The GBP/USD pair trades at fresh weekly highs, having flirted with the 1.4880 area during Asian hours. The pair set a short term double bottom around 1.4810, with buyers maintaining the lead. The fundamental calendar has been empty during the European morning, but the US will release housing, employment and manufacturing data later on in the day, guaranteeing some volatility. The USD is in trouble these days, as tepid macroeconomic data is keeping the American currency under pressure. Should the data come out again below expectations, the pair may advance beyond the 1.4900 level.

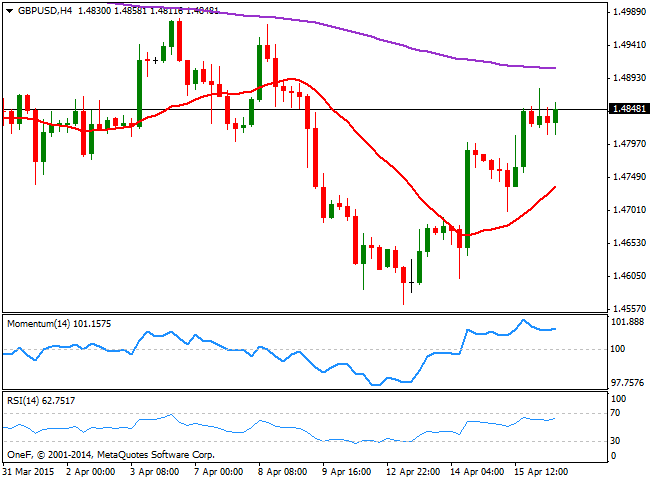

Technically, the 4 hours chart shows that the price develops well above a bullish 20 SMA, whilst the technical indicators are regaining the upside after partially correcting overbought readings, supporting the ongoing bullish tone. In the same chart, the 200 EMA stands at 1.4905, becoming a critical dynamic resistance, as steady gains above it should open doors for an advance towards the 1.5000 price zone.

A break below 1.4810 on the other hand, should revert the intraday bullish trend and see the pair retreating towards the 1.4740/60 price zone.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.