The US dollar appears well bid across the board except against the GBP as we head into the FOMC event. The GBP/USD pair has taken out key resistance at 1.5639 (38.2% of June rally) to trade above 1.5650.

The FOMC statement, due for release today, is not followed by Yellen’s press conference and is neither accompanied by the interest rate dot chart and revisions to the US GDP and inflation forecast. Consequently, it can very well turn out to be the non-event. However, there is a possibility of surprises – hawkish/dovish. In case the Fed is on track to raise the rates in September, the policy statement today is likely to carry a clear cut hint at September rate hike.

How Fed telegraphed QE taper in 2013?

If we look back at how the Fed telegraphed the QE taper, it is quite possible that the Fed statement today could carry a hint at rate hike (especially if plans to do in September). The taper talk begun in Jan 2013, gained pace in May-June 2013. Markets priced-in the first taper in September, but Fed stood pat, and actually announced the taper in December. Consequently, the markets had completely priced-in the taper by December and thus, we did not have a major risk aversion after first taper was initiated in December 2013.

So a rate hike in December..

On similar lines, the Fed could telegraph its rate hike, with the actual move happening in December. However, the policy statement today could talk up the possibility of a hike in September. Moreover, the rate hike talk has not resulted in a kind of turmoil that taper talk had triggered in EM markets in Q3 2013. However, the rate hike talks have pushed up the USD index, which is hurting the US economy. Back in Q3 2013, it was ADXY that had strengthened significantly. Hence, the most likely outcome of the Fed policy today could be a hint at September rate hike accompanied by the strong concern regarding the strength in the USD index.

Fed is widely expected to comment on

Concerns regarding China and falling commodity prices

Domestic inflation still well below target, hurt by strong USD and weak energy prices

Cheer the fact that the Greek crisis is out of the way (at least in the short-run)

Sound upbeat regarding labor market strength

A hawkish surprise would be

Hint at rate hike September

Plays down the negative impact of Chinese turmoil

A dovish surprise would be

- Direct comments on the negative impact of strength in the USD and reiterates lift-off is data dependent

A hawkish surprise would obviously be bearish for the GBP/USD pair. However, the rate hike hint from the Fed would mean the BOE is next in the line. Hence, GBP could strengthen rapidly against the Euro and commodity currencies.

The GBP/USD could also weaken in case the Fed hints at a rate hike, but sounds worried about USD strength. Once again, in this case, the GBP appears more attractive low yielding European currencies as well as commodity currencies. GBP/JPY could take out 194.37 (July 17 high), and rise towards 195.87 (June 24 high).

Meanwhile, a dovish surprise would push the GBP/USD higher, especially since the spot is trading above 1.5639 (38.2% Fib of June rally).

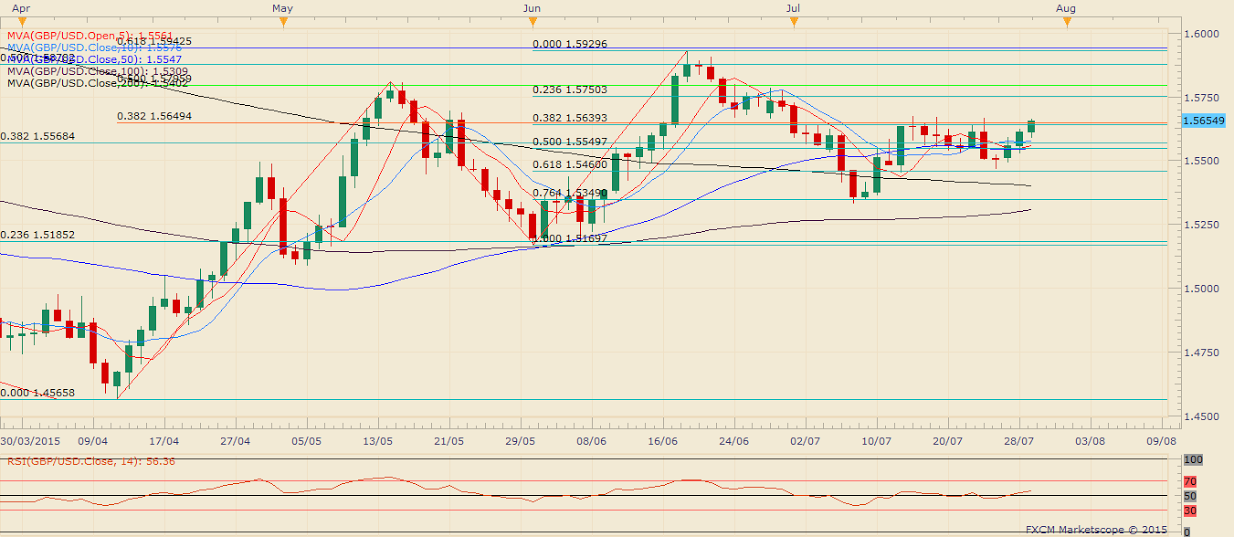

GBP/USD – Daily chart

The spot currently trades above 1.5639 (38.2% Fib R of June rally), a level which the pair has failed repeatedly failed to take out on the daily closing basis since July 1.

A break above 1.5675 (July 15 high) could open doors for 1.5750 (23.6% of June rally). A dovish statement could see the pair rise closer to 1.5750 in the overnight trade.

A failure to take out 1.5639 on the daily closing basis could lead to a fresh sell-off to 1.5460 (61.8% of June rally)-1.5402 (200-DMA).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.