With London market closed on a public holiday and no macroeconomic news coming from the UK, the GBP/USD trades in a tight range right above Friday's low of 1.5113. The pair has surged sharply during the last two weeks, but faltered around the 1.5500 level, from where a sharp decline began, as UK elections loom. On Thursday, Britain will have general elections, and according to the latest polls, there's still no clear winner, which may lead to a hung Parliament, and generate uncertainty over the upcoming economic policies, pressuring the Pound.

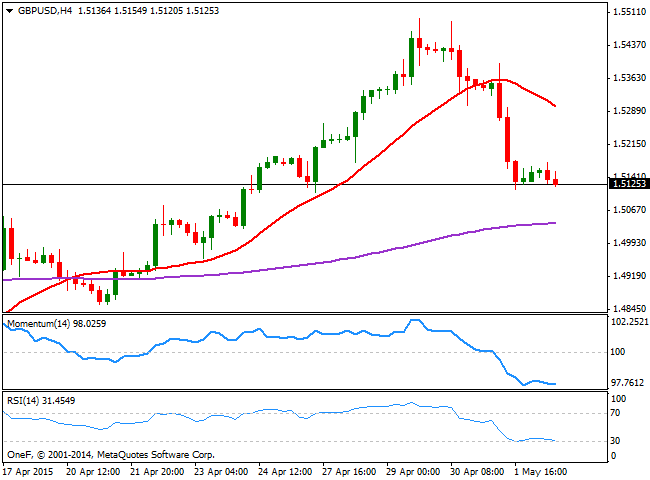

The technical picture for the GBP/USD shows that the pair is biased lower, as the 4 hours chart shows that the 20 SMA gains bearish slope well above the current level, whilst the technical indicators turned back lower near oversold levels, after a limited correction. A downward acceleration below the 1.5110 figure should lead to additional declines towards the 1.5060 level, whilst if this last gives up, the next bearish target comes at 1.5020.

Sellers may surge if the pair recovers up to the top of the range at 1.5170, with a break above the 1.5200 figure required to reverse the intraday bearish bias.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.