Yesterday’s Trading:

On Thursday Draghi made the headlines. No central bank governor shifts the price like he can. The ECB decision and Draghi’s speech shot volatility on the euro/dollar up 3%. The same happened on 3rd December, 2015 when the EUR/USD rose 450 points to 1.0980 after an ECB meeting.

Market volatility in December rose for the 9 minutes preceding the official ECB release. Before the outcome of the meeting was published, the Financial Times from its Twitter account announced that the ECB wouldn’t change its monetary policy. This spanner in the works caused an overreaction on part of the market, with the euro/dollar jumping 120 points to 1.0657. When it became clear that the ECB was to drop its rate for deposits and keep its interest rate as it was, the euro fell by 157 points to 1.0518.

Since market participants expected the ECB to extend its QE program and this was already factored into the price, everyone ended up rushing to close their short positions.

Yesterday saw the euro crumble by one and a half figures (150 points) in response to the ECB dropping three rates. The main interest rate was reduced by 0.05% to 0.00%, the marginal credit interest rate was reduced by 0.05% to 0.25% and the interest rate for deposits was reduced by 0.10% to -0.40%.

The ECB also decided to extend its asset purchasing program by 20 billion to 80 billion euros per month. They included corporate bonds from non-banking corporation with an investment level rating in their list of assets to be purchased.

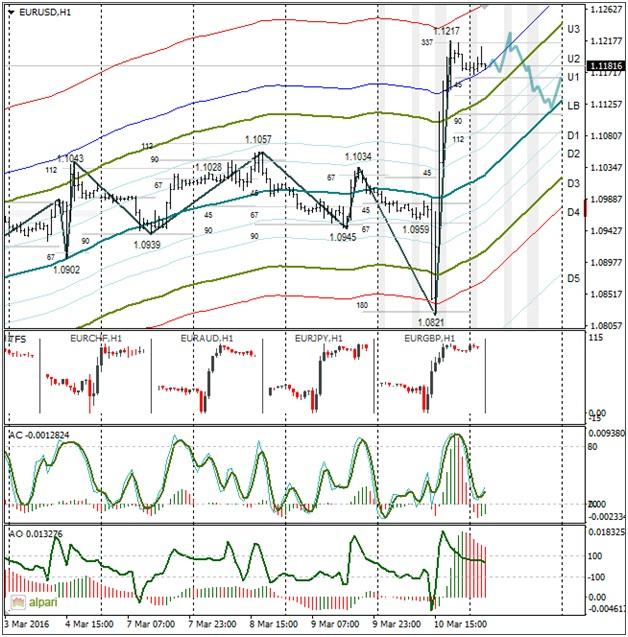

The ECB undertook monetary policy measures to stimulate the economy and the euro/dollar rose by 396 points to 1.1217. Why? Because Draghi announced at his press conference that no more stimulus is required for the time being. If we translate this into trader language, it means: “We’ve already done everything we can, so don’t bother waiting for us to do anything else.”

Speculators took his words to mean that if the ECB doesn’t relax its monetary policy further, we can buy euro. Market participants didn’t pay attention to the US stats.

Market Expectations:

The euro/dollar reached the upper and lower targets after the ECB meeting. Now the pair is in the zone above the U3. This is what I call off the tracks. The price could sit there for a while and then head as quickly as possible to the balance line. The economic calendar for Friday is measly, so it’s likely that we’ll see a correction to 1.1095 after yesterday’s rally.

Day’s News (EET):

11:30, UK January balance of trade.

15:30, Canadian employment changes for February and US import price index for February.

Technical Analysis:

Intraday target maximum: 1.1225, minimum: 1.1100, close: 1.1138.

Intraday volatility for last 10 weeks: 103 points (4 figures).

My forecast for the euro/dollar shows a renewal of the maximum and a fall of the euro to 1.11. If the speculators who opened long positions yesterday start to close them, the euro could easily return to 1.1066 (61.8% Fibo from the 1.0821 to 1.1217 growth). The closest target on the daily is 1.13.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

USD/JPY crashes below 157.00, Japanese intervention in play?

Having briefly recaptured 160.00, USD/JPY came under intense selling and sank below 157.00 on what seems like an FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.