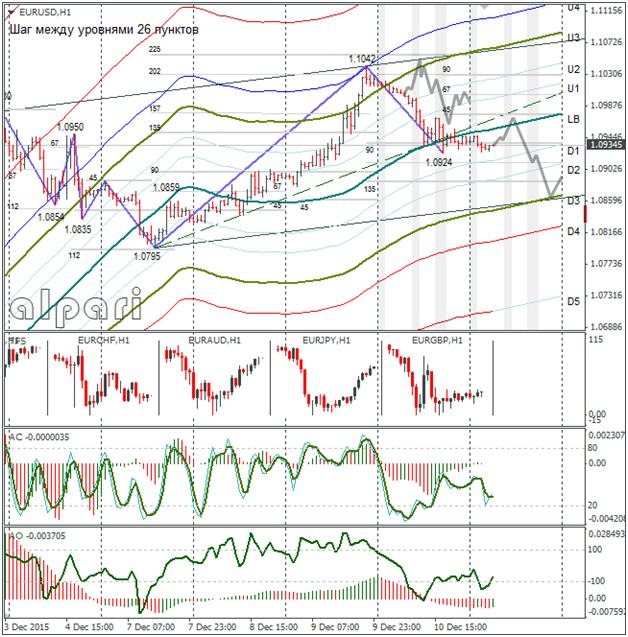

Hourly

Yesterday’s Trading:

The USD on Thursday managed to break its two-day falling habit. The euro/dollar bounced from the LB at 1.1042 to 1.0924. The forecasted data for initial unemployment benefit applications in the US was exceeded and this held back the pair.

The number of for initial unemployment benefit applications in the US for the week ending 05/12 was 282k (forecasted: 269k, previous: 269k).

Main news of the day (EET):

9:00, German November CPI;

11:30, UK consumer inflation expectations;

15:30, US retail sales and producer price index for November;

17:00, US Reuters Michigan December consumer confidence index for December;

On Sunday at 7:30 in China some data will be published on changes in retail sales and industrial manufacturing for November, in addition to data on investment volume in the key funds for October. These are important indicators for currency trading.

Market Expectations:

The pair has been consolidating in a narrow range for 13 hours. I had a look at the different options for Friday: most of them are showing a sharp fall for the euro to the D3. This sort of fall contradicts the daily forecast from the previous idea.

If we make a channel along the three points, 1.0980-1.1042 and 1.0795 (black channel), then the lower limit sits on the D3. We wouldn’t want it to fall below 1.0858, otherwise we will once again see the euro shoot down as the FOMC meeting approaches (16th December). What we get is a wide range forming in which the euro/dollar could remain until the new year.

Technical Analysis:

Intraday target maximum: 1.0971, minimum: 1.0861, close: 1.0890;

Intraday volatility for last 10 weeks: 103 points (4 figures).

On Friday I expect to see the euro cheapen against the dollar to 1.0861. I am a little at odds with myself in saying this, but I will offer one scenario. How else could it go for the euro? A fall to 1.0910 and a ricochet back to 1.1005. As to whether to take a decision on which trade to make, follow your trading rules and signals. The market is changing fast and in an hour the technical picture could be flipped on its head.

Daily

My upward triangle formation is so far being confirmed (read my last euro idea). After a renewal of the maximum, the euro fell. So the pattern isn’t ruined, we need the day to close below 1.0860. Now to the Weekly.

Weekly

I’m continuing to track the forming of a double bottom. The weekly indicators are showing a strengthening of the euro and the daily ones are signalling the death of the bullish impulse. Today is important since any fall in the rate could bring about a bear signal on a pinbar.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.