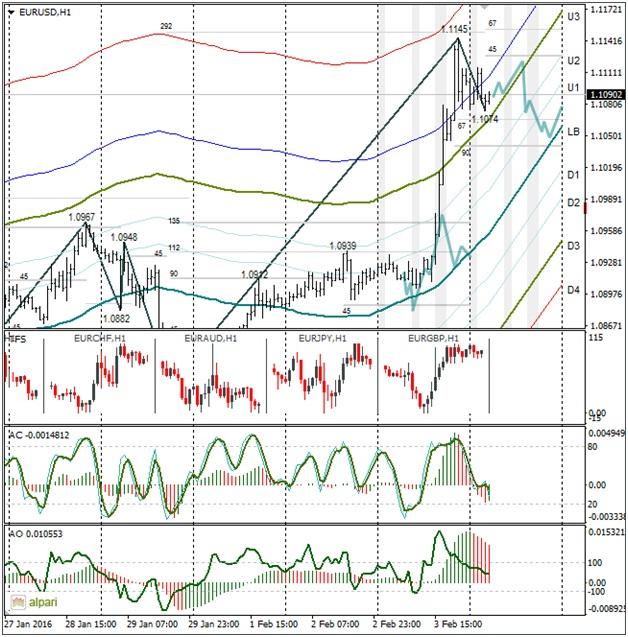

EURUSD 1H

Yesterday’s Trading:

In mid-December the euro bulls didn’t manage to strengthen above 1.10. Now they are in jubilation on part of New York Fed chief Dudley who helped them pass the important technical levels and pop the stops off the sellers’ short positions.

All Dudley had to say was that a strong dollar is the Fed’s, the economy’s and US companies’ main problem and then the speculators began selling US dollar.

At first the 1.0950 resistance was passed, then the main trend line which took its beginnings from the 1.1712 maximum and passed through 1.1045.

The dollar cheapened, despite strong private sector employment data from the US. The data came out better than expected with employment creation in January at 205k (forecasted: 200k, previous: 267k). The previous value was reassessed up from 257k. The official report is out on Friday.

US service PMI from Markit and ISM came out less than expected and in doing so pushed the dollar down further. Now market participants are placing their bets on only one or two interest rate rises this year, instead of the four that they previously expected. The euro/dollar rose to 1.1145 and, according to recent quotes, is trading around 1.1084.

Main news of the day (EET):

10:00, ECB’s Draghi to speak;

11:00, ECB publishing its economic bulletin;

14:00, BoE interest rate decision (0.5%), minutes and asset purchasing program (£375 billion);

14:45, BoE governor Carney to speak;

15:30, US unemployment benefit applications;

17:00, PMI.

Market Expectations:

In the first half of Thursday trader attention will be on the Bank of England minutes and the ECB economic bulletin. In the evening there will be data on unemployment benefit applications. On Friday will be the Non-Farm Payrolls. Taking into account that the euro has been in the oversell zone and way off the channel for a few hours, today I think we’ll see a correction of the pair to the balance line at 1.1050/45. It is the NFP that makes me think that we will see a rebound today.

Technical Analysis:

Intraday target maximum: 1.1120, minimum: 1.1050, close: 1.1080;

Intraday volatility for last 10 weeks: 102 points (4 figures).

Today’s key event for the currency market is the Bank of England’s minutes. Expectations are for an 8-1 vote (keep – rise). Due to this, I expect the cross to fall in the second half of the day, putting pressure on the euro/dollar.

The price is now above the U3. The rate could return to 1.1120 from 1.1070. There is to be growth for partial profit fixation from long positions before the NFP. By the close of the European session I expect to have seen a fall to 1.1045/50. When the price meets the balance line on the hourly, the market will be balanced. Then traders will be waiting for the US labour market report.

EURGBP 1H

The fall was stronger due to UK stats, but on the whole my expectations rang true. A growth of the cross aided the euro/dollar to pass the 1.0950 resistance and the trend line at 1.1045. After the publication of the BoE’s minutes on Thursday, I expect to see a weakening of the euro against the pound. The fall of the cross will have a negative effect on the euro/dollar.

Daily

The euro/dollar has broken two trend lines and exceeded the December maximum from last year. Now the buyers have the road open to 1.1470. Today there should be a correctional phase. Let’s see what the market cooks up after the Bank of England has convened and the NFP is out.

Weekly

The euro/dollar has headed for the heavens. The closest target is 1.1240. If there’s no rebound, it means we’re off to 1.1494 (October 2015 maximum).

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.