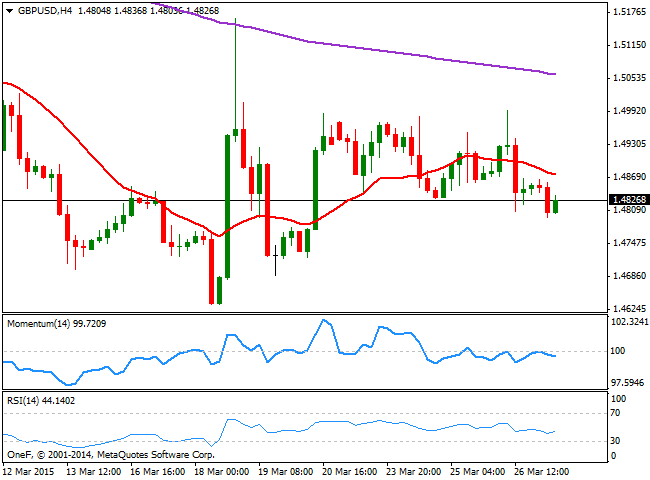

Technically, the pair maintains a bearish bias, as the 4 hours chart shows that the price stands well below a bearish 20 SMA, currently around 1.4870, whilst the Momentum indicator retraces from the 100 level and heads south and the RSI indicator hovers directionless around 42. The pair however, will likely consolidate ahead of the news, with a price acceleration below the 1.4785 level favoring additional declines towards the 1.4730 price zone in the short term. The upside seems more limited, with some follow through above the mentioned 1.4870 level required to confirm another leg higher towards the 1.4920/40 price zone.

View Live Chart for GBP/USD

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.