EURUSD support at 1.12 in focus

Silver surges to top of three-month range

AUD soft ahead of RBA meeting

Silver grew wings today as the commodity currencies (save the AUD) rallied and the EUR battled higher before taking an ungraceful dive.

Today's key FX developments

The euro was all over the map today, first surging higher versus the US dollar and especially the Japanese yen in early trading before reversing hard against both currencies coming into the US hours.

AUD was weak, even amid strong risk appetite and an enthusiastic rally in CAD and NZD as traders perhaps fear a dovish performance from the Reserve Bank of Australia at tonight's meeting.

CHF notably remains toward the weak side of the local range versus the euro today despite the EUR trading generally weakly elsewhere later today. This suggests that while there is no apparent safe-haven bid in the franc, there may be a tendency for the currency to weaken when risk sentiment turns more positive.

Gold remains elevated after Friday's strong performance, and silver really leaped into action today, powering all the way to the top of the three-month range and setting up a test of an interesting zone of resistance (if it continues higher) that could have structural implications.

EURUSD

EURUSD saw an odd double pump and dump since Friday; it seems the local support around 1.1200 is the immediate focus, though we really need to see a breakdown below 1.1100 to get things going again for the bears as we need to work out of this local range.

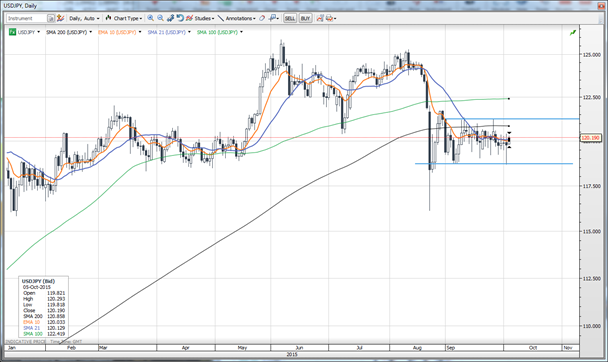

USDJPY

USDJPY saw a very solid bounce from the lows on Friday amid the renewed surge in risk sentiment, which is obviously key for the pair. This marks too many reversals to continue counting them for now as we look for a close either above the 121.25 area or below 119.00. Note that the Bank of Japan makes an announcement on Wednesday.

AUDNZD

Focus on AUD crosses ahead of the RBA tonight and we have this one through the important 1.0900 area, theoretically opening up for the 1.0750 area eventually if the RBA waxes a bit dovish. In the end, though, we are still looking at this as a counter-trend consolidation that eventually yields to a new rally.

XAGUSD

Silver ripped higher on the day and all the way to the top of the 3-month range above $15.50/oz. A continuation of this rally begins to have structural implications, especially if we can continue to power higher (without steep retracements) back above the 200-day moving average currently near $16.00/oz.

- The author(s) and Saxo Capital Markets HK Limited are not responsible for and not liable to any loss arising from any investment based on any recommendation, forecast or any other information contained herein. The contents of this publication should not be construed as an express or implied promise, guarantee or implication by Saxo Capital Markets that clients will profit from the strategies herein or that losses in connection therewith can or will be limited. Trades in accordance with the recommendations in an analysis, especially in leveraged investments such as foreign exchange trading and investment in derivatives, can be very speculative and may result in losses as well as profits, in particular if the conditions mentioned in the analysis do not occur as anticipated. Investors should carefully consider their financial situation and consult their professional advisors as to the suitability of their situation prior to making any investments.

- Risk warning: Leveraged investments in foreign exchange or derivatives carry a high degree of risk and may result in significant gains or losses. You should carefully consider your financial situation and consult your independent financial advisors as to the suitability of your situation prior to making any investments.

Saxo Capital Markets HK Limited holds a Type 1 Regulated Activity (Dealing in securities); Type 2 Regulated Activity (Dealing in Futures Contract) and Type 3 Regulated Activity (Leveraged foreign exchange trading) licenses (CE No. AVD061) issued by the Securities and Futures Commission of Hong Kong.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.