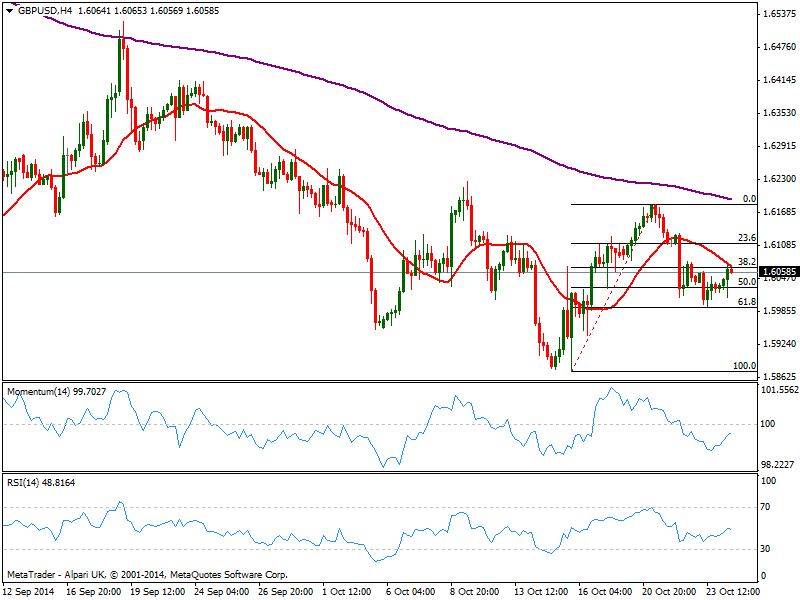

Technically, the 4 hours chart shows price reached 1.6071, 38.2% retracement of the pair’s latest bullish run, where the chart also shows a bearish 20 SMA reinforcing the resistance level. Indicators in the same time frame head higher below their midlines, not providing enough upward momentum to confirm a run higher: price needs to extend above mentioned resistance to be able to gain further, pointing to 1.6125, strong static resistance level. Below 1.6030, 50% retracement of the same rally on the other hand, should see price again falling, with 1.5995 as next probable bearish target in the short term.

View Live Chart for GBP/USD

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.