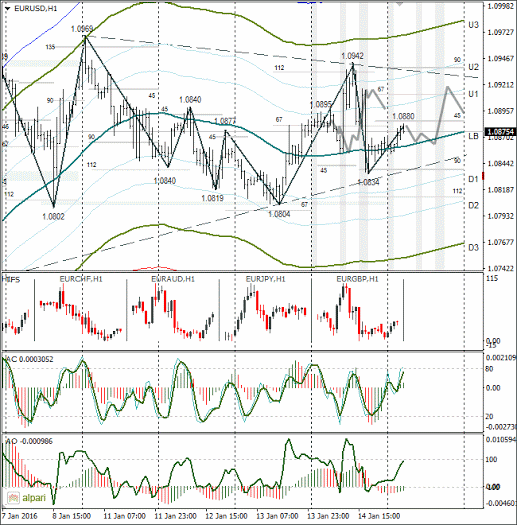

EURUSD 1H

Yesterday’s Trading:

The euro/dollar on Thursday formed a spike. The strengthening of the euro to 1.0942 was caused by Reuters and a fall in European stock indices. Reuters relayed that the majority of ECB representatives are against a further loosening of monetary policy and at that moment the stock indices were trading down by 2-3%.

The euro/dollar on Thursday formed a spike. The strengthening of the euro to 1.0942 was caused by Reuters and a fall in European stock indices. Reuters relayed that the majority of ECB representatives are against a further loosening of monetary policy and at that moment the stock indices were trading down by 2-3%.

Brent was up to $31.16 per barrel. The Bank of England kept its interest rate at 0.5% and its asset purchasing program at 375 billion GBP. The indices were up by about 1.5%.

The number of initial unemployment benefit applications in the US for the week was up from 277k to 284k.

Main news of the day (EET):

12:00, Eurozone November balance of trade;

15:30, US December retail sales, manufacturing activity index from NY Fed for January, December PMI;

16:00, FOMC member Dudley to speak;

16:15, US industrial manufacturing data for December;

17:00, Reuters/Michigan consumer confidence index for December.

Market Expectations:

Trader attention on Friday will be on stock indices’ movements, in addition to US fundamental data. The Japanese Nikkei 225 and the Shanghai Composite are trading in the red zone. Oil is down slightly.

If the European indices head down following Asia, the euro will strengthen against the dollar to 1.0909. In my forecast I’ve gone for a sideways until US trading and then a growth of the euro. Monday is Martin Luther King Day in the US, so the stock indices will be able to take a break and this will give the euro room to rise.

Technical Analysis:

Intraday target maximum: 1.0915/30, minimum: 1.0854 (current Asian), close: 1.0895/1.0900;

Intraday volatility for last 10 weeks: 100 points (4 figures).

The euro/dollar has corrected by 45 degrees (Gann levels) from a minimum of 1.0834. I expect it to close up today. The reason for the euro’s strengthening is written above. It would be decent if the pair can stick out the American session near the balance line (55 average). I expect to see a rise from here to about 1.0915/30.

EURGBP 1H

On Thursday the euro/pound cross rose to 0.7606. After the Bank of England convened it dropped to the LB. When the price is near the balance line, it means it is ready to deviate from it by 0.6 or 1%. Since I expect to see a fall of the US stock indices today before the extended weekend, my scenario for the euro/pound and the euro/dollar are looking up.

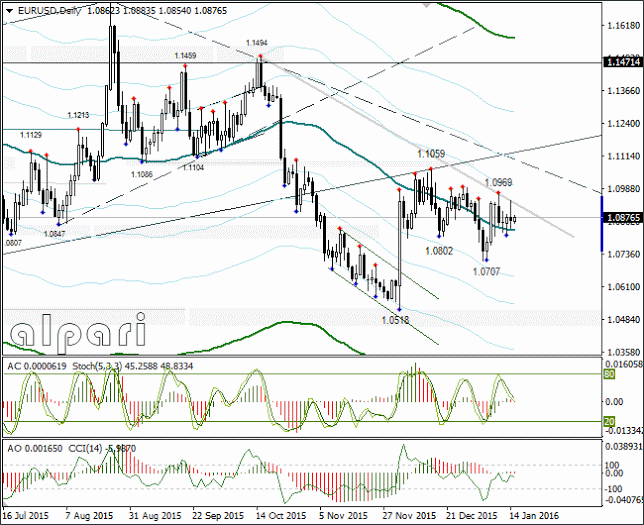

Daily

Due to yesterday’s spike-formed price pattern, the situation is ambiguous once again.

Weekly

A flat is visible on the weekly for six straight weeks. We need to wait for the weekly candle to close.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.