The GBP/USD pair consolidates in between Fibonacci levels and near a 3-week low, stuck around the 1.5400 level. There are no scheduled news in the UK for this Wednesday, and little relevant ahead in the US, which means the pair will probably trade based on sentiment and technical readings today, and therefore, the downside remains favored.

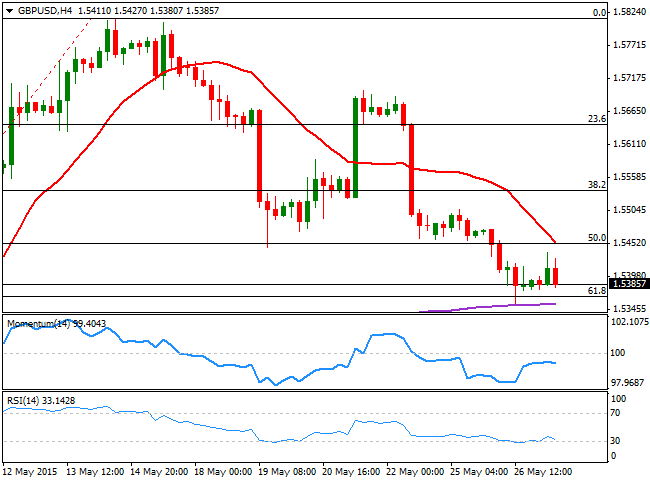

The 4 hours chart shows that the 20 SMA heads sharply lower around the 1.5440/50 region, a few pips above the 50% retracement of the latest bullish run, while the technical indicators have turned back south after a limited correction in negative territory, of oversold readings, all of which supports additional declines. The price has bounced yesterday from its 200 EMA, a few pips below the 61.8% retracement both in the 1.5350 region, so it will take a break below this last to see the pair extending its decline towards the 1.5300 price zone, in route to 1.5260, a strong static support level.

To the upside, 1.5440 continues to be the critical resistance, with a break above it required to change the bias towards the upside, eyeing as the immediate short term target the 1.5480/90 price zone.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY holds rebound near 156.00 after probable Japan's intervention-led crash

USD/JPY consolidates the rebound near 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price struggles for a firm intraday direction, hover above $2,300

Gold price fails to lure buyers amid a fresh leg up in the US bond yields, modest USD uptick. A positive risk tone also contributes to capping the upside for the safe-haven precious metal. Traders, however, might prefer to wait for the US NFP report before placing aggressive bets.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.