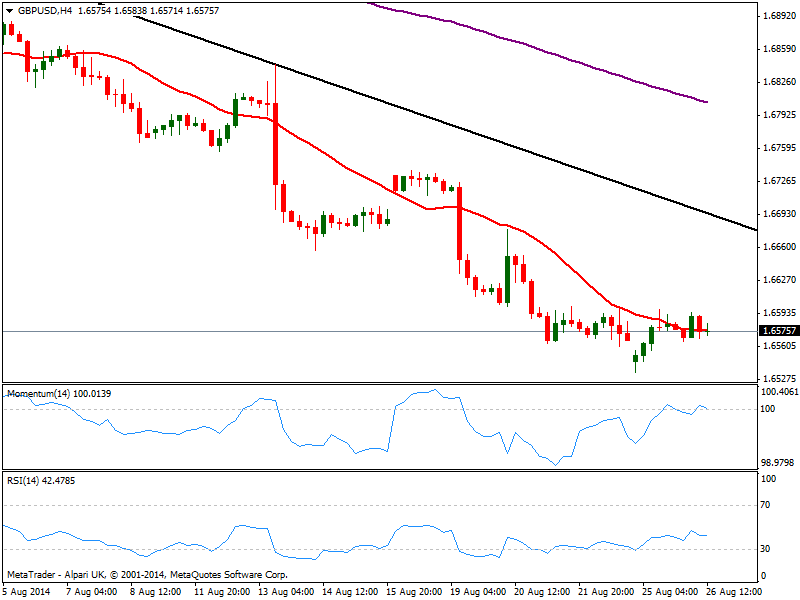

Over the US session, several macroeconomic readings will hit the wires, including Durable Goods Orders, Housing prices and Consumer Confidence, and hopefully market will get some action then. As for the technical picture, the 4 hours chart presents a quite neutral stance, with price hovering around a flat 20 SMA and indicators steady around their midlines, lacking directional strength. The immediate support to follow is 1.6545, April this year low, with a break below it probably favoring a downward move towards the 1.6500 area, with a daily close below this last pointing for a stronger slide towards 1.6250 price zone over the upcoming sessions. Above 1.6600 on the other hand, 1.6650 comes as possible bullish target, as per several intraday highs and lows set around the level.

View Live Chart for GBP/USD

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

USD/JPY holds positive ground above 155.50 following the BoJ Summary of Opinions

The USD/JPY pair trades in positive territory for the fourth consecutive day around 155.60 during the early Asian trading hours on Thursday. However, the fear of further intervention from the Bank of Japan is likely to cap the downside of the Japanese Yen for the time being.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

US inflation data in the market purview

With next week's pivotal US inflation data looming, we're witnessing a stall in stock market momentum and an uptick in US Treasury yields. This shift comes amid murmurs of hawkish sentiment from Fed speak. Indeed the mind games intensify even further as investors cling to their rate cut hopes.