- GBP/USD has been under pressure after BOE Governor Bailey committed to further bond buys.

- Cable's weakness stands out as US retail sales missed estimates.

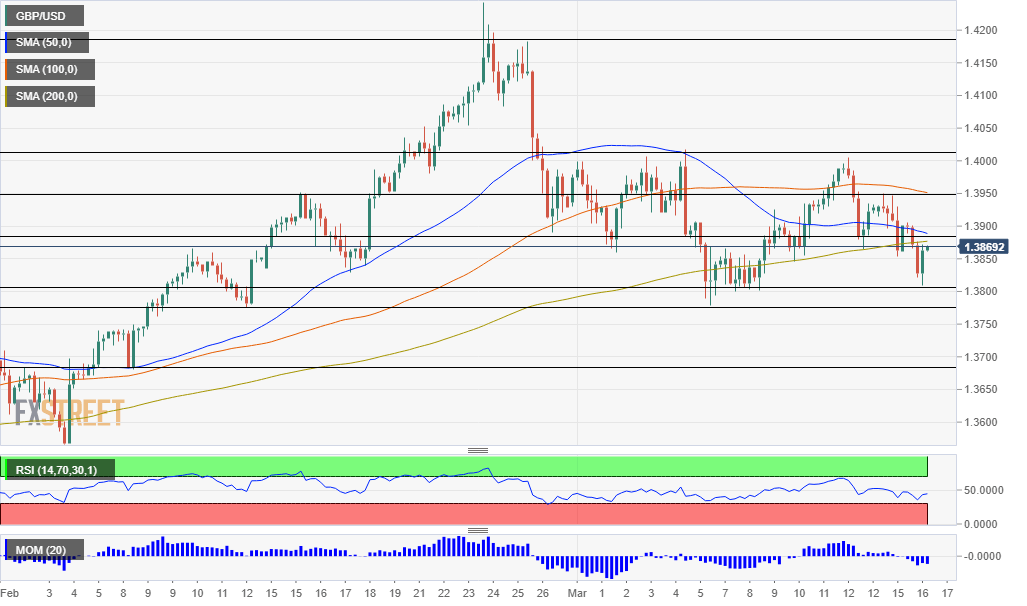

- Tuesday's four-hour chart is showing that bears are in control.

Walking on a tight rope between cheering a recovering economy and not scaring money with rate hikes – that if the job of the Federal Reserve. However, Bank of England Governor Andrew Bailey seemed to have jumped the gun, preempting the Fed and pushing the pound lower.

Despite Britain's successful vaccination campaign, Bailey said that the bank is committed to buying bonds at an elevated pace and seemed somewhat cautious about the recovery. Sterling is suffering.

Another setback for the pound comes from the decision by several EU countries to suspend the rollout of AstraZeneca's vaccines – widely used in the UK. While Britain has yet to report issues with the jabs, the scare from across the Channel is somewhat hurting the pound.

GBP/USD has been able to recover thanks to a weaker dollar. Yields on ten-year Treasuries have dropped below 1.60% as the market mood remains upbeat ahead of Wednesday's Fed decision. Some expect the world's most powerful central bank to hint at an earlier rate hike – following markets' guidance. If that happens, returns on US debt and the greenback could surge.

Jerome Powell, Chair of the Federal Reserve, will have a hard time pledging low rates and enhanced bond-buying despite rosy expectations.

US retail sales figures may help the Fed lower expectations. Americans lowered their expenditure by 3% in February, worse than expected. However, it came on top of an upward revision for January and is blamed on the "deep freeze" in the southern US.

GBP/USD Technical Analysis

Pound/dollar is trading just below the 50, 100, and 200 Simple Moving Averages on the four-hour chart while momentum is to the downside. Bears have the upper hand.

Some resistance awaits at around 1.3890, which is where the 50 and 200 SMAs converge. It is followed by 1.3950, which capped cable last week and finally by 1.4010, the mid-March peak.

Support awaits at the daily low of 1.3805, followed by 1.3775, a low point in early March. Further down, 1.3690 is the next level to watch.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold price turns red below $2,320 amid renewed US dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.