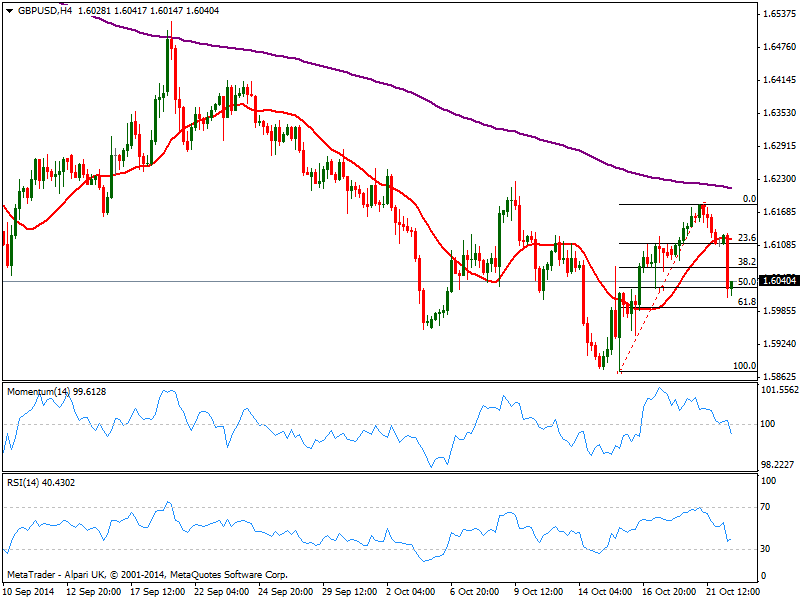

Technically, the 4 hours chart shows price recovering some above the 50% retracement of its latest bullish run at 1.6030, but shows no aims to extend its advance. Indicators in the same time frame maintain their bearish slopes dip in negative territory, supporting further slides ahead: the 61.8% retracement of the same rally stands at 1.5995, and once it gives up, the pair will likely extend its decline towards 1.5940/50 price zone.

The upside should remain capped by 1.6070 price zone, where the pair presents several intraday highs and lows from these last days, along with the 38.2% retracement of the same rally. Only a steady recovery above it, quite unlikely at the time being, will deny the bearish bias and push price back to 1.6110 price zone.

View Live Chart for GBP/USD

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.