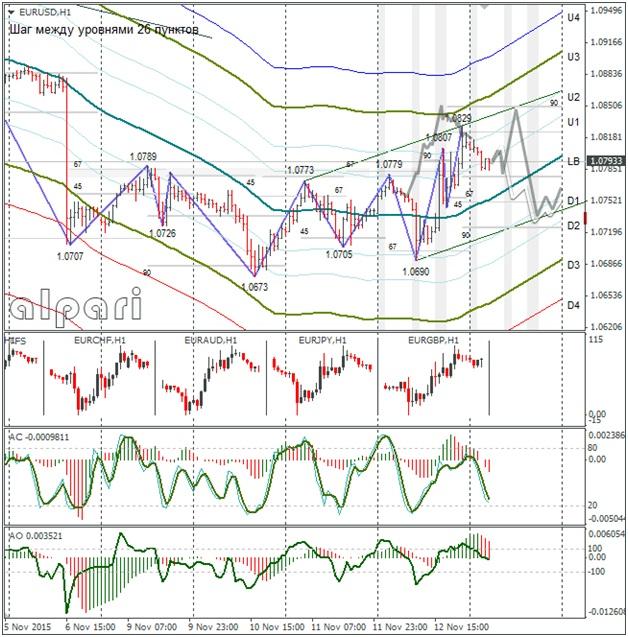

Hourly

Yesterday’s Trading:

On Thursday, trading of the euro/dollar closed up. Sharp fluctuations on the euro were caused by ECB president Draghi’s speech and by speeches from US Fed representatives. Draghi promised to reassess QE in December and the Fed speakers came out with conflicting words: they don’t know exactly when the US interest rate will be increased. Yellen kept her lips tight with regards to US monetary policy.

The number of US initial unemployment benefit applications for the week ending 7/11 stood at 276,000 (forecasted: 276k, previous: 276k).

Main news of the day (EET):

- 09:00, German Q3 preliminary GDP;

11:00, ECB representatives Nowotny and Constancio to speak;

12:00, Eurozone trade balance for September and Eurozone Q3 preliminary GDP;

14:15, ECB representative Mercsh to speak;

15:30, US retail sales and PMI for October;

17:00, US November Reuters/Michigan Consumer confidence index;

20:00, Baker Hughes data on operational drilling rigs.

Market Expectations:

The euro/dollar closed the day having lifted to 1.0829. The price pattern from 1.0707 has a complex formation, so we really need to have a look at previous situations on the pair. If we do this, the patterns which we find with a 250 bar window indicate that the euro will continue to fall, but there is a possibility that there will be a rebound to 1.0850. We need to keep an eye on German and Eurozone GDP data; it could increase market volatility.

Technical Analysis:

Intraday target maximum: 1.0850, minimum: 1.0737, close: 1.0765;

Intraday volatility for last 10 weeks: 119 points (4 figures).

The euro/dollar is down from a maximum of 1.0829 to 1.0784. The 1.0673 and 1.0690 bases can be considered as a double bottom. As I see it, the price should go higher to 1.0890. However, I have limited the rise to only 1.0850 and then a fall to 1.0737. If the GDP data comes out worse than expected, the euro could head straight down. The fundamental data is more important than the technical signals.

Daily

The hammer target worked. Now we need to wait for the stochastic to turn around downwards in order to short the euro. Especially since the trend line has been broken and the euro could lift higher than 1.0877 (23.6% from 1.1494 to 1.0673). Now to the Weekly.

Weekly

The sellers need to be active this Friday. If the weekly candle closes higher than 1.0790, the oscillator stochastic will form a buy signal for the euro.

Whilst the price is below 1.0840 and the CCI is below -100, I expect to see a fall of the euro to 1.0520 (14/04/15 minimum).

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.