Gold Price Forecast: XAU/USD awaits US Q4 GDP print before the next leg down

- Gold price ticks higher on Thursday amid subdued USD demand, albeit lacks follow-through.

- The upbeat market mood caps gains for the metal amid rising bets for a delayed Fed rate cut.

- Traders look to the US macro data dump for some impetus ahead of the US PCE on Friday.

Gold price (XAU/USD) ekes out small gains on Thursday and reverses a part of the overnight heavy losses to the $2,011 area, or a multi-day low, though the uptick lacks bullish conviction. In the absence of any fresh fundamental trigger, subdued US Dollar (USD) price action is seen as a key factor lending some support to the commodity amid worries about escalating geopolitical tensions in the Middle East. Any meaningful appreciating move, however, still seems elusive in the wake of growing acceptance that the Federal Reserve (Fed) will not rush to cut interest rates.

The expectations were reaffirmed by the better-than-expected US data on Wednesday, which showed that the economy kicked off 2024 on a stronger note. The S&P Global flash US Manufacturing PMI rebounded from 47.9 to a 15-month high of 50.3 in January and the gauge for the services sector climbed to 52.9, or the highest reading since last June. Furthermore, the flash US Composite PMI Output Index increased to 52.3 this month, or the highest since last June. This reaffirms the view that the world's largest economy is in good shape and forces investors to further scale back their bets for a more aggressive Fed policy easing in 2024. This, in turn, allows the yield on the benchmark 10-year US government bond to hold steady near a more than one-month high touched last week, which favours the USD bulls and should cap gains for the non-yielding Gold price.

Meanwhile, the global risk sentiment gets an additional boost after the People's Bank of China (PBoC) unexpectedly lowered the Reserve Requirement Ratio (RRR) for local banks by 50 bps starting from February 5 to boost the economy. This remains supportive of the upbeat mood across the global equity markets, which, in turn, suggests that the path of least resistance for the safe-haven Gold price is to the downside. Traders, however, seem reluctant to place aggressive directional bets and prefer to wait for the release of the Advance US Q4 GDP print. Thursday's US economic docket also features the release of Durable Goods Orders, the usual Weekly Initial Jobless Claims and New Home Sales. Apart from this, the European Central Bank (ECB) might provide some impetus to the XAU/USD ahead of the US Personal Consumption Expenditures Price Index on Friday.

Technical Outlook

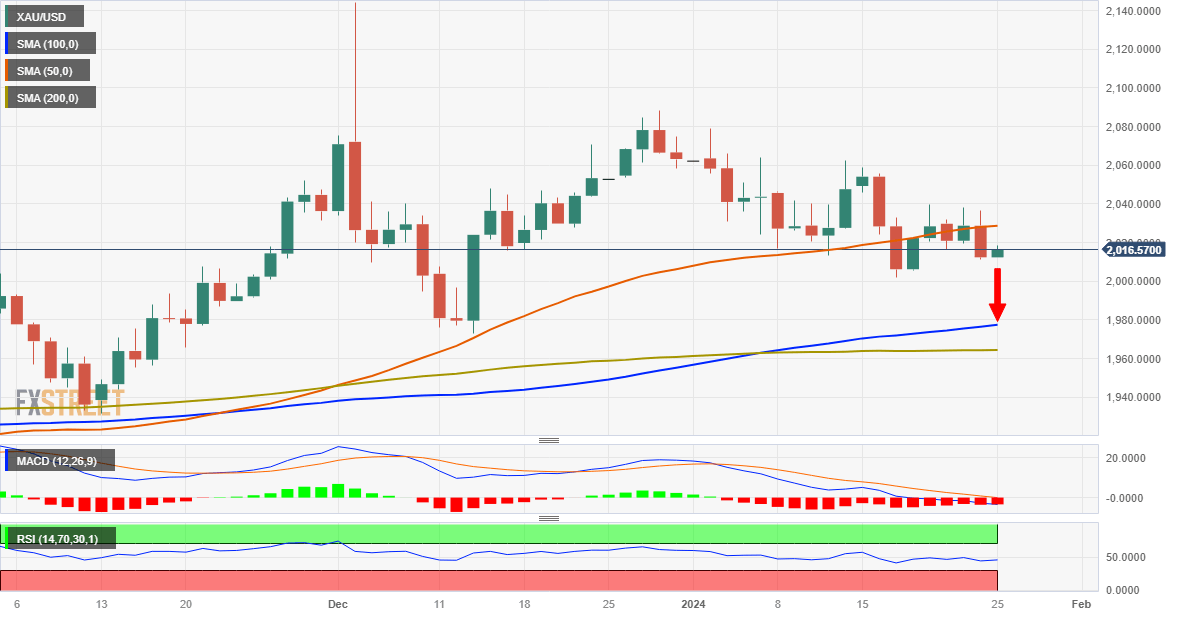

From a technical perspective, the recent repeated failures near the $2,040-2,042 supply zone and the overnight downfall favour bearish traders. Moreover, oscillators on the daily chart have just started gaining negative traction and validate the negative outlook for the Gold price. That said, it will still be prudent to wait for acceptance below the $2,000 psychological mark before positioning for a slide towards the $1,988 intermediate support en route to the 100-day Simple Moving Average (SMA), currently around the $1,975-1,974 area, and the 200-day SMA, near the $1,964-1,963 region.

On the flip side, the $2,025 zone, or the 50-day SMA, is likely to act as an immediate resistance, above which the Gold price could climb back to the $2,040-2.042 hurdle. A sustained strength beyond the latter might trigger a short-covering rally towards the $2,077 region. The momentum could extend further and allow bulls to aim back to reclaim the $2,100 round-figure mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.