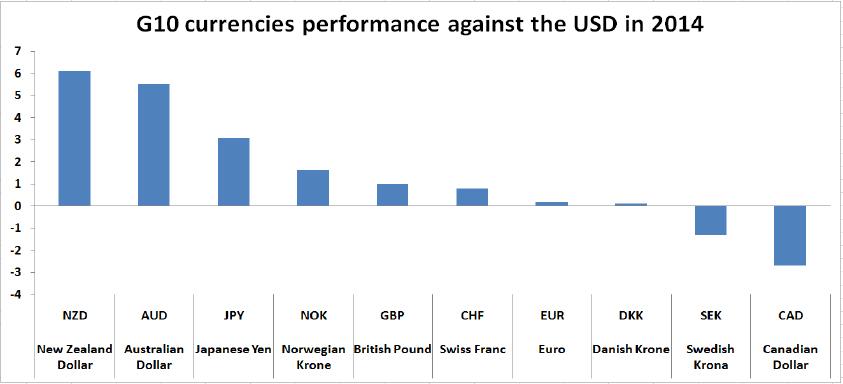

Investors do not seem to have any patience in waiting for Dollar to rally in near term. Speculating accounts recently cut their bullish bets on USD aggressively, as seen from the data of Commodity Futures Trading Commission (CFTC). Dollar only outperformed Swedish Krona and CAD since the beginning of 2014, while the top 3 outperformers are NZD, AUD and JPY.

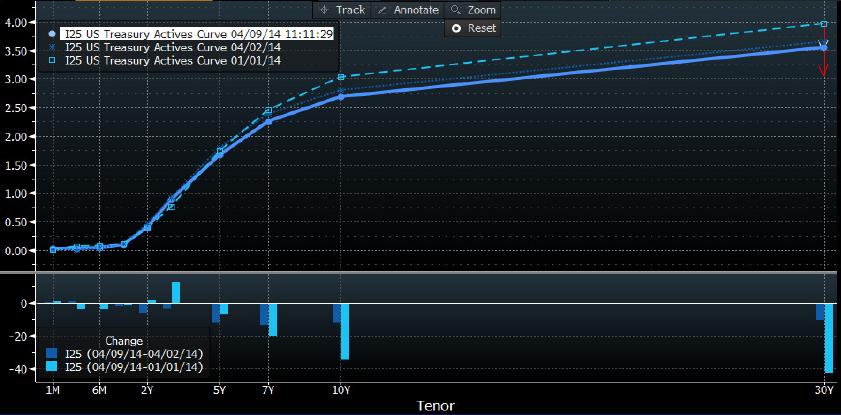

From the end of 2013 until the beginning of this year, investors carried a strong confidence that Dollar would be supported by a stronger U.S. economy and reductions in the Fed’s bond purchases. Until now, many people acknowledged that the earlier weaker data belonged to the effects of bad weather. Not only that Dollar’s performances diverges from earlier consensus, but a flattening U.S. Treasury yield curve suggested that the Fed’s policy will be accommodative for some time.

US. Treasuries Yield Curve

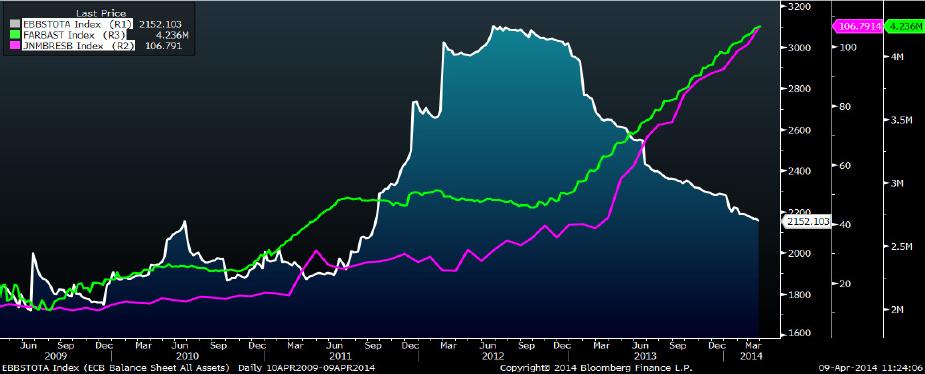

It is also unfair to conclude this year’s weakening Dollar was due to pricing out tightening fears. Dollar index has been in a firm downtrend since the middle of July last year. A less accommodative Fed’s policy would not lead the Greenback to outperform significantly against the rest. By using the “reality” rather than “consensus” to judge, we noticed that the pace of Fed’s balance sheet has been carrying a similar momentum to Bank of Japan’s (BoJ) money base acceleration, while the European Central Bank’s (ECB) balance sheet has been shrinking substantially.

Fed balance sheet (yellow), BOJ balance sheet (purple), ECB’s balance sheet (white)

Investors are focusing on the March Federal Open Market Committee (FOMC) Minutes tonight, as it might tell the direction of the Fed’s incoming policies after Janet Yellen provided a signal that the duration between the end of tapering and the beginning of a rate hike would be in around six months. Fewer interests generated on the pace of tapering nowadays, as the timing of a rate hike would become one of the key engines to drive the Greenback. However, as mentioned above, the Fed’s balance sheet is still expanding aggressively comparing to most of other central banks’.

Traders expected a monetary policy divergence between the Fed and its Euro Area and Japanese counterparts to support the Dollar. But the scenario does not seem like it at the moment or in the near future. Further expansions of ECB’s and BoJ’s balance sheets are merely expectations by investors so far. The possibility of this happening is relatively low in the second quarter of this year, when ECB needs some time to design the Quantitative Easing (QE) program when needed, and when BoJ needs to evaluate the consequences of sales tax hike.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.