Having displayed a pennant bullish break on Thursday, XAU/USD (gold price in terms of USD) witnessed an almost $ 30 rally on Friday and rose to the highest levels in thirteen months at 1279.84. The bullion booked heavy gains in the US last session, after the US labour market report failed to boost further Fed rate hike bets this year. Although NFP bettered expectations (242k actual vs. 195k exp.), average hourly earnings grew only 2.2% y/y in Feb, missing expectations for unchanged performance over the month at 2.5% and booked the first drop since December 2014. Gold tends to benefit in a low-interest rate environment as it is a non-interest bearing investment asset. More so, the upsurge in gold was largely on the back of technical-driven buying following the pennant formation on daily charts.

Gold prices kicked-off the week on a bearish note, embarking upon a corrective mode after the recent upsurge. Further, the US dollar also attempted a recovery from post-NFP lows and now advances 0.35% against its six major peers, which also keeps a lid on the prices. However, the prices are expected to regain poise and resume its bullish run towards 1280 levels, underpinned by risk-off moods seen in Europe amid falling stocks and oil prices. Meanwhile, amid a lack of significant macro data from the US in the day ahead, attention will be paid to the speeches by Fed’s officials Brainard and Fischer later in the NY session.

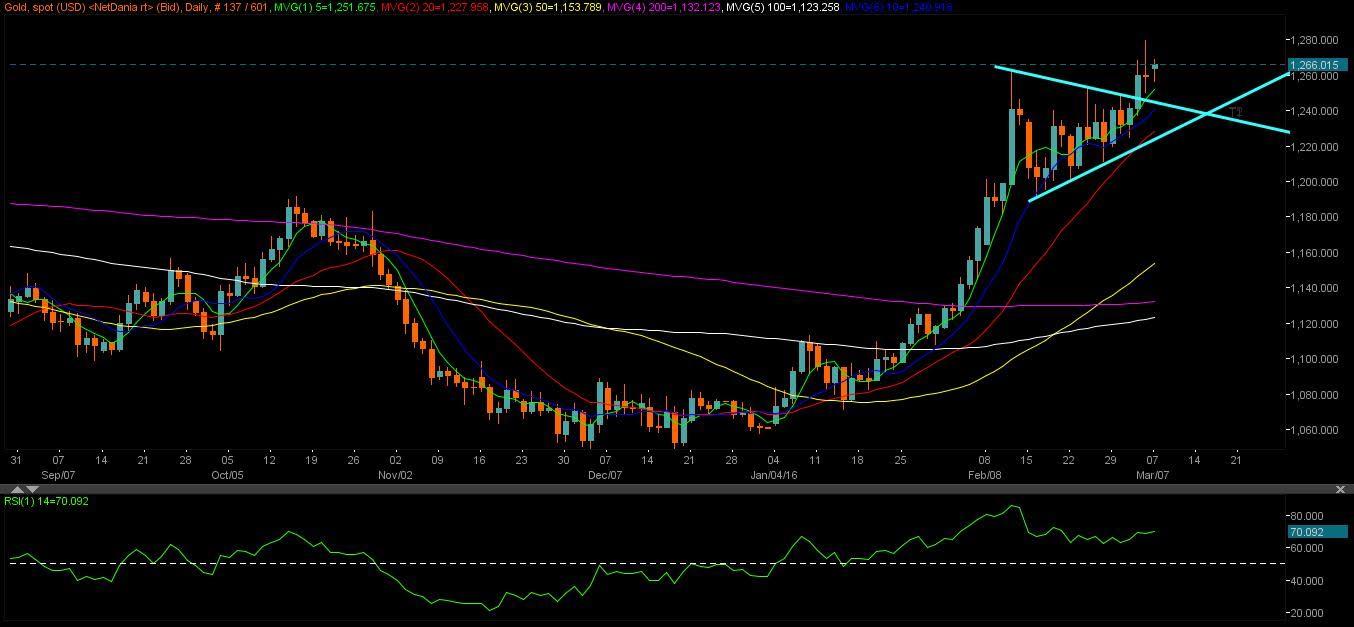

Technicals – Could swing back higher to $ 1280

Gold prices are expected to extend higher as represented by the daily charts, with the pennant breakout on daily sticks behind the latest surge. The prices managed to sustain above 1260 barrier and now extends higher in sync with the sharply higher most major DMAs. While the daily RSI at 70, continues to point higher and thus, suggest more room for upside. A break above 1270 level remains a key for a retest of previous highs of 1280 and beyond. On the flip side, a breach of today’s low at 1256.71, opens doors for further southwards move towards crucial support near 1251-1250, the confluence zone of 5-DMA and Friday’s low. Overall, the risk remains to the upside as the bullion remains supported on the back of technical buying.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.