Overall it appears that US economic activity has lost momentum over the last year and the strength in the labor market looks out of place. Weaker growth trends in the UK and Japan and doubts returning over growth momentum in China point to waning global growth momentum. After the significant fall in the USD this year and lower US rate hike expectations we see less scope for either the US currency or rates to act as a release valve for weaker sentiment for US earnings growth. As such, we see significant downside risk for US equities and global investor sentiment. We expect gold to outperform all currencies in this environment as the market seeks an alternative store of value. FX market direction is harder to predict and may become increasingly fickle and volatile.

Weaker payrolls report may loom ahead

On the eve of the US payrolls the probability, in our view, is leaning towards a weaker than expected outcome. Overall it appears that US economic activity has lost momentum over the last year and the strength in the labor market looks out of place.

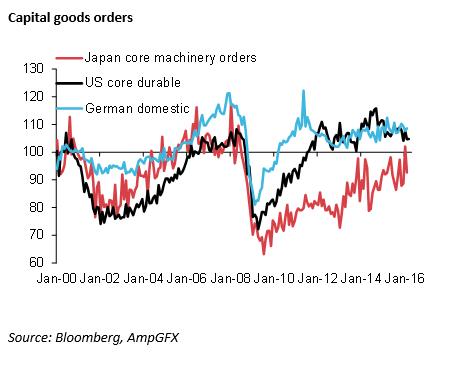

Orders for core domestic capital goods have essentially been trending down since they reached a peak in Q3-2014. Momentum is weaker than for German factory orders or Japanese core machinery orders.

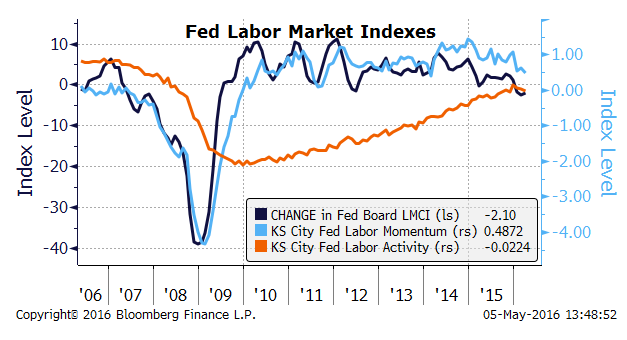

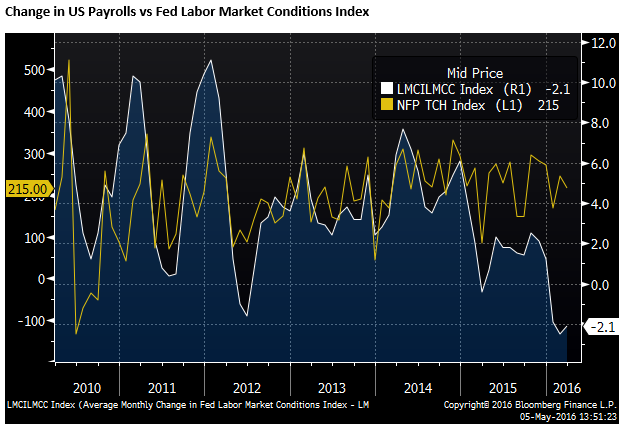

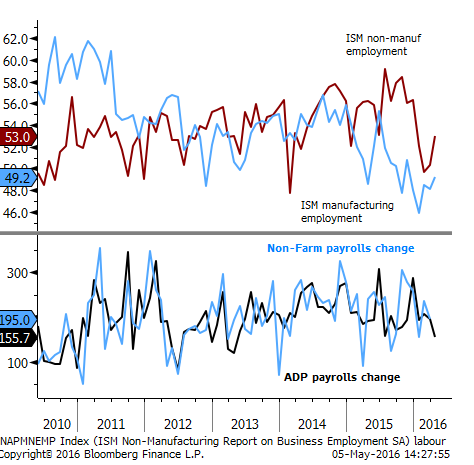

While payrolls growth has held up so far, other indicators of momentum in the US labor market have fallen.

The Fed’s Labor Market Conditions index, a weighted average of 19 labor market variables has fallen in each of the first three months of this year. The Kansas City Federal Reserve Labor Market Conditions Momentum indicator based on 24 variables also illustrates that momentum has weakened, and its index of the level of labour market conditions is down somewhat this year.

Comparing the non-farm payrolls with these Fed labor market indicators that include broader and leading indicators suggests that payrolls may start to fall back in coming months.

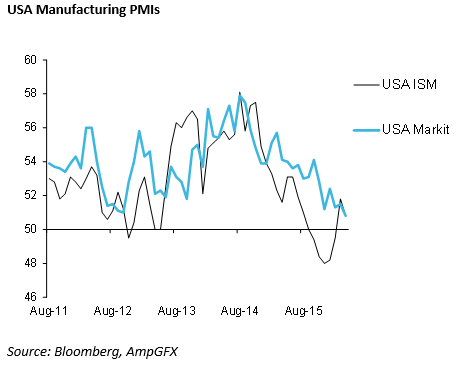

PMI surveys show a new low for the Markit PMI manufacturing index and a dip back in the ISM measure in May, both much lower than a year ago.

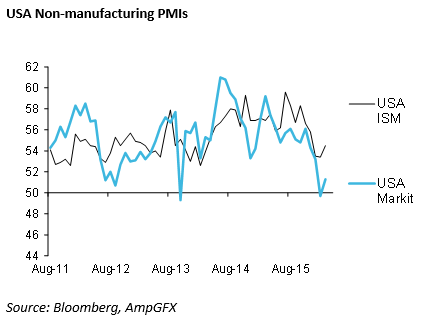

The non-manufacturing ISM rose for a second month in May from a low in February, but remains below the levels of last year.

The employment components in the ISM measures mirror the trends in the overall indices and while they have lifted from lows early in the year they remain below the range over recent years.

Weaker global trends

The USA has in recent years been seen as the strongest economy, and it remains the only developed country where rate hikes are anticipated over the year ahead. But now it has fallen back to the pack and there is no major country exhibiting a clear path to sustainable recovery. Recent Japanese and UK economic data have deteriorated.

The recent modest pickup in Chinese economic growth is also in doubt. Metals prices in China have slipped back in recent weeks, and Chinese financial markets remain sluggish, including recent sustained weakness in corporate bonds and a steady decline in the CNY against the government’s reference basket of currencies.

Global equity markets have slipped in recent weeks and the prospect of them resuming the recovery from the lows in Jan/Feb now seem bleaker. There is limited scope for additional global monetary or fiscal stimulus, and fears over tepid and waning economic momentum and recent underwhelming earnings reports may dominate.

Release valves closing

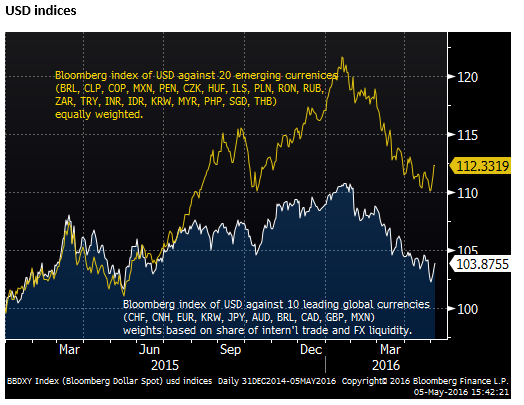

The USD is unlikely to respond well to a weaker payrolls report, but it has already weakened significantly since earlier in the year, at around its weakest levels against the EUR since it first implemented its QE policy in January 2015, and at its weakest level against the JPY since before the BoJ’s second stage of QQE policy in October 2014, the scope for a significant further decline against these currencies may be lessening.

The potential for a further recovery in EM and commodity currencies may also be lessened after their solid rebound in recent months with broader global growth concerns increasing and industrial commodities prices weakening in recent weeks.

With limited scope for the USD or for rates to fall significantly on a weaker US payrolls report, the release valves for downside pressure on the US equity market will appear shut, and US stocks may take the brunt of weaker sentiment for the US economy.

The USD may firm on a stronger than expected payrolls but equities may struggle to see the positive as it threatens to encourage the Fed to push ahead with policy tightening despite broader evidence of weakening growth and weak global indicators.

Overall we see risk weighted towards weak global equities and an extension of the rising trend in gold against a range of currencies from the USD, alternative risk havens like JPY and EUR, and EM and commodity currencies.

AmpGFX publications and all material in this website is intended to provide general advice, and does not purport to make any recommendation that any foreign exchange, financial market securities or derivatives transaction is appropriate to your particular investment objectives, financial situation or particular needs. The information that we provide (or that is derived from our website) is not, and should not be construed in any manner to be, personalized advice. Trading in foreign exchange, financial securities and derivatives can involve substantial risk. The information that we provide or that is derived from our website should not be a substitute for advice from an investment professional. We encourage you to obtain personal advice from your professional investment advisor and to make independent investigations before acting on the information that you obtain from AmpGFX or derived from our website. Only you can determine what level of risk is appropriate for you.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.