XAU/USD (gold in terms of USD) reversed previous losses and extended higher on Monday, finally closing well above 100-DMA then at 1105 levels. The prices rallied on the back increased safe-haven bids as a renewed bout of risk aversion gripped markets after the oil prices end a 2-day short-covering rally and slipped back in the red. The bullion witnessed a $ 12 rally intraday and remained firmer also on a broadly lower USD as markets cast doubts over the Fed’s outlook for future interest rate rises, with the upside further boosted on falling treasury yields. The prices pierced through the 100-DMA barrier and rose as high as 1109.14 before easing slight to 1108.72 at close.

Currently, the yellow metal trades at the highest levels in twelve weeks above $ 1115 , rallying sharply this Tuesday as investors flocked to safety assets amid falling oil prices and stocks, as global growth concerns intensify. Moreover, the crash in the Chinese equities today reinforced China slowdown fears, which also means that the Fed may take a more dovish stance in wake of external headwinds at its 2-day policy meeting commencing later today. Hence, gold prices remain underpinned as markets have already started out-pricing four rate hikes this year. Nothing of note in the macro calendar today, except for the consumer confidence data from the US. Focus now remains on the Fed decision due tomorrow, with markets wary whether the Fed will acknowledge the recent turbulence across the financial markets.

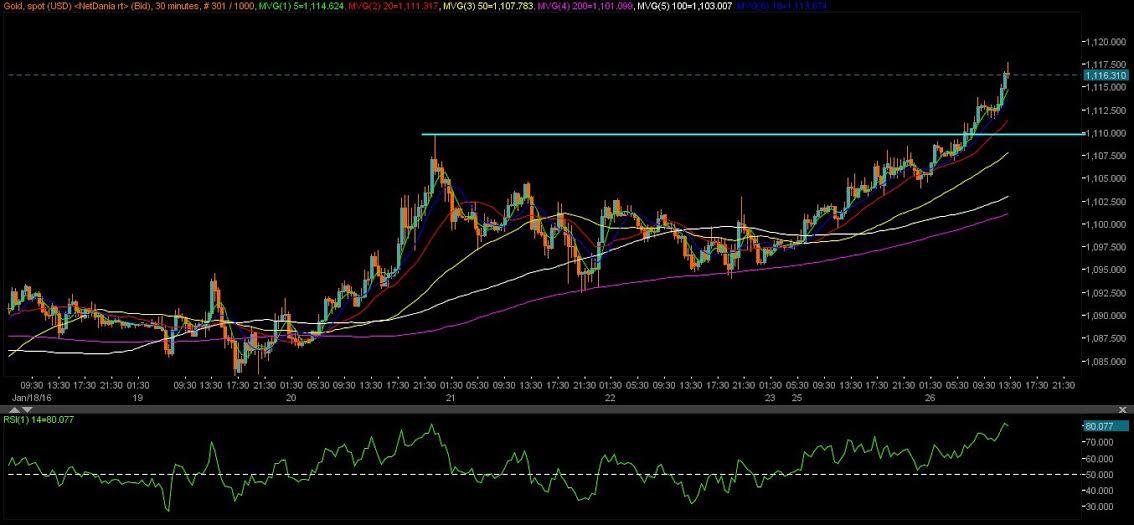

Technicals – Flight to safety likely to push gold towards $ 1130

On hourly charts, gold has given a rounding bottom bullish break at 1111 levels, and hence justifies the ongoing rally in the metal. The pattern target holds just shy of $ 1130 and it appears that amid persistent global market uncertainties, the bullion will achieve the last ahead of Wednesday’s Fed outcome. Although a minor correction in the day ahead cannot be ruled after the extensive rise, while the RSI turns lower from overbought territory. However, the broader uptrend remains in place as the bullion continues to trade well beyond the moving averages.

The daily charts clearly display a cup and handle breakout, for which the medium term target is placed near $ 1180 levels. For the near-term, $ 1130 target looks achievable as it coincides with the 200-DMA. The daily RSI aims higher at 64, suggesting further scope for upside. To the downside, the resistance-turned support at 100-DMA (1105) is likely to act as a crucial support, where the 5-DMA also intersects. A break below the last, 1100 barrier could be retested. However, the risk remains to the upside as we head towards the main risk event for the bullion this week, the FOMC decision.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.