The GBP/USD had a remarkable second week of 2018 with the currency cross rising to the highest level since June 2016 Brexit referendum. Although the beginning of the week was marked by political jitters with UK government reshuffling, the GBP/USD managed to hold above $1.3450 level unaffected by reports of massive labor market outflows and investment and output losses following possible disorderly Brexit scenario.

While politics weighed on GBP/USD, the helping hand to the currency pair has been given by German political development on Friday as news of major German political parties agreeing on outlines of a future coalition. The EUR/USD has been boosted massively on German political news dragging the US Dollar lower.

After the GBP/USD broke above $1.3615, stop-loss orders managed to push Sterling to a new 19-month high of $1.3695 on Friday, leaving post-Brexit high of $1.3470 behind. As GBP/USD broke above the post-Brexit high of $1.3670, the currency pair is likely to attack round big figure of $1.3700 before targeting $1.3850, representing 61.8% Fibonacci retracement of the Brexit related slump from $1.5000 all the way down to $1.1940.

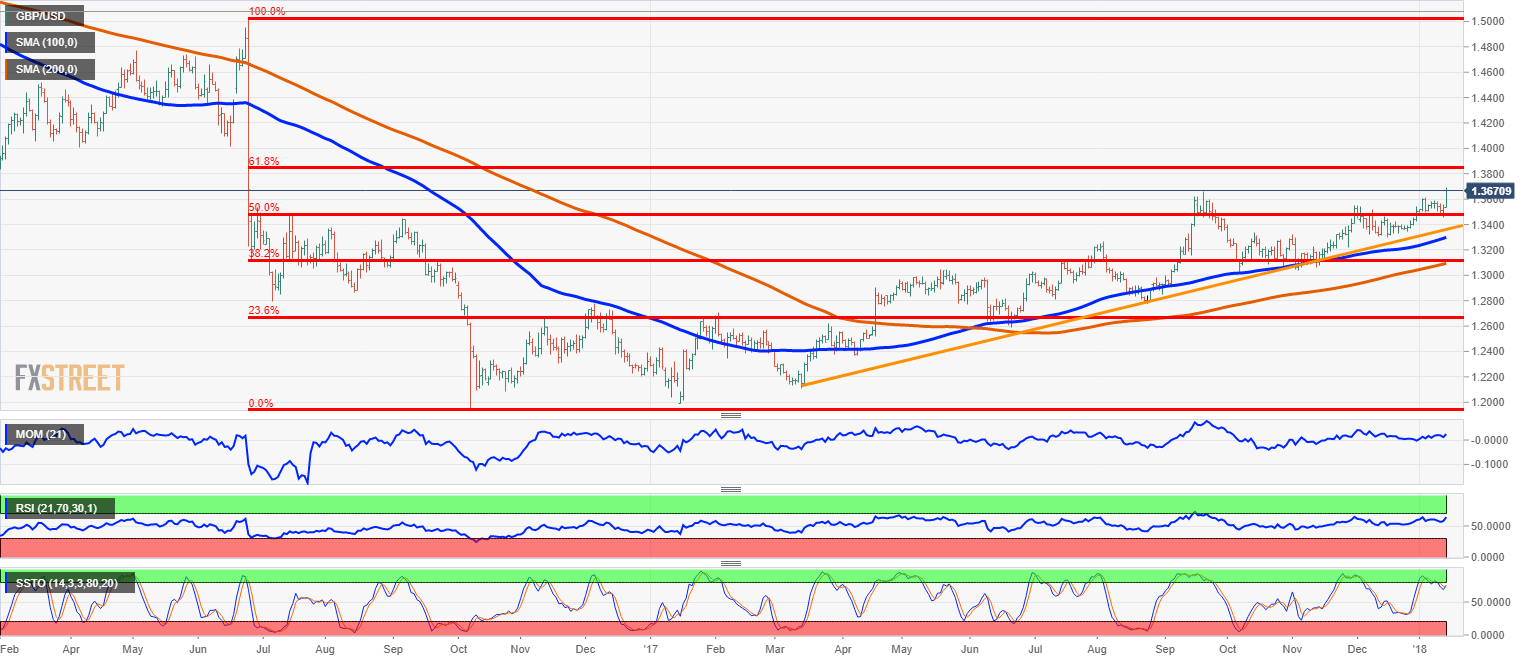

Technical outlook

The technical picture for the GBP/USD is Sterling positive. All of the technical oscillators are pointing upwards on the daily chart with Momentum, the Relative Strength Index and Slow Stochastics all pointing upwards. With GBP/USD moving 1.6% higher during the last two trading days of the second week of 2018 and position of the technical oscillators relative to the Oversold territory, in my view, the momentum in favor of Sterling is still in place.

GBP/USD daily chart

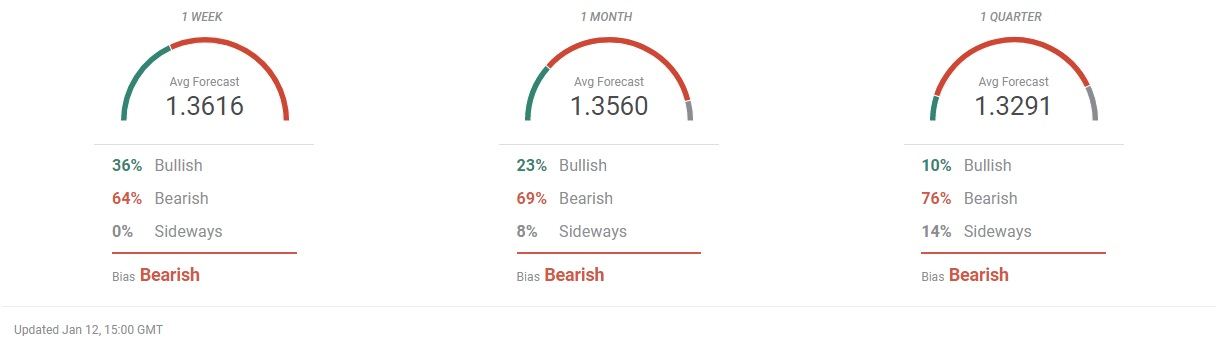

While the majority of participants in the FXStreet Forecast Poll expect GBP/USD bearish trend to prevail in a week ahead, I still expect the positive momentum for GBP/USD to prevail even with fundamentals like the US core inflation ticking up in December being in favor of the US Dollar.

FXStreet Forecast Poll for 1-week, 1-month, and 3-months ahead

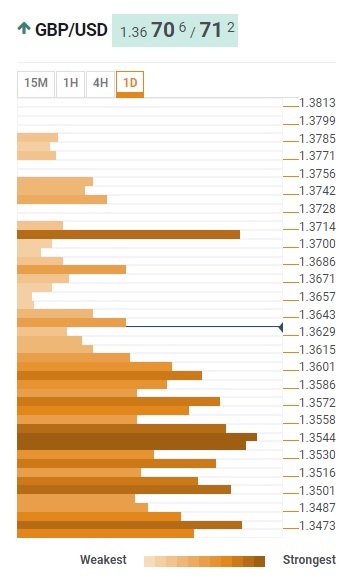

The argument in Sterling’s favor is also supported by the technical confluences that were piling up around $1.3550 level and then at around $1.3600. Once the round big figure of $1.3600 was broken on the upside, the trend higher was supported by stop-loss orders being hit that brought the GBP/USD all the way up to $1.3695. It is only the minor psychological level of round big figure of $1.3700 to be tested before the GBP/USD moves higher targeting $1.3850 represented by the 61.8% Fibonacci retracement line of a major fall from $1.5000 to $1.1940.

FXStreet Confluence indicator on daily chart

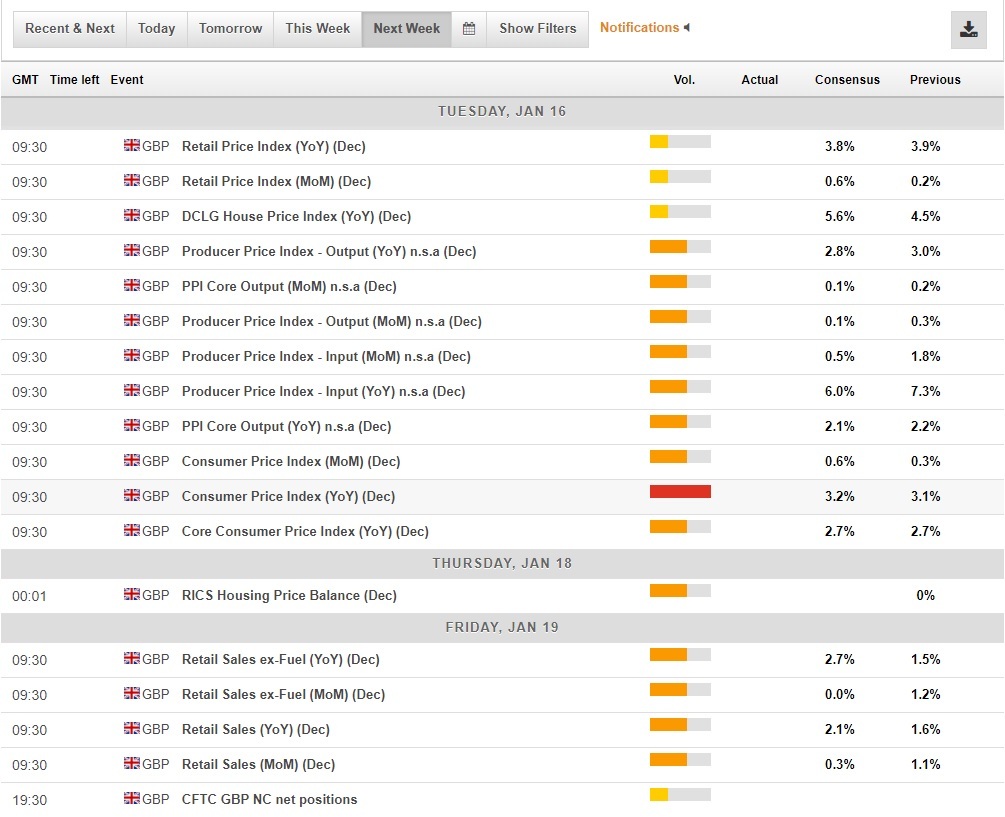

The UK data ahead

While the second week of 2018 saw only the data on the UK manufacturing output and industrial production in November, during the third week of January there is more macro data due.

On Tuesday, January 16, the UK inflation indices are due with the most important out of the variety of price indices being the Consumer Price Index (CPI) measured on a year-to-year basis. The CPI is an important indicator for the Bank of England that sets inflation as its policy target. The market consensus points to UK CPI to peak at 3.2% in December, up from 3.1% in the previous month with the Bank of England Governor Mark Carney having to write an explanatory letter to the UK Chancellor for the second month in a row.

On Friday, the UK retail sales data for the month of December are due. The Christmas shortened month of December is expected to deliver rather disappointing deceleration of retail sales in December. With households in the UK roiled by a prolonged period of higher inflation and increasing preference of internet purchases that are underestimated by traditional statistical estimations, the lower number of business days also plays the role.

The UK retail sales are expected to rise 0.3% m/m in December with core sales excluding motor flue stagnant after rising strong 1.1% m/m in November.

The UK economic calendar for January 15-19, 2018

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.