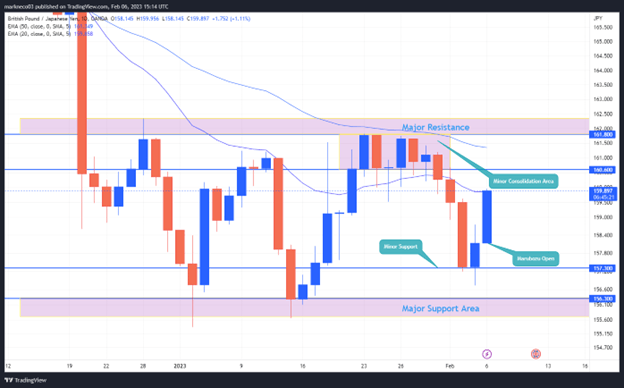

GBP/JPY keeps bouncing 161.800 and 156.300

GBPJPY has consolidated in the daily chart since the start of the year, following a steep decline in December. The price for GBPJPY keeps bouncing on the major area between 161.800 resistance and 156.300 support on the daily timeframe. There is also a minor consolidation between 161.800 and 160.600. This minor consolidation area is highlighted between the 50-EMA and 20-EMA periods

Last week the break in the minor consolidation led to a downward move. A noticeable three-bearish candle pattern formed a three-black crow after the break of structure from the minor consolidation. This formation may signal a potential further move to the downside. However, before the week ended last week, the formation of minor support occurred at 157.300, following the pattern formation.

After the price created minor support at 157.300, the price recovered about half of its loss after the breakout at the minor consolidation area. It may tap at 160.600 or the 20-EMA period for a possible retest before a rejection happen. It is also worth noting that the weekly candle does not have a bottom wick which can be considered a Marubozu open. This type of candle could mean that the bulls are in control at the moment, and the price keeps moving without falling, which supports that we may have enough strength for a retest. On the other hand, some believe that a candle without a wick will eventually form one, either at the top or bottom. This could mean that after a retest, there is a possibility of a downward move to create a bottom wick. Historically, a candle closes without a wick is rarely seen in the forex market.

Since GBPJPY is technically in a consolidation period in general, it is hard to say that the current downtrend will continue. But the signal given by the three-black crow formation may hold if the price found itself breaking below this major daily consolidation area between 161.800 and 156.300.

In conclusion, GBPJPY has been consolidating between the price range of 161.800 to 156.300 since the start of the year. A recent minor consolidation between 161.800 and 160.600 was broken, leading to a downward move which created the three-black crow pattern. However, the creation of minor support at 157.300 allowed the price to recover half of its losses. A possible retest at 160.600 or the 20-EMA period is possible, but it is uncertain whether the downtrend will continue. The current trend and the signals given by the three-black crow formation will depend on whether the price breaks below the major daily consolidation area between 161.800 and 156.300.

Author

Mark O’Donnell

Blackbull Markets Limited

Mark O’Donnell is a Research Analyst with BlackBull Markets in Auckland, New Zealand.