Global equities slump as US COVID-19 death toll crosses 250,000

Global equities declined today as market participants weighed the Covid situation in the United States where the country confirmed more than 170,000 cases yesterday. More than 250,000 Americans have died of the illness. As a result, many analysts believe that more US states will announce more measures to prevent the disease from spreading. On the other hand, there are positive signs of a Covid vaccine. In a statement today, AstraZeneca said that its vaccine was showing promising results. The news came a day after Pfizer said that its vaccine was 95% efficient. In the United States, futures tied to the Dow Jones and S&P 500 plunged by more than 0.40% while in Europe, the DAX and FTSE 100 fell by more than 1%.

The Australian dollar erased earlier gains even after some encouraging data from Australia. In a report released earlier today. According to Australia’s Bureau of Statistics, the economy added more than 178k jobs in October after shedding more than 29k in the previous month. That happened as the country moved from a lockdown in Melbourne and Victoria. At the same time, the unemployment rate rose from 6.9% to 7.0% in October, better than the estimated 7.2%. The participation rate also increased from 64.8% to 65.8%. These numbers came a few days after the RBA ruled out implementing negative interest rates.

The euro declined today as traders focused on a meeting of EU leaders to deliberate on the bloc’s seven-year budget. The bloc is facing a veto from Hungary and Poland, who oppose some of the provisions in the deal. In particular, they oppose provisions that seek to bar funding from countries based on democratic norms. Without an agreement by all countries, the bloc will not be able to move forward with the 750 -billion-euro package passed in July. Also, the commission will not have the resources for the next seven years.

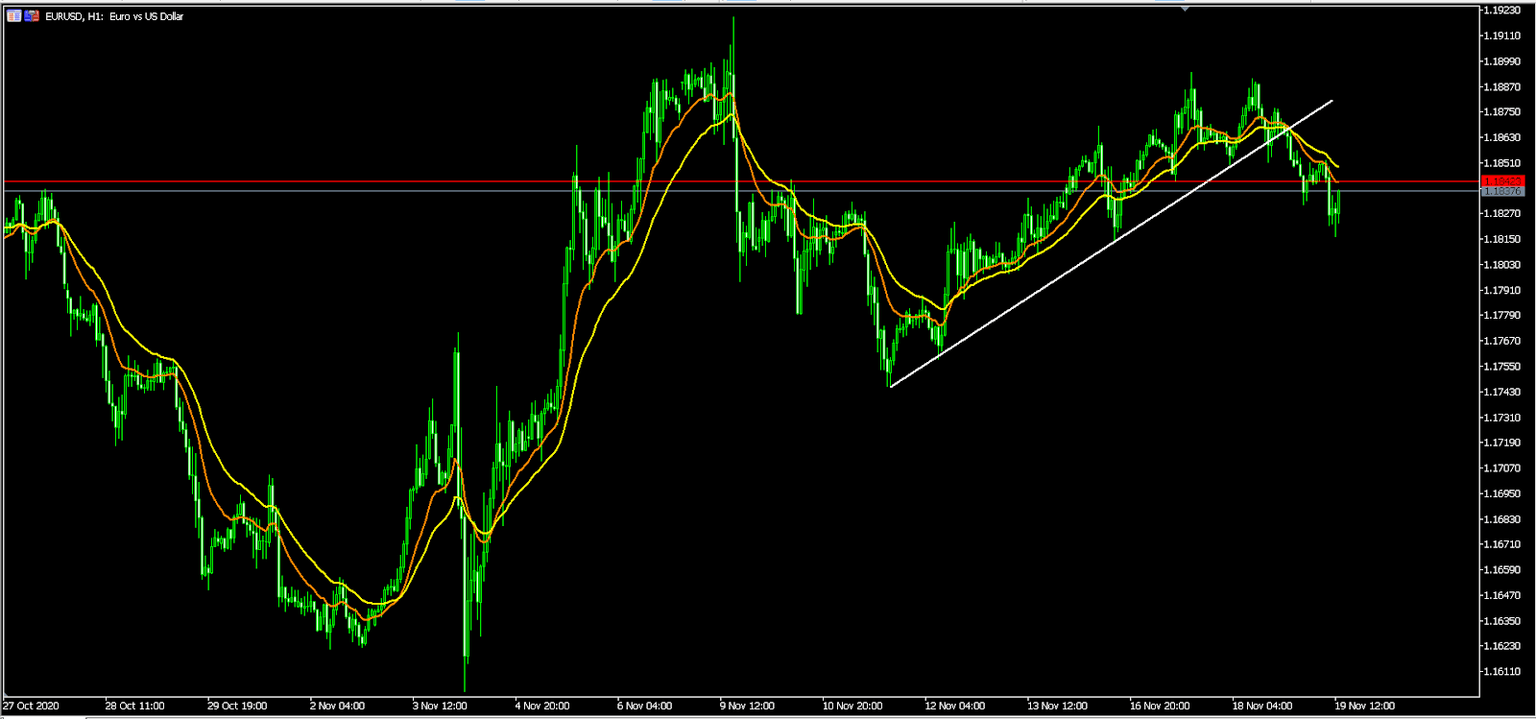

EUR/USD

The EUR/USD pair dropped to an intraday low of 1.1815 today. On the hourly chart, the pair then formed a hammer pattern, which is usually a bullish reversal signal. It remains below the previous ascending trendline and below the 25-day and 15-day moving averages. It has also formed a head and shoulders pattern, which is usually a bearish signal. The neckline of this pattern is at the 1.1843 level. Therefore, the pair will likely continue falling as bears attempt to move below 1.1800.

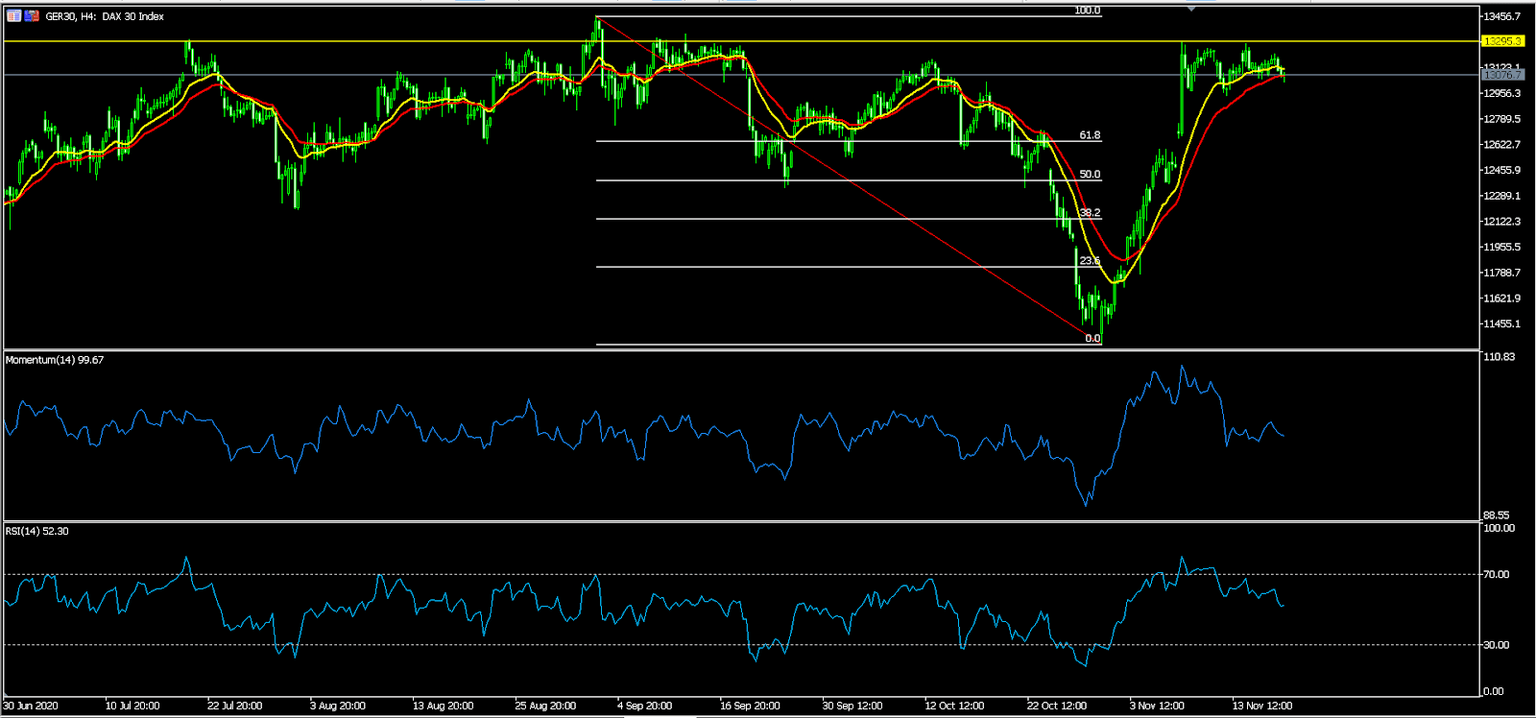

GER30

The German DAX index dropped to an intraday low of €13,030. On the four-hour chart, this price is below this week’s high of €13,295. It is also between the 25-day and 15-day moving average and slightly above the 78.6% Fibonacci retracement level. The momentum indicator has also fallen and the RSI has moved from a high of 80.73 to the current 52. Therefore, the index will possibly end the day below the opening price of €13,138.

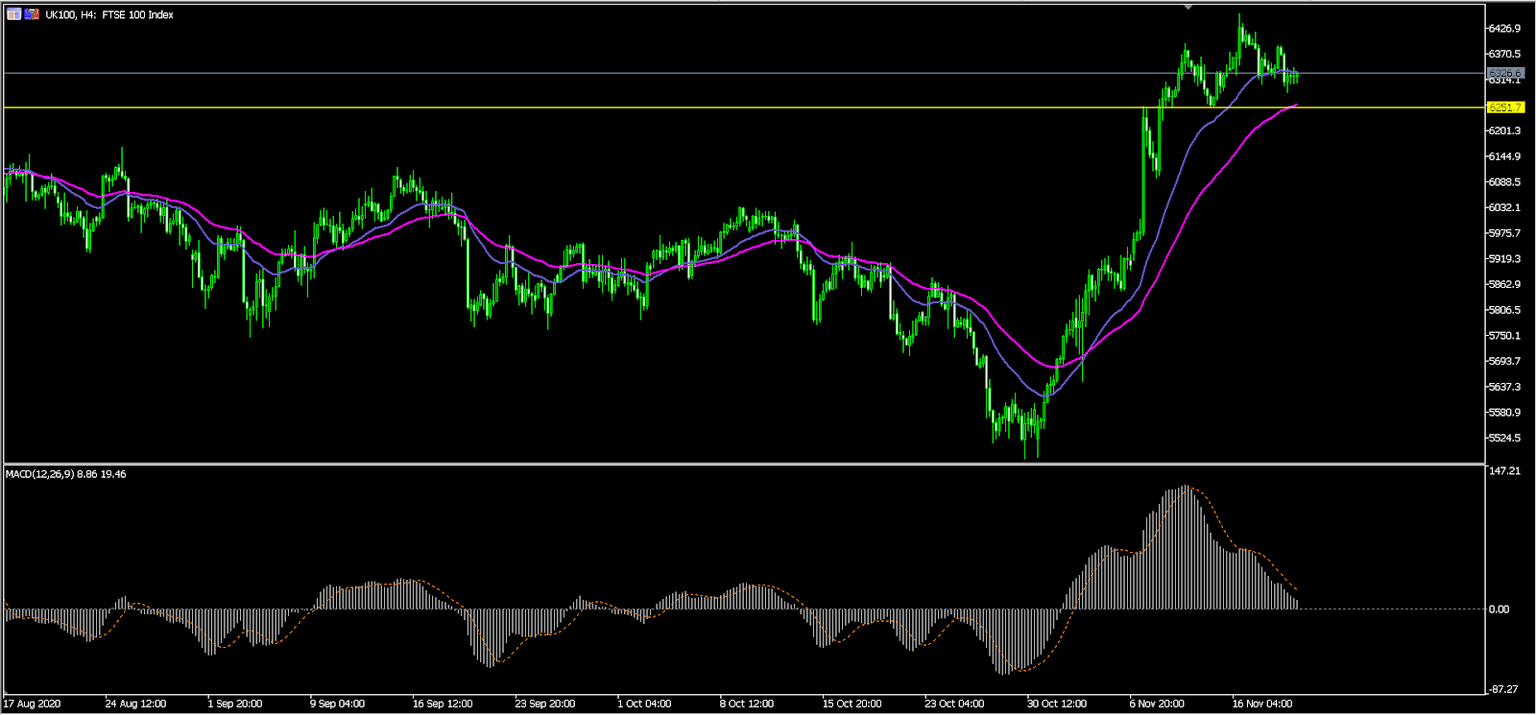

UK100

The FTSE 100 index declined to an intraday low of £6,286. This price is below this week’s high of £6,465. It is also at the same level as the 25-day simple moving average while the histogram and main line of the MACD has continued to fall. It is also forming a head and shoulders pattern. Therefore, the index may continue falling, with the next support being at £6,251.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.