- GBP/USD has been advancing amid the EU deal and moderation in US coronavirus cases, and UK vaccine hopes.

- A brewing political scandal and Brexit uncertainty may limit gains.

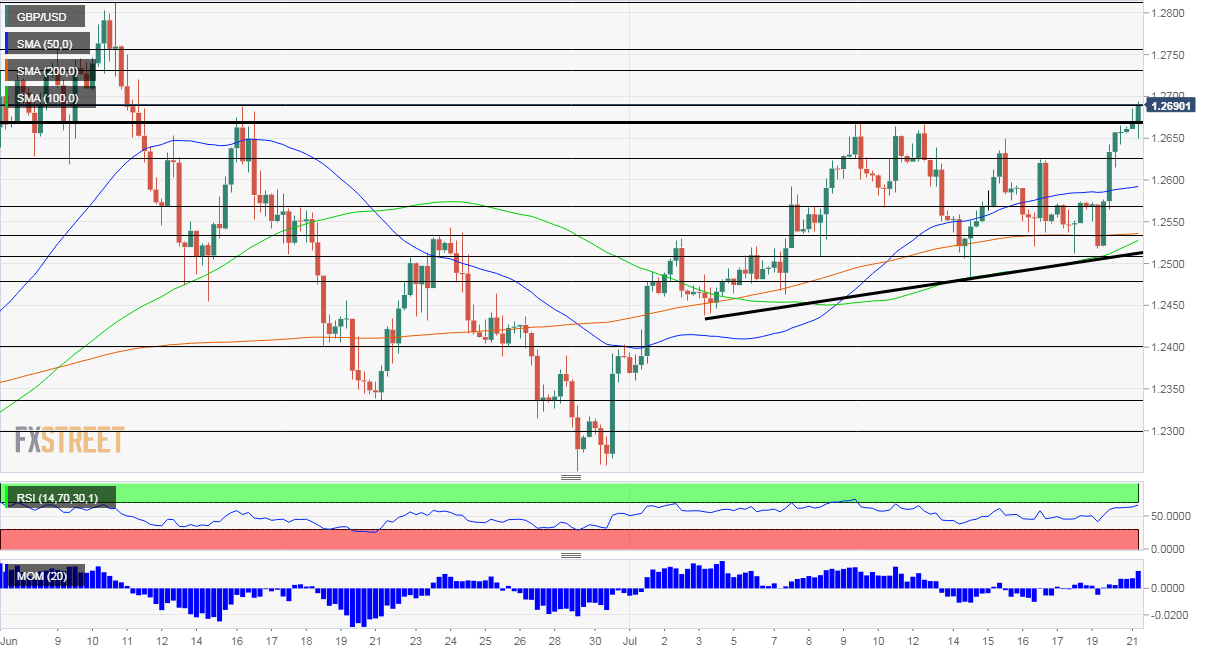

- Tuesday's four-hour chart is showing room for further gains after breaking above the triple top.

Pay rise – around 900,000 British public sector workers in education and health will receive a boost to their salaries. The increases are minor, around 3% on average, but the pound has other reasons to rise.

The University of Oxford and AstraZeneca announced that the Phase 1/2 trial of a COVID-19 vaccine candidate proved safe and effective, providing hope for administering immunization to Brits and others within a year.

The Lancet, which published the results, hailed the British achievement and also criticized the government's plan to hoard the vaccines. For investors, the potential for more rapid deployment of a vaccine to Brits is a boost to the pound. One UK paper splashed "Vaccine by Christmas" on its front page.

Other efforts – most notably by BioNTech/Pfizer, Moderna, and CanSinoBIO are also making progress and lifting the broader market mood, pushing the safe-haven dollar down. Investors are also encouraged by moderation in US coronavirus statistics – around 60,000 cases and 500 deaths reported on Monday – which were below the peak. While most are aware that figures related to the weekend tend to be low, the upbeat mood prevails. Updated figures are due out in the US session.

Another reason for markets' cheering is the EU deal – not on Brexit, but on a recovery fund. After five months of crisis and nearly five days of exhausting talks, leaders in the old continent found a compromise. The bloc will deploy some €750 billion in funds and higher demand from the continent could also help the UK.

See EU Deal Analysis: EUR/USD buy opportunity? Why the move is historic and should keep the euro bid

Brexit talks remain deadlocked – yet no progress is expected until the fall, closer to when the transition period expires at the end of the year. Sterling is shrugging off the saga.

The pound may be in peril when Britain later releases a report on Russian meddling in UK politics. Prime Minister Boris Johnson's Conservatives have ties to donors originating from Vladimir Putin's country. Any suspicion of influence – especially in the 2016 EU Referendum – would hinder the ability of the government to act and potentially weigh on sterling.

Another factor that may weigh on the pound also comes from abroad – tensions with China have deteriorated after the UK canceled its extradition treaty with Hong Kong. China vowed to retaliate on this topic and also in response to Britain's decision to phase out Hauwei technology.

Overall, GBP/USD has reasons to rise, but the road ahead may be bumpy.

GBP/USD Technical Analysis

Pound/dollar has broken above the triple top at 1.2670, a stubborn cap that held cable down three times. At the time of writing, the currency pair is battling the 1.2690, a swing high which was seen in mid-June. The next caps are 1.2730 and 1.2750, stepping stones on the way up. The big prize is 1.2815, June's peak.

That trounced triple-top of 1.2670 now turns into support, and it is followed by 1.2625, a high point last week. Next, 1.2570 served as support last week and it is followed by 1.2530, where the 200 Simple Moving Average hits the price.

GBP/USD is trading well above the uptrend support line which has accompanied it since early July and benefits from upside momentum. The Relative Strength Index is rising but remains below 70 – outside overbought territory. Another move up may already trigger profit-taking.

More Central banks make way for governments to act and move markets, but there is only one real boss

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.