XAU/USD (gold price in terms of USD) witnessed a volatile session on Easter Monday, with limited volatility and low volumes exaggerating the moves in the precious metal. The prices dropped sharply to 1207.69 troughs ahead of the US session, although staged a robust $ 16 recovery from thereon and spiked to daily high at $ 1223.12 following tepid US economic releases. The US personal spending showed slower growth in Feb, while the pending home sales jumped to 7-month high last month. The prices recovered entire losses and swung back higher only to find stiff resistance near 1223-1224 region, and eased slightly to 1222.64 at close. However, the bullion managed to book the first daily gain in three consecutive sessions.

As for today’s trade so far, the yellow metal snapped its overnight recovery and fell back in the negative territory as the US dollar witnessed a minor pullback against its major peers ahead of Fed Chair Yellen’s speech due later in the NY session this Tuesday. The prices dipped, although remains above one-month lows and continues to consolidate in a tight range near $ 1220, as markets refrain from placing big heading into the main risk event for today – Yellen’s speech. Besides, the US consumer confidence the US consumer confidence data may provide fresh cues on the US economic recovery and eventually on the Fed interest rates outlook. Markets are expecting hawkish comments from Yellen, following a recent series of hawkish comments from other Fed officials. However, in case of dovish comments from the Fed Chair in wake of the slower pace of growth in the prices pressures, the USD could take another round of beating and therefore, boost the dollar-priced in gold.

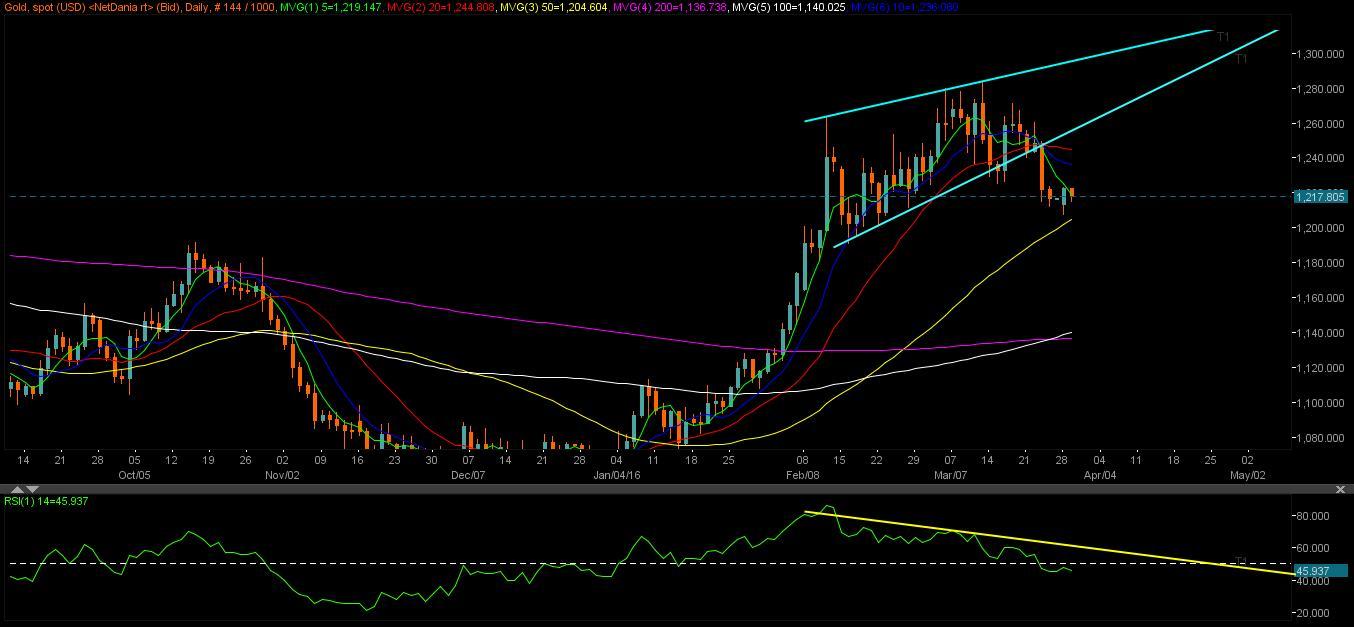

Technicals –$ 1200 or $ 1240 on Yellen?

The daily chart for gold still appears bearish, with the daily RSI below the mid-line and still aiming lower, which suggests further scope for downside. Moreover, the prices fail to resist above extremely bearish 5-DMA placed at 1219.15, with offers pushing the bullion towards previous low reached at 1207.69. A break below the last, the crucial 1204/00 (upward sloping 50-DMA/ psychological levels) would be tested, opening floors for further downside towards $ 1190 levels. In case Yellen raises concerns over the softer inflation numbers and emphasis Fed’s gradual rate hikes stance, then the prices could swing back towards 10-DMA located near 1240 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.