We sent out 2 Gold & Silver Trading Alerts yesterday and the situation at this time remains just as we described it in the second of them. Consequently, we will mostly quote it, illustrate the phenomena mentioned, and add more comments when necessary. Let’s start with gold

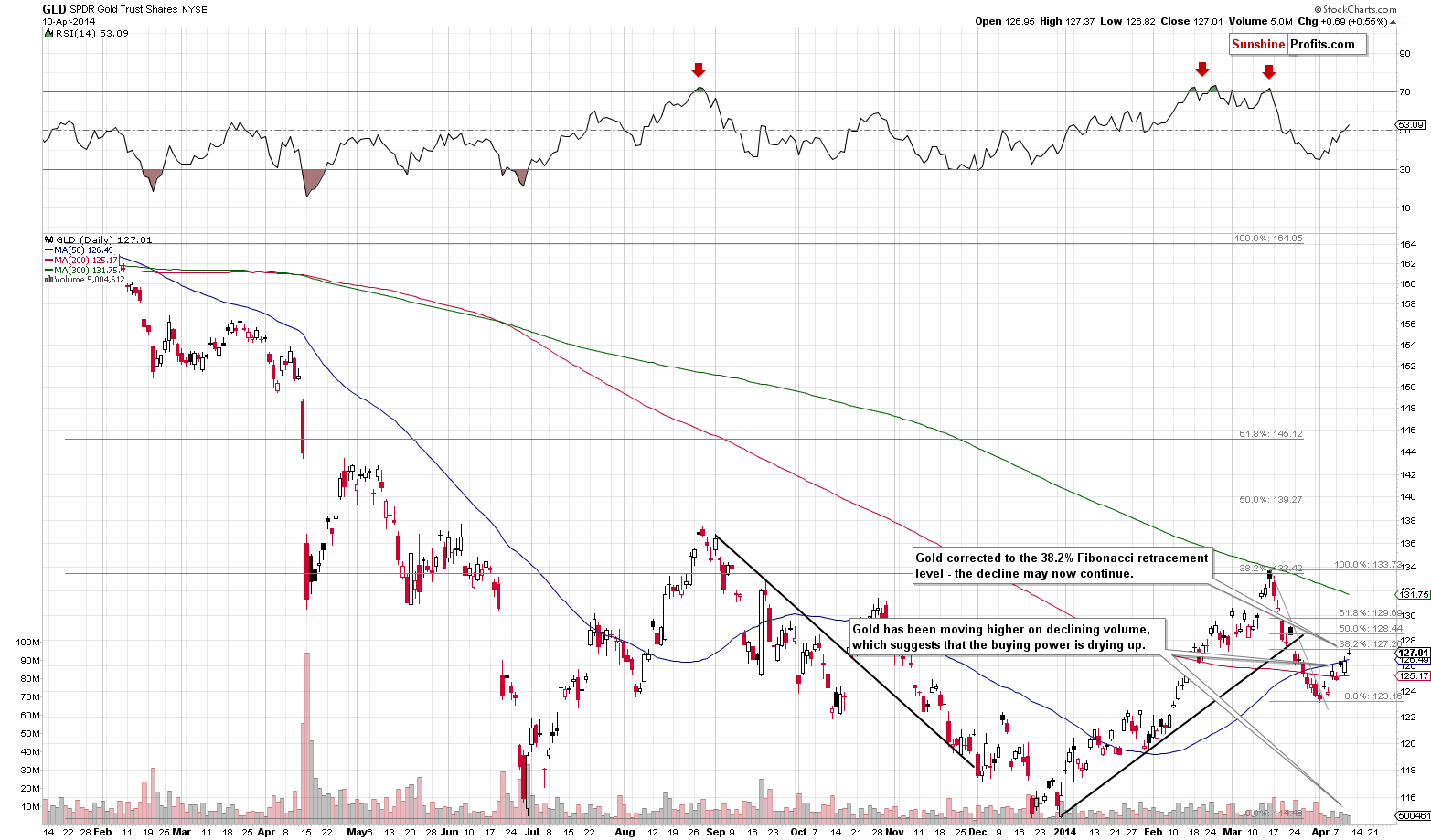

- About gold: "Please note that this upward correction is relatively small – it hasn’t even wiped out 38.2% of the March decline. Perhaps this is the level that will be reached before the next local top is in – we will watch out for signals confirming this theory."

This level was reached today.

Today, we can add that the GLD’s rally was accompanied by volume that was slightly lower than on the previous day, when the rally was much smaller. The above is another bearish sign.

- About silver: "Silver continues to underperform and miners are indeed moving higher, but they are doing so on rather low volume. It does seem that the current upswing is a corrective move, not a true rally. If silver finally rallies strongly relative to the rest of the precious metals sector it will quite likely not be a bullish sign, but a day when the entire sector tops (or very close to it). That’s not a clear prediction, just an early heads-up – we don’t think that jumping on the silver bandwagon as soon as it seems to be gaining speed is a good idea at this market juncture. There will be a time when silver rallies strongly and the rally will be sustainable, but it doesn’t seem we are at this point just yet."

Silver rallied by more than 1.5%, while gold moved higher by less than 1% and miners didn't rally. Silver moved above the previous April highs - we are seeing the very short-term outperformance.

Silver finally ended the session lower than it had been when we sent out yesterday’s alert, but still, it moved higher (percentagewise) than gold and mining stocks, so the implications remained in place.

- About mining stocks: "The mining stocks are still moving higher and are still doing so on low volume. Miners are moving up more visibly than gold does, which is a slight indication that the move higher is not over yet, but at the same time the low volume suggests that the rally will not take place for much longer."

Today, miners are underperforming in a very visible way. They might catch up later today, but for now, we get a clear bearish indication for the short term.

Miners didn’t catch up – they declined even more, almost 2%. The volume that accompanied the decline was not huge, but was not very low either. The fact that miners have declined almost 2% while gold moved higher is much more important in our view.

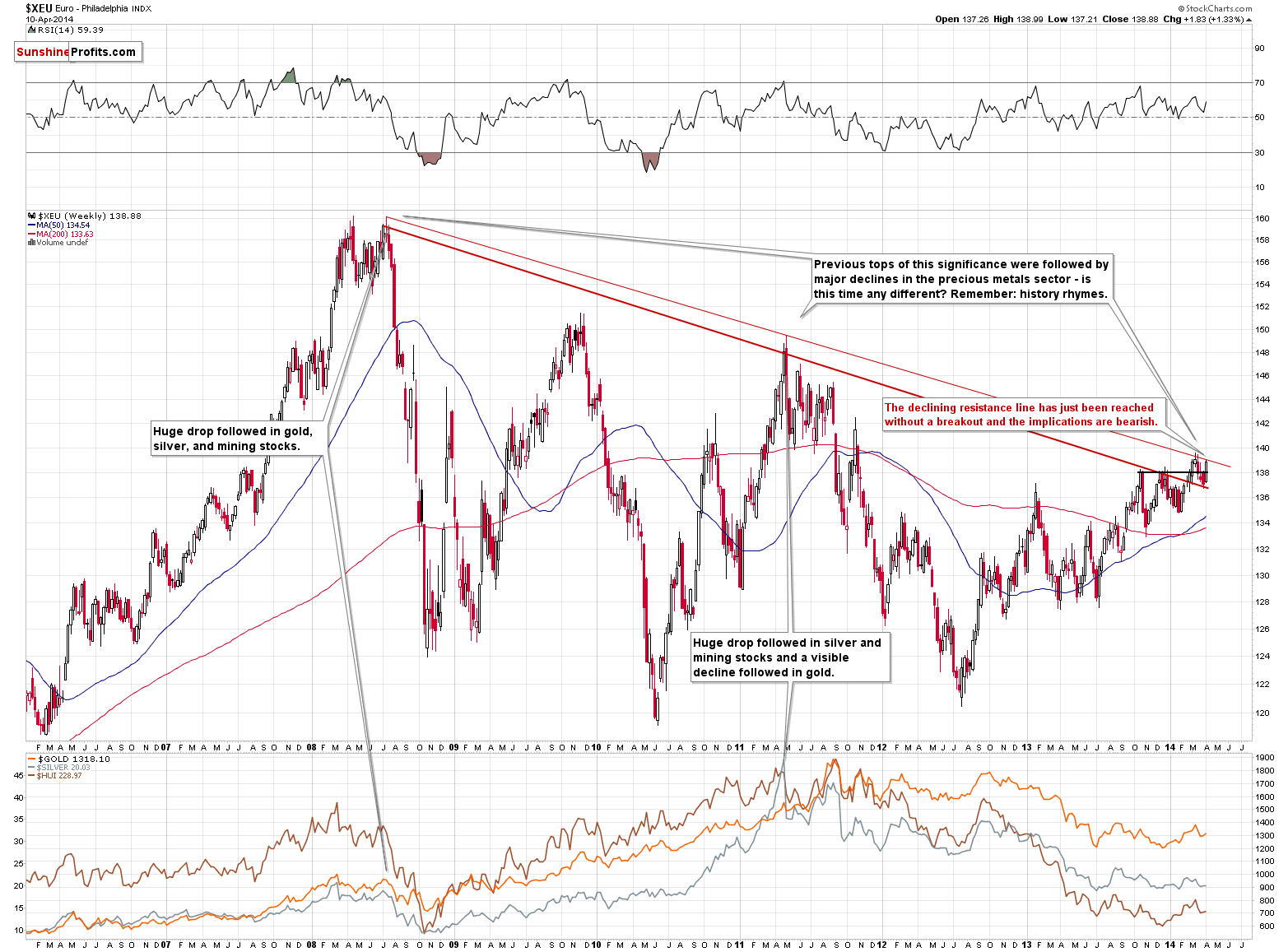

- About the Euro Index: "We will be looking for confirmations along the way, but at this time our best guess is that the Euro Index will rally to the 139 level or close to it (a move to the March high is not out of the question) and make gold move to one of the Fibonacci retracement levels – probably the first one, which is just about $10 higher than where gold closed on Wednesday."

The Euro Index moved to 138.99 today - practically reaching the above-mentioned 139 level.

The 138.99 level was not breached yesterday, and we saw only a small move above it in today’s pre-market trading (to 1.3906 in the EUR/USD exchange rate, after which we saw another slide back below 1.39). Consequently, the above-mentioned implications remain in place.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.