The XAU/USD pair (gold prices in terms of the US dollar) rallied to fresh two-week highs at 1142.06 levels on Monday, extending its effort to conquer the downward sloping 100-DMA located at 1144.50 levels. The prices found the catalyst in the worse-than expected US ISM non-manufacturing PMI report, which dragged the greenback lower. The US services sector data reported by ISM showed a drop to 56.9 versus 58.0 estimates. The data added to the recent streak of weak US fundamentals, thus raising concerns over US economic outlook and further dropping expectations of the Fed rate hike this year. The prices quickly retraced from highs and ended the day slightly in the red at 1135.80, below the key Fib 61.80% (last week’s fall) level located at 1136.52.

As for today’s trade so far, XAU/USD extended its side-ways movement and sits near fresh 2-week highs, around 1138 levels. The prices witnessed fresh buying interest this session as the risk-off sentiment returned to markets after the European stocks halted its previous rally and turned in the negative territory, boosting the demand for safe-havens. While the persisting broad based US dollar weakness also keeps the yellow metal supported. Looking ahead, the pair is likely to get influenced by the upcoming US trade data. Markets are expecting a widening of the trade gap to $42.5 billion in August from the $41.9 billion in July. Hence, another weak US data release later today will bolster the XAU bulls further.

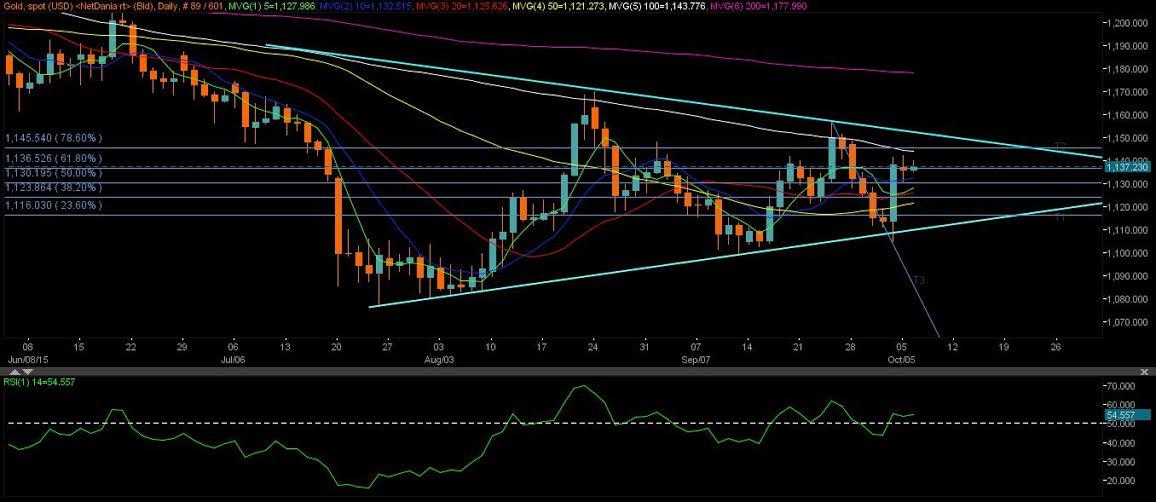

Technicals – could test the upside barrier of the potential symmetrical triangle formation

On daily charts, the prices have formed a small white body candle and remains supported above the key Fib 61.80% resistance (last week’s fall) located at 1136.52. The daily RSI has ticked higher above the mid-lines supporting the case for further advances. The prices are likely to retest two-week highs located at 1142.06, beyond which a test of the 100-DMA will become imminent, driving towards the falling trend line of the potential symmetrical triangle pattern located at 1152.20.

Should the data surprise on the upside and the USD reacts positively, we could see gold prices falling back towards the Fib 50% (of the same drop) located at 1130.20, which also coincides with Monday’s low. However, the downside in the pair may remain restricted amid dropping 2015 Fed rate hike bets and a broadly weaker greenback.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.