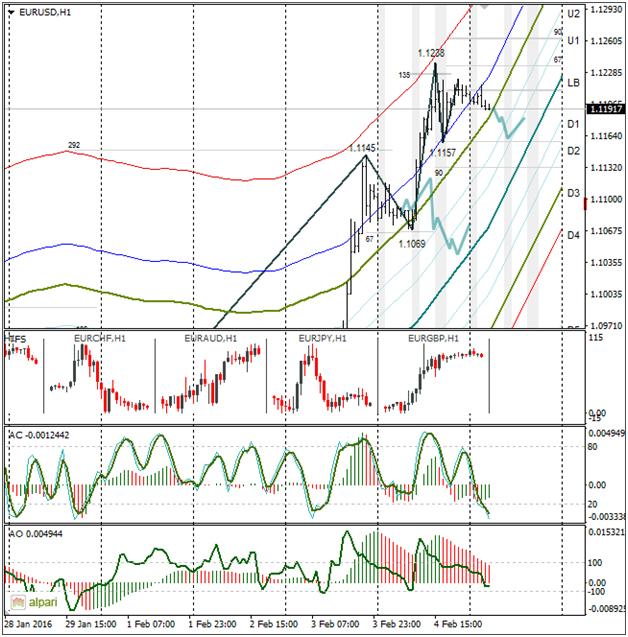

EURUSD 1H

Yesterday’s Trading:

The euro was up against the dollar on Thursday, having past 1.1200. The BoE and weak US stats had a positive effect on the price of the euro.

The Bank of England decided to leave things unchanged with interest rates at 0.5% and asset purchasing at £375 billion. The voting for the interest rate to remain unchanged, changing from 8 for to 9 for. It was this change that changed the fate of the euro.

The euro/pound cross’ effect lasted until Carney spoke. The Bank governor surprised everyone by saying that the next interest rate change is likely to be an increase. The pound won back its losses against the dollar and updated its maximum.

The dollar was under pressure on Wednesday after Fed representative Dudley expressed worries about a strong dollar. Worsening economic data from the States lowered the likelihood of us seeing the Fed up rates in March.

Unemployment benefit applications in the US for the week ending 20th January was 285k (forecasted: 280k, previous: 277k). The country’s PMI fell from -0.2% to -2.9%.

Main news of the day (EET):

09:00, German December PMI;

15:30, US NFP, average working week length, average hourly wage and unemployment for January. Canadian data on external trade, unemployment level and employment changes in January;

17:00, Canadian Ivey PMI for January.

Market Expectations:

The euro/dollar is trading at around 1.1194. Trader attention is on US labour market data. It is expected that there were 190k jobs created in the non-agricultural sector in January, against 292k in December. Before the NFP comes out and by Asian session close, a fall of the euro to 1.1160 is expected. I’ve no thoughts on the payrolls.

Technical Analysis:

The euro/dollar was up to 1.1238 and it was last going for 1.1194. Whist the price is above the MA U3 line it’s risky to purchase euro. We’re likely to see a rebound to 1.1150.

Further risks of a fall will come with the NFP which is unforecasted and so will have a powerful effect on the currency market. It could be strong or weak. If we account for the fact that the euro/dollar for the last two days has shot up by 300 points, we can say that a weak value for the indicator has been already taken into account by the market. With this in mind, it’s better to stay off the market today.

EURGBP 1H

The euro/pound was up to 0.7701 on the European session. The euro’s strengthening against the pound was caused by MPC voting for interest rates to be left unchanged in which voting went from 8/9 for to 9/9 for. The growth of the cross lent support to the euro in the EUR/USD.

There is a lack of bear divergence between the AO indicator and the price. This means that a renewal of the maximum could take place before a downward correction. I’ve relied more on indicators of fundamental analysis. Since the NFP is out at 15:30 EET today, I expect to see a correction to the U1 at 0.7663.

Daily

The euro/dollar reached 1.1238, with the dollar losing 300 points over the course of two days. If the euro keeps strengthening after the NFP comes out, I see only one target: 1.1359/66 along the upper limit of an upwards channel (dotted line).

Weekly

We could say the 1.1240 target has been reached. Now we can target 1.1366.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.