Yesterday’s Trading:

The euro/dollar has been in a sideways since April Fools’ Day. All of the daily candles are similar to dojis with long shades for these days. The mixed dynamic of the pair yesterday was caused by a rise in oil prices and because of what Fed representative Harker had to say.

Oil was up to $44.78 due to rumours that Russia and Saudi Arabia have reached a consensus as to freezing oil output. There was no confirmation of this from officials. Harker announced that the Fed could raise rates three times this year if inflation speeds up.

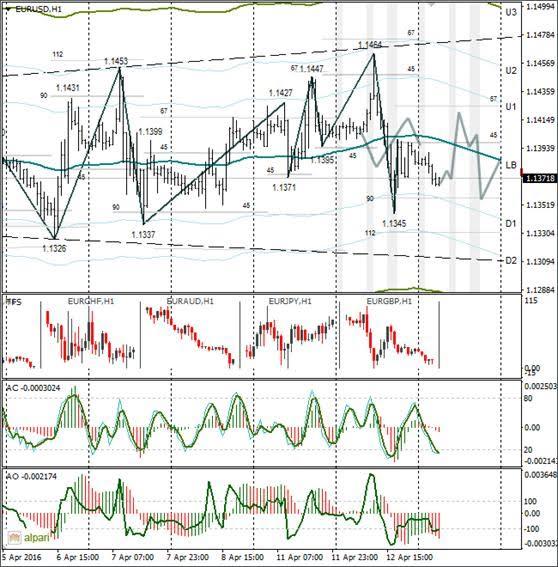

The euro/dollar closed at 1.1383 and was treading near the LB in the middle of a 1.1326-1.1464 range in Asia.

Market Expectations:

On Tuesday the API oil reserve report came out before the daily candle closed. US oil reserves were up 6.2 million against the previous week’s fall of -4.3 million. Brent dropped to $44.11 on this news. It was an insignificant fall in the quotes for the rise in reserves due to market participants’ attention being firmly focussed on the OPEC meeting in Doha. We could say that Brent in Europe is in any case set to test $45 and after which we would see the start of a correction.

The key event of the day is the Bank of Canada’s (BoC) press conference. The hourly indicators are down and aren’t contradicting euro purchases in the first half of the day. The euro is expected to close at around 1.1380.

Day’s News (EET):

12:00, Eurozone changes in industrial production for February;

15:30, US changes in retail trade and PMI for March;

17:00, BoC interest rate decision and monetary policy report;

17:30, US oil reserves from Ministry for Energy;

18:15, BoC press conference;

21:00, US Beige Book.

Technical Analysis:

The euro/dollar has been in a sideways trend with a 1.1394 average for 8 days. A break in the lower limit of the range at 1.1326 will open up the road to 1.1250 for the sellers. We need to prepare ourselves for a weakening of the euro. The 1.1396/1.14 levels will be Wednesday’s resistance. Expect some swings during the American session during the BoC press conference and when the US Ministry for Energy oil report is released.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

The EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 on Monday during the early Asian trading hours. The softer US Dollar provides some support to the major pair.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.