A slowing in Chinese economic growth, a devaluation of the yuan, the constant increases in oil reserves and OPEC’s refusal to drop their extraction quota have caused oil prices to collapse once again. Since May the oil market has switched into a bear phase.

Additional pressure on prices has come from the oil extraction companies themselves: via their hedging of risk. They attempted to fix the oil price for themselves on the futures and options markets for future extraction. In this case, they receive the difference between the current price and any fall in prices. It’s worth noting that not all oil companies were hedging their risks via options since, when purchasing PUT options, one has to pay a premium.

The options were used by the big companies. As an example, every year Mexico hedges risks from the possible fall in oil prices. Expenses for insurance can be anywhere from $750 million to $1.2 billion. In this case, the banks which sold PUT options had to hedge their risks on the market by selling oil futures, thereby pushing prices further down.

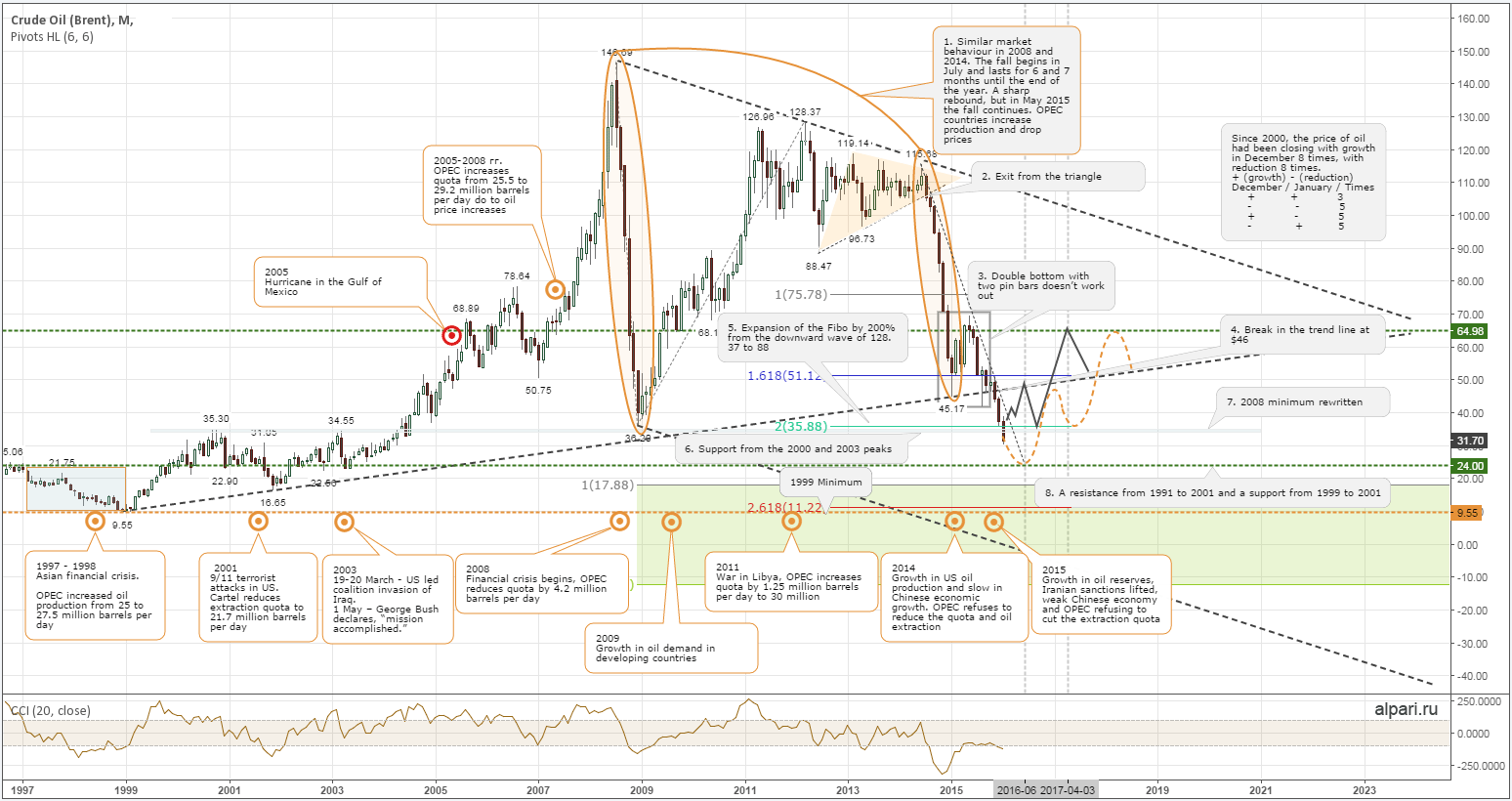

All of the important events from 1997 are marked out on the graph. If there was data available on Brent quotes from 1980 then I would’ve had the graph start from 1980. This year was an important one since this is when Brent became the main benchmark for the formation of Russian export oil benchmarks (Urals, Siberian Light and REBCO).

There’s no point in commenting on each and every event. It’s clear from the comment boxes which events had an effect on the oil market. This graph could be used in the future as a cheat sheet for oil prices for the last 24 years. Now to the analysis.

The comments with a white background relate to fundamental events and those with grey backgrounds relate to technical analysis. The latter have been numbered.

In 2008 the price rocketed from a 36.20 USD minimum and recovered by 50% to $89.55. From here the important $89 marker takes its beginnings. By March 2012, a barrel of Brent was going for $128.37 due to a growth in oil demand in developing countries. Then the market formed a triangle over the course of a year and from this the price headed downwards (2). From this moment a new fall in oil prices began.

Take a look at the downward waves highlighted by ellipses from 2008 and 2014 (1). Between these years there were many interesting things going on with the price movement. First of all, the correlation between them is 61.8% (Fibonacci number). In 2008 the fall was 110.49 USD (75.32% to $36.20 and in 2014 it was by $70.51 (-60.95%) to $45.17. Now we find the correlation between the waves as (70.51 x 100) / 100.49 = 63.8 (the closest value to the 61.8% Fibonacci number). Secondly, the fall in prices began in July. Thirdly, oil prices fell right up until the end of the year and in January of the next year a rebound took place.

Amongst the factors mentioned there was reason for a rebound to take place last year. In 2015 a false break took place. After a pinbar was formed (3), growth in quotes was expected; as was the case in 2008. The pinbar came off perfect. The price restored to $60.16 and from here it returned back to the trend line (4).

At first the price broke the trend line (4) after an unsuccessful attempt to break from it and bring about a double bottom pattern (3). Then the December minimum from 2008 was rewritten: $36.20 (7).

After falling below the August minimum of $42.20, the Fibonacci level was broken last week: 200% (5) from the $128.37 to $88.47 downward wave with a reference point from $115.68 and a support zone formed from the years 2000 and 2003’s peaks (6). The instrument for expanding the Fibonacci can be applied when checking the waves for completeness in proportional analysis (correlation of Elliot waves).

2015 closed down as well and the growth only renewed on 14th January. 2009 began with a growth from market opening. Note that when $36.20 was reached in 2008, the media was coming out with forecasts of $20-25 per barrel, as is the case right now. When it became clear for all to see that oil futures should only be for sale, the market turned against the crowds.

2016 also opened down and the sellers updated the minimum over the holiday period. Oil cheapened due to a crash of the Chinese stock markets. Since the analysis has been done on a monthly time frame, in order to see a signal for a downward correction, we need to wait for the formation of a pinbar (hammer) or a candle formation for bull divergence as the month closes.

From the right hand side of the graph at the top, there’s a statistic from the year 2000. Many will wonder whether a seasonal factor was involved in December and January. And so, in 8 of 16 years oil has cheapened and closed up by the same amount. In January oil closed up eight times and down seven times. If these figures are grouped and checked for alternation, it turns out that there is absolutely no link between the figures and the months of December and January. Oil in January can jump sharply up, just as it can fall sharply.

Now to the important technical levels. One of them is $24. From 1991 to 1999 it has been a resistance and from 1999 to 2001 it has been a support (8).

OPEC doesn’t want to drop its oil extraction quotas. The bears are dominating the market. The US Fed has started to increase its rates. It seems that there are no current signals for a rise in prices. However, what will happen if the Chinese stock markets suddenly stop falling and switch into a growth phase? Whilst statistical institutes are locked in currency wars and are manipulating the markets, constantly tinkering with previous values, there is no trusting the statistical data that comes out.

The OPEC countries are now vying for their share of the market and trying to edge out their competitors. So what will be if the cartel unexpectedly drops its oil extraction quotas? Not many people are in the loop as to what is said at the negotiation table and what will happen in 2016. Although, we do know how the market operates. 5-10% of the players are taking money off the remaining 90-95%. Before the big players do a U-turn, they will sell up to the crowds. For this to take place, there needs to be an informational background from the media to say that oil will fall to $10 and 90% need to believe this will happen.

So here it’s worth keeping an eye on the positions of these big fish by taking a look at the COT (Commitments of Traders). It is published once per week, on Fridays, by the CFTC (US Commodity Futures Trading Commission).

For a comparison, we’ll take two reports on WTI since the volume on them is larger than that of Brent. The first is for the 24th June, 2014 when the market began to drop and the latter is for the 5th January, 2016. Back then, the figures stood at 2.317 million contracts and now they are at 2.335 million (+0.77%). At the same time, the structure of positions has changed. Between 24th June, 2014 and 5th January, 2016, big players have reduced their long positions from 548,476 to 479,540 (-12.5%) and increased their short positions from 68,737 to 261,293 (+280%). Meanwhile, locked positions are up 8%.

Looking at the hedgers we see the opposite. They have increased their long and cut their short positions. In 2008 there was a build-up of long positions from October and the growth began in January 2009.

As an example let’s look at cycles on the monthly. A correction began on 25th-28th January. Seasonal cyclic reoccurrence (365 days) indicates a market inversion starting on 12th January. There is yet one more factor which points to a market inversion for oil prices: a positive annual correlation of 2015 with 1993 (93%) and 2008 (78.9%). After these years oil prices increased.

Taking all of the factors indicated above into account, there are two scenarios on the cards. The first is a rebound after the formation of a pinbar at the close of January. The second is a fall to $24 and a renewal to 1999’s trend line (4).

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.