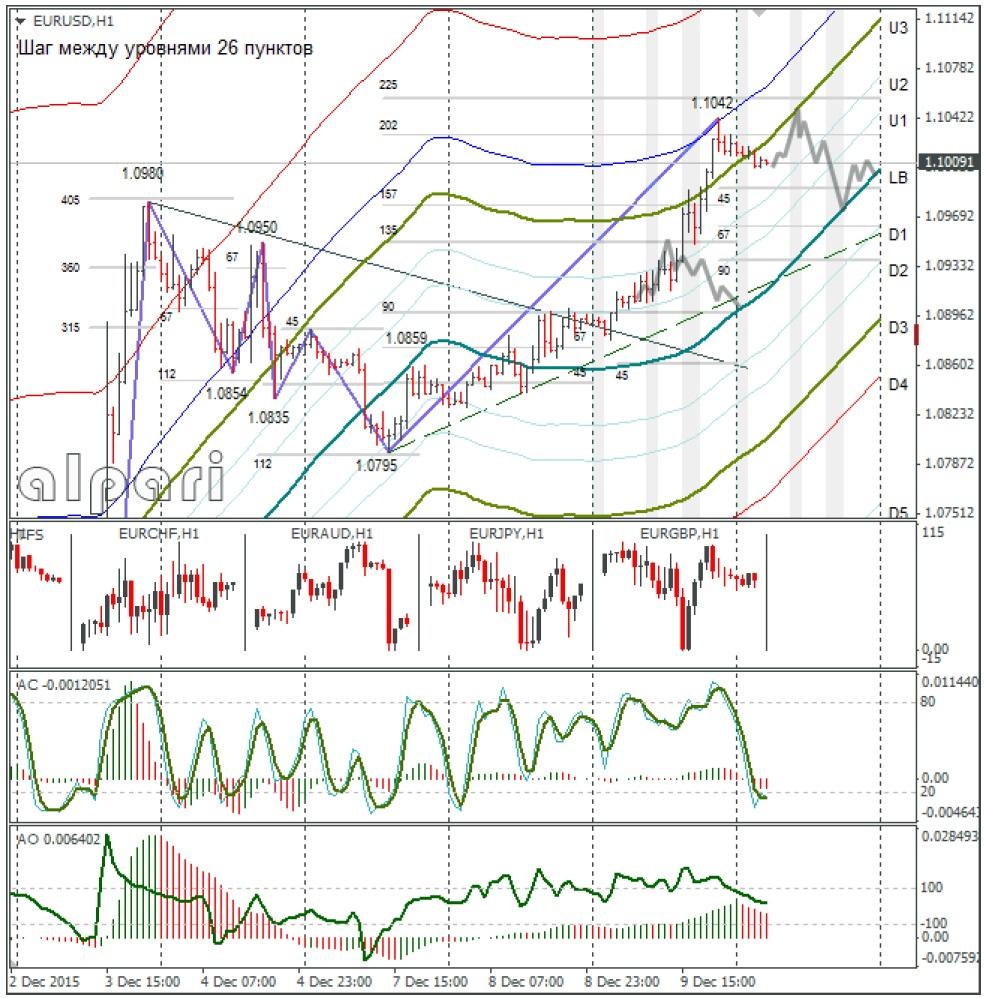

Hourly

Yesterday’s Trading:

By the end of Wednesday the euro/dollar had renewed to the U4 at 1.1042. Growth for the pair exceeded one figure. There was no news yesterday to put the dollar down. More long positions on the dollar were closed yesterday as they have been since the ECB declined to ratchet up their efforts and loosen their monetary policy.

Traders who have been buying dollars all year are patiently waiting for the Fed to up their base rate and the regulator has been making them wait since April of this year due to the weak macroeconomic data.

Main news of the day (EET):

10:30, SNB interest rate decision;

11:30, UK balance of trade for October;

14:00, BoE interest rate decision and asset purchases. At the same time we will get a look at the Bank’s minutes;

15:30, US initial unemployment benefit applications;

20:30, Mark Carney to speak;

21:00, US monthly budget report (November).

Market Expectations:

The focus for Thursday is on the Swiss National Bank and Bank of England.

The euro/dollar is at the top of the MA channel. Due to this, I expect the pair to renew its maximum and return to the LB at 1.0975.

Technical Analysis:

Intraday target maximum: 1.1050, minimum: 1.0975, close: 1.1000;

Intraday volatility for last 10 weeks: 103 points (4 figures).

At the moment we can see my previous forecast working its magic for the euro. Since the hourly stochastic is already down, I expect to see a renewal of the maximum and a bounce to the LB. Today we need to keep an eye on how the euro/pound does. Volatility will build after the BoE’s minutes come out. If there are more (than one) MPC members who want to up the rate, the pound/dollar will shoot up by another 100 points and this will send the euro/pound right down. Due to this, the euro could be down against the dollar.

Daily

The euro/dollar set a new maximum on Wednesday. My upward triangle is so far right as rain (read yesterday’s euro idea). The euro/dollar was down to 1.0518 as a saw. Now I’m looking at this pattern as if it’s mirrored. Only the number of waves and the structure could be different. Now to the Weekly.

Weekly

My eyes are on the formation of a double bottom. If the speed of the recovery on the euro doesn’t slow up, the closest resistance level will become 1.11. The weekly indicators are showing a strengthening for the euro.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.