GBP/USD Forecast: Three reasons to expect a sustained Santa rally for sterling

- A Brexit deal seems with reach – and the saga is nearing an end in any case.

- Sterling has room to rise amid Britain's robust covid vaccine preparedness.

- The central bank's readiness to fund the government generously is another factor

A picture of political chaos is a conclusion one could come to when reading British newspapers – and that would be unfavorable for the pound. Prime Minister Boris Johnson has been ceding ground to the opposition Labour Party, clashing with Conservative MPs, and losing top advisors.

Most recently, he was forced to isolate again, after being exposed to someone testing positive for COVID-19. However, politics is not everything There are three reasons to be bullish on GBP/USD.

1) Brexit will soon be over

Sterling has been jumping up and down in response to the daily see-saw of Brexit headlines. That has been the pattern in the past few weeks – and also the past four and a half years since the EU Referendum. GBP/USD is still below the June 23 2016 levels near 1.50 and it is unclear if it can attack that level. Nevertheless, the seemingly endless saga will soon be over.

The UK has formally left the bloc in January this year but is still in a transition period that expires at year-end. The 2019 Brexit Withdrawal Agreement – aka the "divorce deal" has settled the burning issues of financial settlements and citizens' rights.

What is discussed right now is the future of trade relations between the EU and the UK – undoubtedly important, yet without the "cliff-edge" risk. The difference is between agreeing on more favorable or less favorable commerce arrangements, not an economic paralysis.

Moreover, the economic risks of a no-trade-deal are unlikely to be fully felt as the economic damage from the pandemic is far more significant. Nevertheless, there are reasons to believe that London and Brussels will eventually strike a deal.

First, negotiators have made substantial progress on most topics, leaving only two main issues on the agenda – fisheries and state aid, where there have been reports about "bending red lines."

Second, the incoming Joe Biden administration in America has warned Britain that any risk to the peace agreement in Ireland would deny the UK a trade deal with the US.

Third, circling back to New Year's Eve – there is nothing like a deadline to sharpen minds. Both sides would prefer smooth trade in the post-Brexit world and may save the most painful compromises to the last minute.

2) Vaccine readiness

Johnson and his colleagues have been at the receiving end of immense – and mostly justified – criticism about their handling of the pandemic. From the lack of Personal Protective Equipment (PPE) in the spring through the PM's U-turn on a second nationwide lockdown.

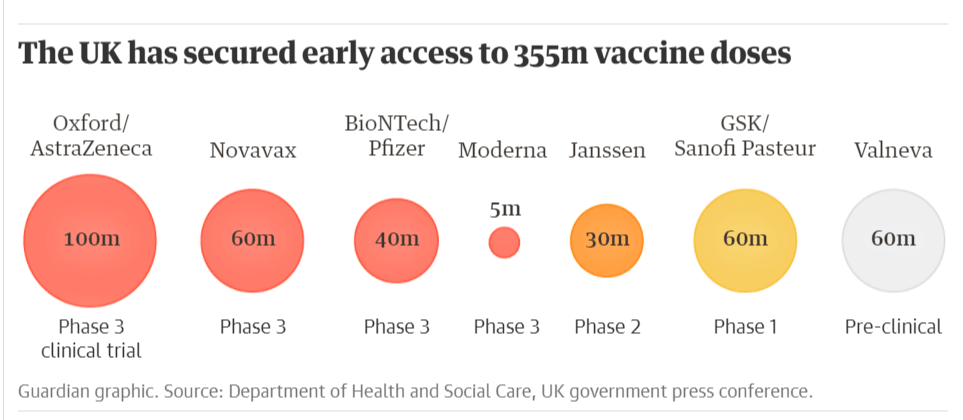

However, there is at least one thing the UK got right – its vaccine strategy. Officials set up a task force handling immunization and this group successfully secured deals worth 355 million vaccine doses from seven companies that are at different stages of trials.

Source: The Guardian

Most immunization treatments require two doses and some of the material will likely be lost in processes or due to extremely cold storing conditions. Nevertheless, the total UK population is just under 67 million people and two jabs for each person amounts to 134 million shots in the arm.

The total of 355 million doses, including 200 million doses within Phase 3 trials, puts the UK on a sound footing to exit the crisis faster than its peers.

3) Bailey ready to buy bonds

When the Bank of England first announced its Asset Purchase Facility program in 2009, it sent the pound down. Buying bonds using money created out of thin air devalued the currency – following a pattern that happened all over the world. While the same logic still applies for the US dollar, the pandemic changed that reaction function for the pound and also the euro.

Each time the "Old Lady" announced it would buy more bonds – in March, June, and November – sterling jumped. Why?

These moves by the BOE were quickly followed by announcements of additional fiscal stimulus by the government. In the latest iteration, the treasury waited for the bank to extend its furlough scheme, putting more money in the pockets of those unable to work due to the pandemic. In turn, that means a stronger economy – and a more robust currency.

Critics may say that such moves amount to monetary financing or Modern Monetary Theory (MMT) that would create inflation down the road. Nevertheless, in the era of the pandemic and after years of nearly non-existent inflation, investors favor the promise of near-term growth over any long-term fears.

The US is hesitating about additional fiscal stimulus and central bank orthodoxy in Europe is still limiting such bold moves. That leaves room for sterling to shine.

Conclusion

With the US elections in the rear-view mirror and looking toward year-end, GBP/USD has room to rally. The mix of an end to the Brexit saga, the UK's vaccine preparedness, and its generous central bank all set up the pound for upside success.

See What you need to know about the dollar in the post-vaccine announcement world

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.