speculations that the Fed may bring forward the timeline for tapering its bond purchases. This was evident from a fresh leg up in the US Treasury bond yields, which provided an additional boost to the greenback and further drove flows away from the non-yielding yellow metal. Even a softer tone around the equity markets also did little to ease the bearish pressure surrounding the safe-haven XAU/USD or stall the sharp intraday decline on Thursday.

The downward momentum extended through the early part of the Asian trading session on Friday and drag the commodity to the lowest level since May 19, though stalled just ahead of the $1,850 level. Investors now turned cautious and preferred to move on the sidelines as the focus remains on the closely-watched US monthly jobs report – popularly known as NFP. This will be one of the most important pieces of economic data that would set the tone for the upcoming FOMC meeting later this month and provide a fresh directional impetus to the metal.

Short-term technical outlook

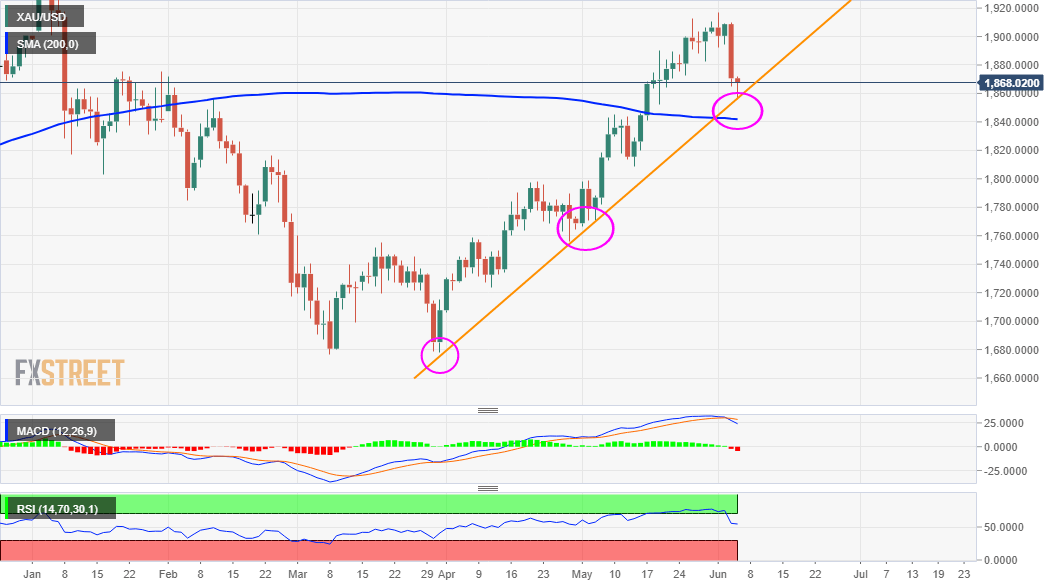

From a technical perspective, the XAU/USD, for now, seems to have found some support near an ascending trend-line extending from YTD lows. This should now act as a key pivotal point for short-term traders and help determine the near-term trajectory. The mentioned trend-line, around the $1,855 region, is followed by the very important 200-day SMA near the $1,842 area. Sustained weakness below will be seen as a fresh trigger for bearish traders and accelerate the slide further towards the $1,816-15 intermediate support en-route the $1,800 round-figure mark.

On the flip side, immediate resistance is now pegged near the $1,880-82 region ahead of the $1,895-$1,900 zone. Any subsequent move up might continue to confront some supply near the $1,915-16 area, which if cleared would set the stage for additional gains. The precious metal might then aim to surpass an intermediate resistance near the $1,925 level and accelerate the momentum further towards the $1,950 level.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.