GBPJPY

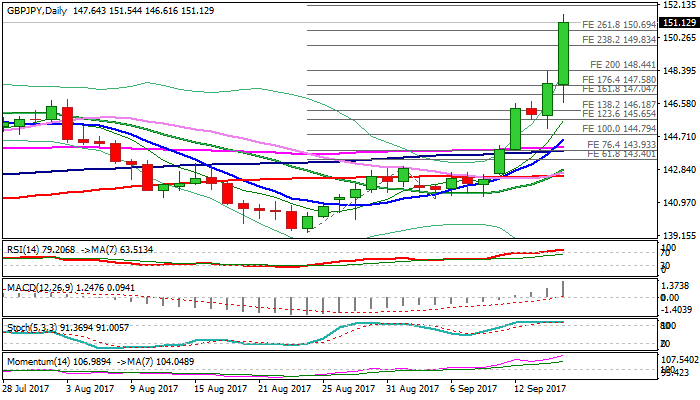

The pair blasted through psychological 150 barrier on Thursday and broke above strong barrier at 151.11 (Fibo 38.2% of larger 195.24/123.83 (Aug 2015 / Sep 2016 descend), boosted by fresh hawkish comments from BoE MPC member about interest rate hike in coming months.

Weekly close above this pivotal point would generate another strong bullish signal for further advance.

The pair is currently riding on the third wave of five-wave cycle from 139.30 and eyes its FE 300% at 152.08.

There are no firmer signals of fatigue so far, as the pair gained over 3.5% in less than two days and strongly overbought daily studies, however, corrective action could be anticipated in coming sessions.

Former tops at 148.45; 148.10 and 147.77 (posted on 11 Dec 2016; 07 May and 09 July 2017 respectively) now act as solid supports.

Res: 151.54; 152.08; 153.01; 154.24

Sup: 151.00; 150.00; 149.31; 148.45

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.