Economic data is pretty light around the world this week, after the long Easter weekend. RBNZ’s rate decision and China flash manufacturing PMI could be one of the key events to watch in the coming days. Any surprising outcome could move the relevant markets and currencies, like Aussie and Kiwi.

It will not be an easy task for RBNZ to make a rate decision this week. There are several reasons for them not to rush into a rate hike decision. Dairy prices have been falling tremendously in the past months, hurting New Zealand’s exports revenue, as a large dependency of its exports are of food & milk related items. The country’s inflation also fell to 1.5% YoY in the quarter of the first three months of the year, from 1.6% in the 4Q last year. Rising tobacco tax and education fee failed to push the inflation closer to RBNZ’s upper inflation target range, and the NZD spot is already 2-3% above its TWI basis.

New Zealand milk price (yellow) vs. New Zealand CPI YoY (white)

While headline inflation has been moderate, inflationary pressures are increasing and are expected to continue doing so over the next two years, according to the RBNZ’s statement. There has been some moderation in the housing market, but the level is far from enough to satisfy RBNZ. Restrictions on high loan-to-value ratio mortgage lending are starting to ease pressure; another interest rate hike in 2Q will have a further moderating influence. Due to the concerns for the rising of housing related prices, we forecast one more rate hike in 2Q and the chances of it falling this week will be no less than 70%.

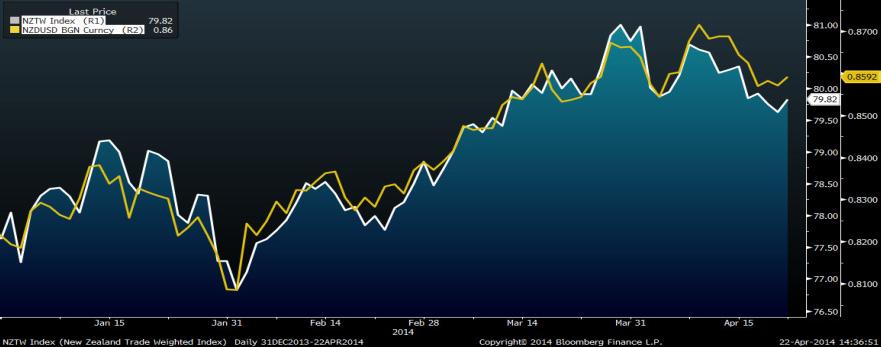

NZDUSD spot (yellow) vs. NZD Trade Weighted Index YoY (white)

China flash manufacturing PMI is the first important guidance of the 2Q growth. Flash PMI tomorrow is likely to confirm a modest recovery in April, due to a seasonal cyclical rebound after Chinese New Year. Warmer weather conditions results in construction related industries to start engaging in more activities given a few mini-stimuli offered by the government recently. This is likely to offer an improvement to the current stagnant economy.

Increasing number of companies in the private sector are willing to boost their hiring in 2Q comparing to 1Q, according to a survey by Manpower in China. We forecast the number in April will rise to 48.3 from previous 48.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.