GBP/USD Forecast: Sellers look to retain control despite improving risk mood

- GBP/USD stays below 1.2850 following Tuesday's failed recovery attempt

- The near-term technical outlook suggests that the bearish bias remains intact.

- The Fed will announce monetary policy decisions later in the American session.

After rising above 1.2850 during the European trading hours on Tuesday, GBP/USD lost its traction and closed the day in negative territory. The pair moves sideways slightly below 1.2850 in the European session on Wednesday as investors refrain from taking large positions ahead of the Federal Reserve's (Fed) and the Bank of England's (BoE) monetary policy announcements.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.37% | 0.32% | -2.00% | 0.11% | 0.84% | -0.43% | -0.23% | |

| EUR | -0.37% | -0.07% | -2.32% | -0.23% | 0.53% | -0.80% | -0.57% | |

| GBP | -0.32% | 0.07% | -2.28% | -0.18% | 0.60% | -0.71% | -0.50% | |

| JPY | 2.00% | 2.32% | 2.28% | 2.07% | 2.87% | 1.56% | 1.83% | |

| CAD | -0.11% | 0.23% | 0.18% | -2.07% | 0.76% | -0.56% | -0.32% | |

| AUD | -0.84% | -0.53% | -0.60% | -2.87% | -0.76% | -1.29% | -1.09% | |

| NZD | 0.43% | 0.80% | 0.71% | -1.56% | 0.56% | 1.29% | 0.22% | |

| CHF | 0.23% | 0.57% | 0.50% | -1.83% | 0.32% | 1.09% | -0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

The US Dollar (USD) held resilient against its rivals after the data from the US showed that the CB Consumer Confidence Index improved in July. Additionally, JOLTS Job Openings for June came in at 8.18 million, surpassing the market expectation of 8.03 million and further supporting the USD.

Early Wednesday, the UK's FTSE 100 is up more than 1% on the day and US stock index futures trade in positive territory. The positive shift seen in risk mood, however, fails to help GBP/USD stage a rebound.

The Fed is widely anticipated to leave the policy rate unchanged after the July 30-31 policy meeting. At this point, a confirmation of a rate cut in September is unlikely to trigger a market reaction, with the CME FedWatch Tool showing that a 25 basis points rate reduction in this month is already fully priced in.

Investors will scrutinize comments from Fed Chairman Jerome Powell to see whether the US central bank is likely to take additional easing steps in the last quarter of the year. The CME FedWatch Tool suggests that there is a stronger than 60% chance that the Fed will cut the policy rate by another 50 bps after the September cut. If Powell hints that they will remain patient before opting for another rate cut after September, citing robust growth figures, the USD could gather further strength and trigger another leg lower in GBP/USD.

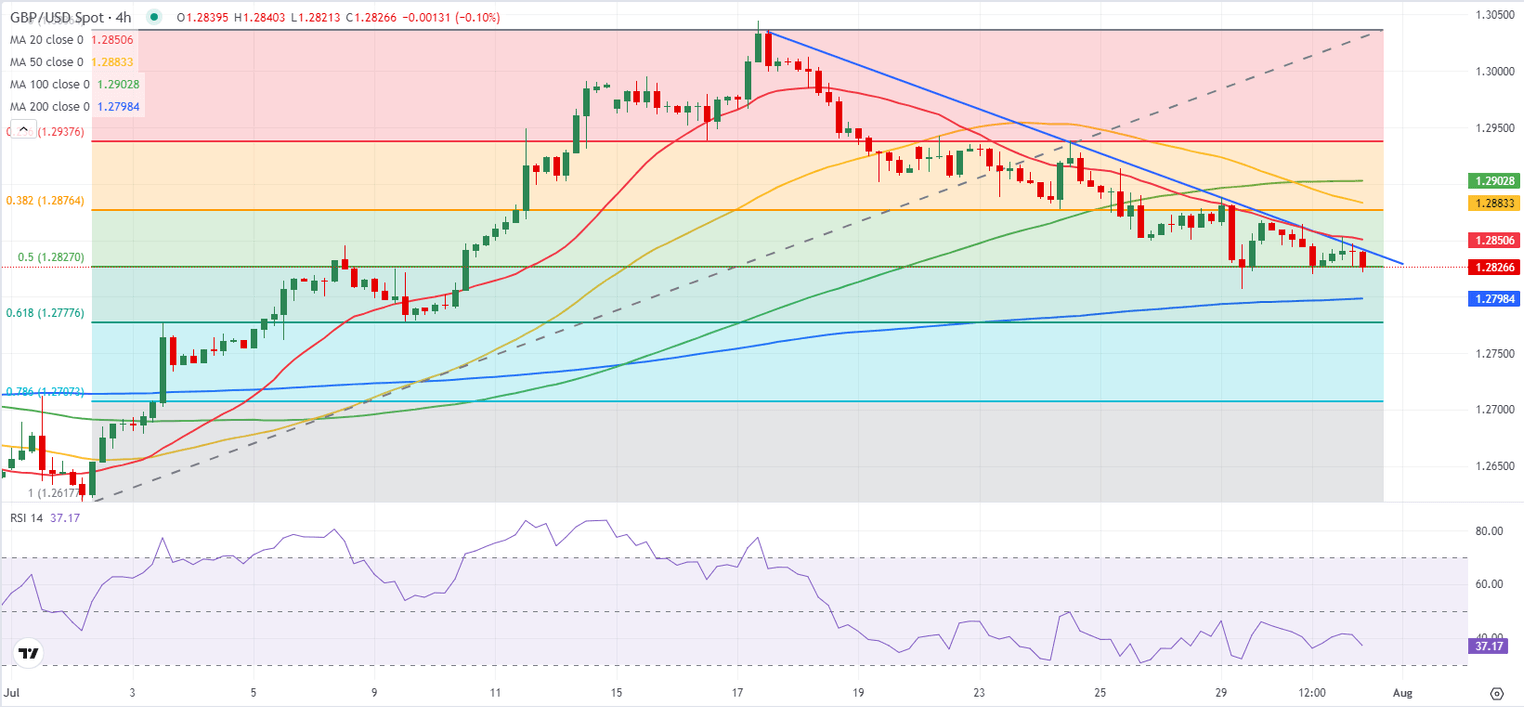

GBP/USD Technical Analysis

GBP/USD continues to trade below the descending trend line coming from mid-July and the Relative Strength Index (RS) indicator on the 4-hour chart stays below 40, reflecting the bearish stance.

On the downside, immediate support is located at 1.2830 (Fibonacci 50% retracement of the latest uptrend). Once that level turns into resistance, additional losses toward 1.2800 (200-period Simple Moving Average (SMA), psychological level), 1.2780 (Fibonacci 61.8% retracement) and 1.2750 (static level) could be seen.

If GPB/USD manages to break above the descending trend line, currently located near 1.2840, it could face next resistance at 1.2880 (Fibonacci 38.2% retracement) before testing 1.2900 (100-period SMA).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.